October is shaping as much as be a vital time for this crypto cycle. Bitcoin hit an all-time excessive of $125,782 earlier than dropping to $123,440, whereas Ethereum climbed to $4,563. The 2 main cryptocurrencies are setting the tone for “Uptober,” with a complete market cap above $4.21 trillion.

Globally, circumstances are favorable. U.S. fiscal stress, rising debt prices and shutdown hypothesis have led to elevated hedging. Bitcoin, already seen as digital gold, is doing properly.

Bitcoin hits $125,782, and El Salvador reveals $475,000,000 revenue

Bitcoin is making historical past as soon as once more. With intraday highs at $125,782, BTC is holding robust in document territory. Revenue-taking has been absorbed fairly easily, with $3.7 billion in realized good points in latest classes offset by recent inflows.

Including to the optimistic story is El Salvador. President Nayib Bukele simply dropped the newest numbers on the nation’s Bitcoin holdings, revealing a whopping unrealized revenue of $475,000,000. For a rustic that made international headlines by adopting BTC as authorized tender in 2021, that is enormous.

BTC is up towards some resistance at round $126,000 to $127,000. That is the place quite a lot of derivatives liquidations are taking place. If it breaks by way of this degree, it may hit $130,000-$135,000 fairly rapidly. The dangerous information is that $120,000 is the zone to defend.

Ethereum whale sends $426,890,000 to Binance

Ethereum’s been all about whales these days. The primary altcoin is buying and selling at $4,563, which is nearly 2% up on the day, however the greater story is on-chain flows.

A dormant Ethereum OG pockets reawakened and despatched 4,500 ETH ($20,400,000) to Kraken. The handle has transferred 5,502 ETH ($23,380,000) to exchanges over 4 months, nonetheless holding 3,051 ETH ($13,800,000).

Even bigger flows got here from Pattern Analysis, which has despatched 96,100 ETH ($426,890,000) to Binance since Oct. 1. Analysts say these are structured strikes slightly than whole exits, however the volumes are worrying.

Ethereum’s vary is straightforward to see. The resistance degree is between $4,600 and $4,800, and if it breaks out, it may hit $5,000. Assist is holding robust at $4,300. Funding charges are nonetheless comparatively low, which factors to wholesome progress in leverage. If Bitcoin hits its ceiling, Ethereum could be subsequent to set a brand new all-time excessive.

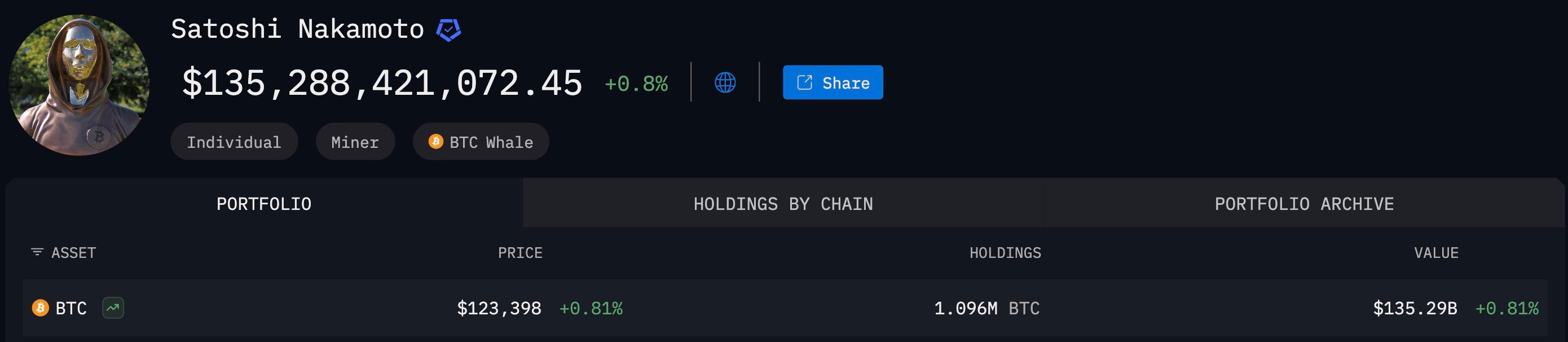

Determine of day: Satoshi internet value hits $136,288,000,000

With Bitcoin hitting new document highs, the wallets linked to Satoshi Nakamoto at the moment are value a jaw-dropping $136,288,000,000. With 1.096 million BTC unmoved since 2010, Satoshi is likely one of the 5 richest people on earth — no less than on paper.

Proper now, Satoshi’s holdings are value as a lot as Warren Buffett and Invoice Gates. If it is liquid, it might be on par with Elon Musk’s peak Tesla fortune.

This contradiction is on the coronary heart of Bitcoin’s mystique. The most important holder disappeared 13 years in the past, which solely provides to the shortage of the asset.

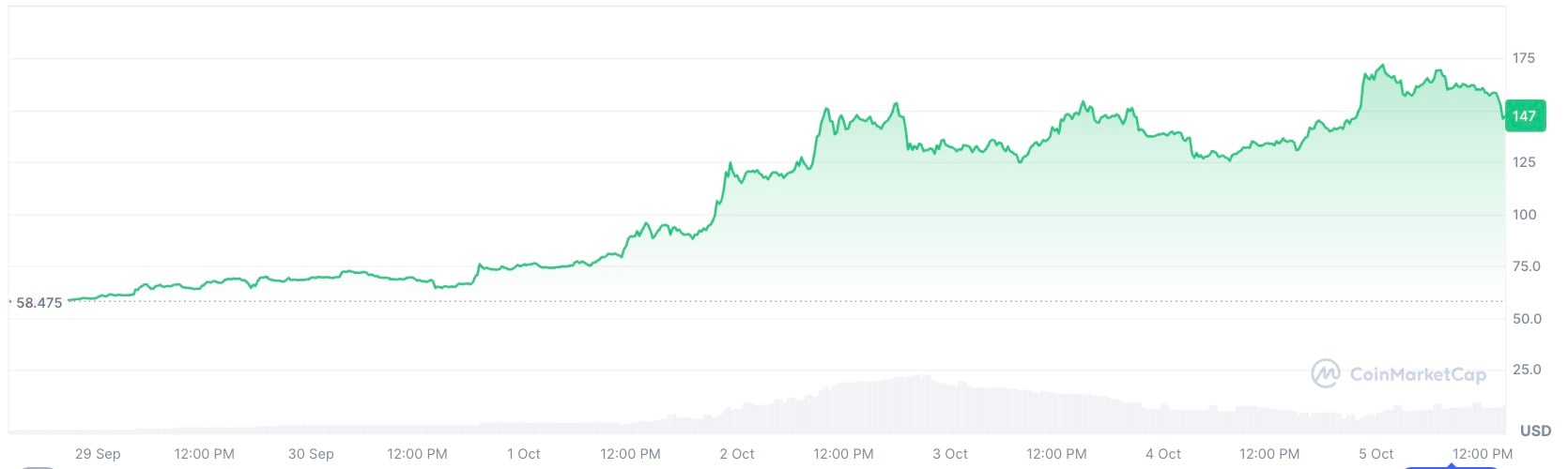

Chart of day: Zcash (ZEC) targets $221 subsequent after 283% surge in week

Zcash (ZEC) is the altcoin story of the week, partially because of Naval Ravikant. After being dormant for years, the privateness token has out of the blue surged, gaining 154.99% up to now seven days and 283% over the previous month. ZEC is at the moment buying and selling at $155.75, with a earlier peak of $176.20. The market cap has risen to $2.57 billion, with $423 million in every day gross sales.

Fibonacci ranges present that $221 and $318 are the following possible targets, with an opportunity of going even greater, perhaps as excessive as $476-$614, if the present momentum retains up.

That is taking place similtaneously there’s been a renewed concentrate on privateness narratives within the crypto house. Ethereum’s Basis launched its personal privateness street map, and Ripple mentioned confidentiality earlier this month, however ZEC’s pure-play standing makes it extra interesting to merchants on the lookout for a speculative rotation.

Do not miss what’s subsequent

As of this night, Bitcoin’s key degree is $126,000. If the value closes above this zone every day, it may result in a liquidation cascade, which might push BTC as much as $130,000-$135,000. If the ceiling holds, we’ll be defending $120,000.

Ethereum’s key value vary is between $4,600 and $4,800. If it breaks above that, it may go as excessive as $5,000. But when it dips again all the way down to $4,300, that may most likely be a great spot to purchase.

In terms of altcoins, ZEC is certainly the frontrunner. With a 283% achieve this month, it may hit $220-$320. SPX token (+68% weekly) and PENGU (+24% weekly) are additionally displaying robust habits.