Whales are on the transfer once more, and this time it aligns with one of many largest ETF shopping for weeks of the yr for Bitcoin and Ethereum. Each Spot Bitcoin and Ethereum ETFs returned to inflows final week, and knowledge exhibits some whales addresses are additionally shifting their crypto property from exchanges and into self custody.

On-chain tracker Lookonchain reported that newly created wallets have withdrawn large quantities of Bitcoin and Ethereum from main exchanges, displaying the large-scale accumulation by crypto whales.

Associated Studying

Huge Withdrawals From Crypto Exchanges

In accordance with knowledge from SosoValue, Spot Bitcoin ETFs recorded $3.24 billion value of inflows within the just-concluded week, reversing the $902.5 million outflows seen the earlier week. Notably, this week’s influx quantity is the most important weekly influx on file for Spot Bitcoin ETFs this yr. Spot Ethereum ETFs, then again, noticed $1.30 billion inflows final week, which is one other drastic change from final week’s outflows of $795.56 million.

Nevertheless, this exercise is just not restricted to Spot ETFs alone. Recent pockets exercise exhibits aggressive accumulation exercise amongst whale addresses shifting into self custody. In a single occasion, on-chain analytics tracker Lookonchain famous {that a} newly created pockets, recognized as 0x982C, withdrew 26,029 ETH value roughly $118 million from Kraken.

One other newly created Bitcoin pockets, bc1qks, withdrew 620 BTC valued at $76 million from Binance. Each actions are large-scale repositioning of capital away from exchanges, and it is a signal that whales expect additional value appreciation.

Whales are shopping for $ETH and $BTC!

Newly created pockets 0x982C withdrew 26,029 $ETH($118M) from #Kraken 8 hours in the past.

Newly created pockets bc1qks withdrew 620 $BTC($76M) from #Binance 6 hours in the past.https://t.co/8Aa1g0BgWthttps://t.co/qsasXKFHuN pic.twitter.com/iTYhz8jwq3

— Lookonchain (@lookonchain) October 4, 2025

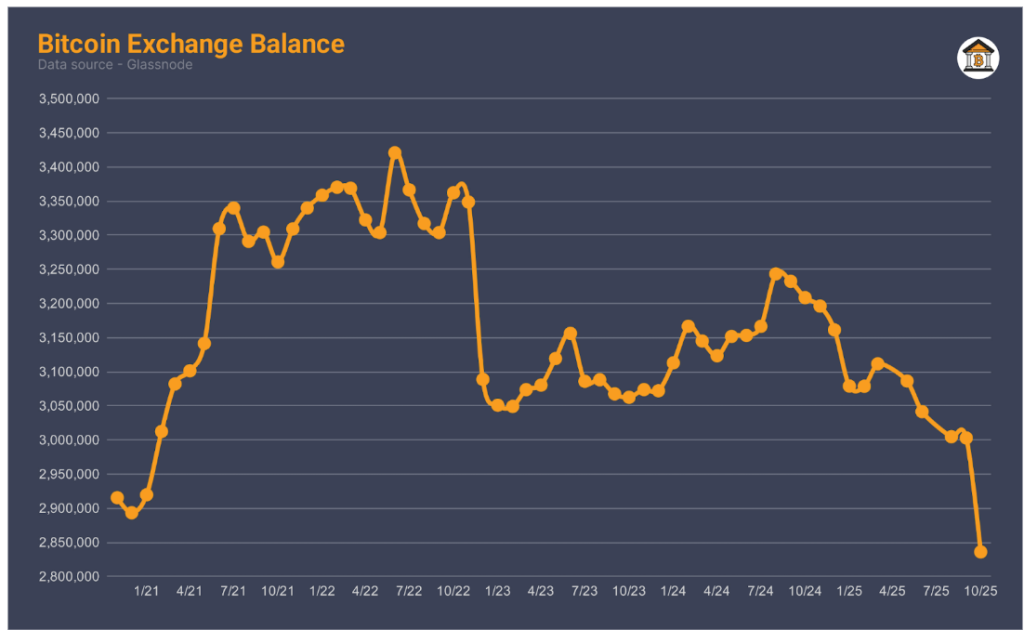

Apparently, Bitcoin change balances have fallen to their lowest degree in 5 years. Nearly 170,000 Bitcoin have been faraway from crypto exchanges within the final 30 days, with probably the most exercise coming within the simply concluded week. This has pushed the Bitcoin change stability under 2.85 million BTC for the primary time since January 2021.

Bitcoin Change Stability. Supply: @btconexchanges on X

Worth Outlook For Bitcoin And Ethereum

The mixture of institutional inflows and whale accumulation has been already mirrored within the value motion of each Bitcoin and Ethereum. Bitcoin has surged previous its earlier file to hit a brand new all-time excessive of $125,506 inside the previous few hours, and is at the moment buying and selling round $124,813. It is a drastic change from only a week in the past, when Bitcoin broke under $110,000, which triggered the Bitcoin Worry and Greed Index to crash to its lowest level since March.

Associated Studying

Ethereum has additionally turned bullish and is buying and selling at $4,575 on the time of writing. One other good week of Spot ETF inflows and whale accumulation persevering with on the present tempo might trigger Bitcoin to lengthen its rally all through the week. This, in flip might see Bitcoin break $130,000 earlier than the top of the brand new week. Nevertheless, a short cooldown isn’t off the desk. Any pullback might trigger Bitcoin to retest $120,000 earlier than the following leg larger.

Nonetheless on the bullish case, Ethereum’s value might additionally push to new all-time highs above $5,000 within the coming weeks.

Featured picture from Unsplash, chart from TradingView