- Bitcoin hits a recent all-time excessive at $125,580, powered by $3.2B in ETF inflows final week.

- Coinbase Premium Index stays constructive for 30 straight days, signaling regular U.S. institutional accumulation.

- Technicals counsel $130K subsequent, with $150K potential by year-end regardless of short-term overbought dangers.

Bitcoin simply printed one other all-time excessive, blowing previous $125,500 and touchdown at $125,580 on October 5. The surge has been fueled by a wild run of institutional demand, with spot Bitcoin ETFs scooping up greater than $3.2 billion in recent inflows over the previous week alone. It’s the type of shopping for frenzy that has merchants whispering in regards to the subsequent large milestone: $150,000.

Below the hood, the story will get much more fascinating. On-chain information reveals that the Coinbase Premium Index has been constructive for a straight 30 days, one thing we haven’t seen in a protracted whereas. Mainly, it means U.S. establishments—these regulated gamers on Coinbase—are constantly paying above-market costs in comparison with abroad exchanges. That’s a reasonably clear sign of aggressive accumulation, even by way of the late September wobble the place Bitcoin dipped from $124,500 right down to $108,600 earlier than snapping proper again.

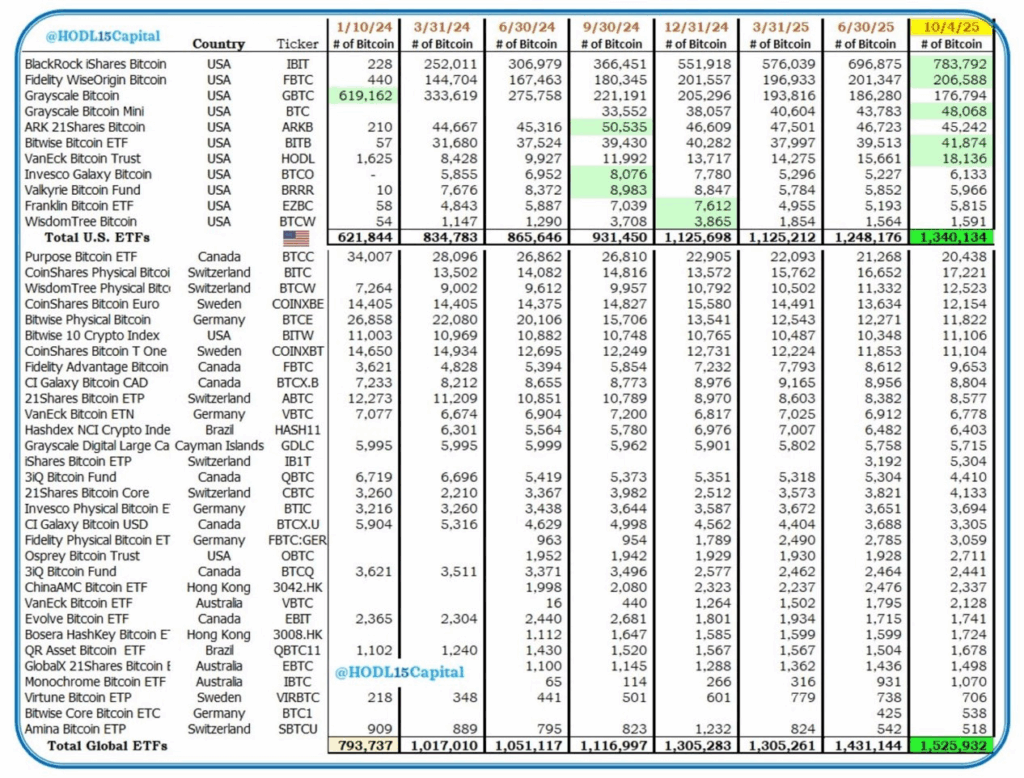

Institutional Urge for food Retains Rising

The ETF scene has been on fireplace. In keeping with Farside Buyers, Bitcoin ETFs closed final week with practically a billion {dollars} in inflows simply on Friday, and a complete of $3.24 billion throughout the week—second-highest since these merchandise launched in January 2024. That resilience is notable as a result of even throughout corrections, establishments saved piling in fairly than backing away.

This mix of ETF demand and premium pricing means that the large cash crowd sees these dips as alternatives, not warnings. Whereas retail merchants took income round mid-September, the information exhibits establishments used that second to quietly load their baggage. If something, it’s a reminder that the market’s heartbeat is now being set by skilled capital, not simply day merchants chasing fast positive factors.

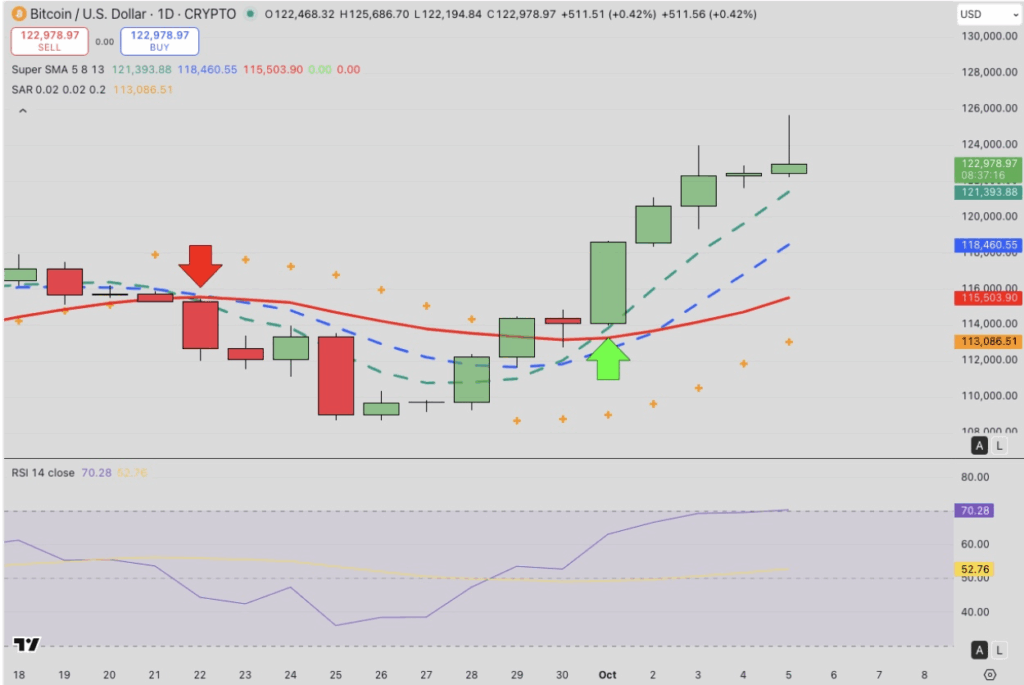

Technical Image Factors Increased

From a chart perspective, issues look sturdy. Bitcoin has now closed inexperienced in 9 of the final ten periods, breaking by way of each near-term resistance stage with stunning ease. After clearing the demise cross at $118,461 throughout the September stoop, BTC has entered recent value discovery—hovering comfortably above its 5-, 8-, and 13-day shifting averages.

The Parabolic SAR nonetheless sits under $113,000, hinting that if a correction does come, patrons will probably step in shortly. On the flip aspect, RSI is brushing up towards 70, which suggests we’d see a little bit cooling off earlier than one other leg larger. Merchants are already setting sights on $130,000 as the subsequent logical checkpoint, with $150,000 sitting on the market as the large psychological prize earlier than year-end.

Outlook: Sturdy Arms vs. Overheated Markets

All informed, Bitcoin’s construction seems bullish, with ETF demand and institutional flows offering a sturdy spine. However the market’s nonetheless delicate—momentum this sturdy can result in overbought circumstances, and the slightest pause may set off quick pullbacks. Nonetheless, if the influx machine retains buzzing and the Coinbase premium holds regular, BTC might be staring down $150,000 ahead of most count on.

For now, the trail appears clear: establishments are shopping for, ETFs are stacking, and Bitcoin continues carving recent highs into the chart. The query hanging within the air is easy—how a lot larger can this wave carry earlier than gravity lastly kicks in?

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.