Key Takeaways

- Gold hits new all-time highs of $3,940 as Bitcoin trails its value motion with potential new all-time highs imminent.

- BTC’s value motion above $125,500 would see value rally in the direction of $130,000 as spot ETF and financial uncertainties drive quantity.

- Crypto specialists counsel a value of $200,000 or above for BTC if the value reverts to the bullish pattern seen in the previous couple of months.

Bitcoin and Gold proceed to rally to new all-time highs regardless of rising fiscal issues because the world’s largest economies endure setbacks, leaving merchants and traders to hedge towards these property as they proceed to surge to new highs.

With rising debt piles hitting the likes of the US, Europe, and Japan, this has pressured many to show to different currencies and cryptocurrencies relatively than fiat currencies within the FX market. Gold, seeing a brand new all-time excessive of $3,940, and Bitcoin struggling to commerce above $124,000 on Monday, has sparked a response of potential value catching up with Gold.

Since its low of $3,300 for Gold, the value has rallied by over 17% in the previous couple of weeks, reaching a excessive of $3,940. If the value of Bitcoin had been to expertise a 20% value rally, we might see the value commerce in the direction of a key area of $130,000 and above earlier than the top of October, as traditionally, this month has been a good one for the crypto market.

In accordance with merchants and traders, there’s excessive conviction that the value of BTC will commerce in the direction of new all-time highs following a short market rally to a excessive of $125,800 on Sunday, as the value traced again into its zone of $123,000.

Bitcoin Sustains Bullish Worth

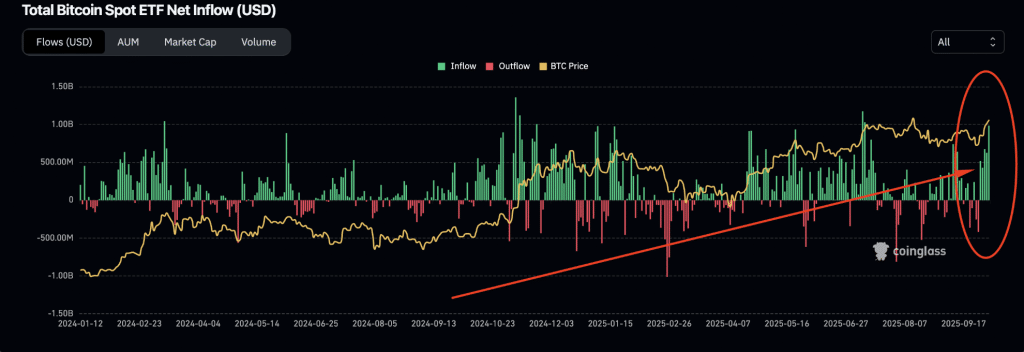

Supply – Bitcoin ETF Influx from CoinMarketCap

Regardless of macroeconomic shifts in the previous couple of days, with the US asserting a shutdown resulting in market uncertainties and the weakening of Japanese pairs, many merchants and traders have turned to digital currencies reminiscent of Bitcoin as the value of the crypto asset continues to construct sturdy market value motion and achieve sturdy demand from spot ETF inflows in the previous couple of days.

A breakout for the BTC value above the $125,500 area might set off a powerful market push to the upside, as value discovery for this crypto asset could purpose in the direction of a spread of $130,000 to $150,000.

Nonetheless, a break in the direction of a low of $120,000 might activate large market liquidation to the draw back.

Crypto Market Perception to Debt Pile

Following the latest value motion of Gold and BTC, Ansem, the crypto professional, prompt {that a} shut of the BTC value beneath the weekly low of $120k would have invalidated the present value motion. Nonetheless, with the value displaying power, he has prompt that many expose themselves to shares and Bitcoin.

His options had been based mostly on present macroeconomic occasions ensuing from the debt pile throughout the US, Japan, and Europe. With publicity to BTC and Gold, merchants would have the ability to hedge towards struggling economies.

General, Bitcoin stays bullish as the value goals for a breakout above $125,500, searching for to meet up with the present Gold rally.

FAQs

Does Bitcoin go up when Gold goes up?

Debate and knowledge counsel that BTC and Gold are correlated by a number of proportion factors, as the value of BTC on a number of events has tried to meet up with Gold.

Is it higher to purchase Gold or Bitcoin?

Shopping for BTC or Gold is dependent upon preferences; traders and merchants have used each as a hedge towards financial uncertainties and devaluation.

Is holding Gold higher than money?

Gold stays a haven towards financial uncertainties and devaluations; thus, many merchants and traders want to carry Gold.

Associated Learn

5 Years of Ready – BTC Breakout May Change Every part