Be part of Our Telegram channel to remain updated on breaking information protection

The GENIUS stablecoin act may cease banks ripping off retail depositors, with tech giants Apple, Google, and Meta set to problem them by embedding high-yield stablecoins into their platforms.

That’s based on Tushar Jain, a co-founder of crypto fund manger Multicoin Capital.

“The GENIUS Invoice is the start of the tip for banks’ capability to tear off their retail depositors with minimal curiosity,” Jain wrote in an X submit. ”Banks are going to must pay extra curiosity to depositors and their earnings will considerably endure because of this.”

Tech Giants Will Compete With Banks Utilizing “Mega Distribution” Platforms

Jain stated the tech giants will use their ”mega distribution” platforms to supply higher yields to depositors, present 24/7 funds, and improved digital experiences.

His submit follows a June article by Fortune journal that stated that Apple, Google, Airbnb, and X have been amongst among the high tech firms exploring issuing their very own stablecoins.

Bitwise Chief Govt Officer (CEO) Hunter Horsley has come to the identical conclusion as Jain, arguing in a Oct. 6 submit on X that the tech giants will seemingly launch their very own wallets after which add stablecoin integration into them as the primary transfer to tackle banks.

“Software program is consuming the world,” he stated. ”The monetary system is subsequent.”

Meta, Google, Apple, and many others are going to compete with banks.

By way of stablecoins, you’ll have the ability to have deposits with curiosity with them.

By way of tokenization, you’ll have the ability to commerce crypto and securities with them.

Tech cos have experimented with monetary providers earlier than.…

— Hunter Horsley (@HHorsley) October 6, 2025

Stripe CEO Patrick Collison wrote in a submit on X over the weekend that the common rate of interest for financial savings accounts within the US is 0.40%, and solely 0.25% in Europe.

Charges for Tether’s USDT and Circle’s USD Coin (USDC) on the decentralized finance (DeFi) platform Aave stand at 4.02% and three.69%, respectively.

“Client hostile” banks are in a ”dropping place,” he stated

$6.6 Trillion May Go away The Banking System, US Treasury Warns

The US Division of the Treasury estimated in April that the mass adoption of stablecoins may result in $6.6 trillion in outflows from the normal banking system.

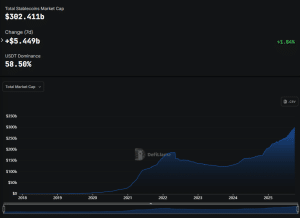

The market capitalization of stablecoins stands at a document excessive $302.411 billion, up from round $255 billion in July, based on DefiLlama.

Stablecoin market cap (Supply: DefiLlama)

The sector’s market cap climbed by greater than $5.4 billion up to now week alone.

However the continued development of the stablecoin market might find yourself amplifying deposit flight threat, “particularly in occasions of stress, that can undermine credit score creation all through the economic system,” the Financial institution Coverage Institute warned in August.

“The corresponding discount in credit score provide means increased rates of interest, fewer loans, and elevated prices for Principal Road companies and households,” it stated.

Banking Teams Already Tried To Shutdown Stablecoin Yields

The GENIUS Act, which was enacted in July this 12 months, establishes the regulatory tips for stablecoin corporations seeking to difficulty their tokens within the US.

It additionally prohibits stablecoin issuers from providing curiosity or yield to token holders, however doesn’t explicitly prolong the ban to 3rd events akin to crypto exchanges or enterprise associates. This leaves the door open for stablecoin issuers to bypass the ban and nonetheless provide yields to their shoppers.

For instance, USD Coin (USDC) issuer Circle shouldn’t be allowed to supply direct yields, however crypto alternate Coinbase can.

Lend USDC. Earn as much as 10%.

Now dwell in all launch markets. pic.twitter.com/mxcu2ppEZ7

— Coinbase 🛡️ (@coinbase) October 2, 2025

“The banking foyer tried to guard their earnings with the Genius Act’s prohibition on passing curiosity to stablecoin holders however that’s simply circumvented as you’ll be able to see by Coinbase’s yield sharing with prospects,” stated Jain.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection