- Solana trades above $230 after a 9% weekly acquire, with bulls eyeing the $296 excessive.

- Stablecoin market cap hit $15.11B and TVL neared report highs at $12.69B.

- Derivatives knowledge and technicals affirm bullish sentiment, although $213 stays a key help if a pullback comes.

Solana began the week buying and selling within the inexperienced, sitting above $230 after climbing almost 9% over the previous seven days. Traders appear to be warming up once more, and the charts are exhibiting it too. With stronger on-chain flows and bullish indicators in derivatives markets, merchants are already trying forward towards the all-time excessive close to $296. The momentum feels completely different this time—regular, however with loads of power constructing below the floor.

Stablecoin Development and Rising TVL Increase Solana Community Power

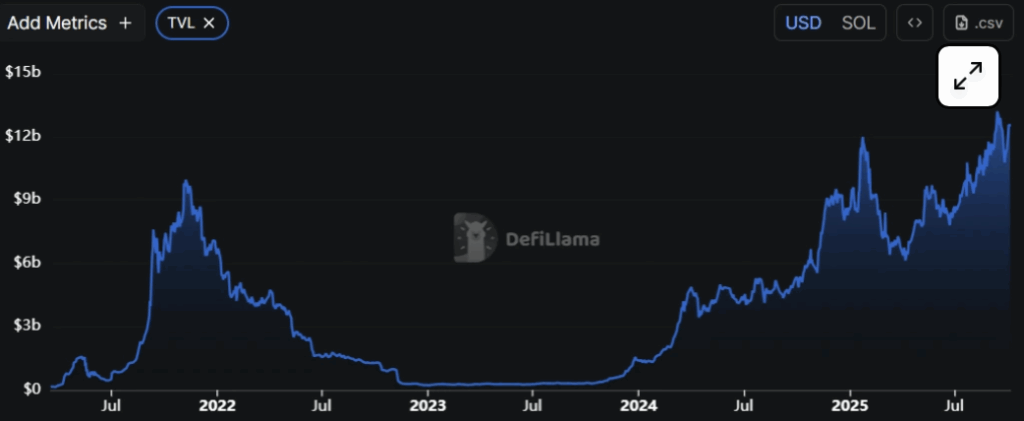

In keeping with DeFiLlama, Solana’s stablecoin market cap has reached a recent report of $15.11 billion, rising persistently since mid-September. This can be a large deal since stablecoins typically act as gasoline for DeFi, funds, and even meme coin hypothesis, bringing extra liquidity into the ecosystem. On the similar time, Solana’s Whole Worth Locked (TVL) jumped from $10.78 billion on the finish of September to $12.69 billion now—near its all-time excessive of $13.02 billion. Rising TVL exhibits that extra customers are actively depositing and fascinating with Solana-based protocols, a transparent signal of rising belief within the community.

Derivatives Knowledge Confirms Bullish Sentiment for SOL

Past on-chain development, derivatives merchants are leaning bullish too. CoinGlass knowledge exhibits Solana’s funding price flipped constructive over the weekend, sitting at 0.0052% on Monday. Which means lengthy merchants are paying shorts—an indicator typically seen earlier than sharp rallies. Traditionally, each time funding charges flipped like this, Solana’s value adopted with robust upside strikes. The long-to-short ratio can be at its highest in additional than a month, one other signal that merchants are positioning for increased costs.

Solana Value Prediction: Key Assist at $230, Subsequent Goal $296

Technically, Solana has bounced onerous since holding help across the 61.8% Fibonacci retracement at $193.52 in late September. The worth has since gained almost 18%, buying and selling now close to $232. If help at $230 holds agency, analysts see a path towards retesting the all-time excessive of $295.83. Momentum indicators again up the case: the RSI is at 57, signaling bullish power with out being overbought, whereas the MACD exhibits a current bullish crossover with rising histogram bars. On the flip aspect, if a correction units in, Solana may dip again towards the 50-day EMA at $213. For now, although, the bulls look to be firmly in management.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.