- ASTER jumped from $1.84 to $2.18 after Binance listed it.

- $2.10 stays the important pivot for the subsequent breakout towards $3+.

- Whale inflows, FUD debates, and powerful technical ranges make this one of many most-watched tokens proper now.

Aster (ASTER) has been using a wave of contemporary momentum after Binance dropped its itemizing, sparking a sudden burst of volatility that carried the token from $1.84 to as excessive as $2.18. Analysts are already pointing on the $3 and even $3.55 zones as the subsequent large checkpoints if bulls can preserve the warmth on.

At press time, ASTER sits round $2.06, barely off its intraday highs however nonetheless holding agency. Merchants say the bottom line is easy — defend the $2.10 mark, flip it into help, and the highway to $3 begins to open. Lose that stage, although, and issues may get uneven quick.

ASTER Value Evaluation: Breakout Ranges Merchants Should Watch at $2.10 and $2.50

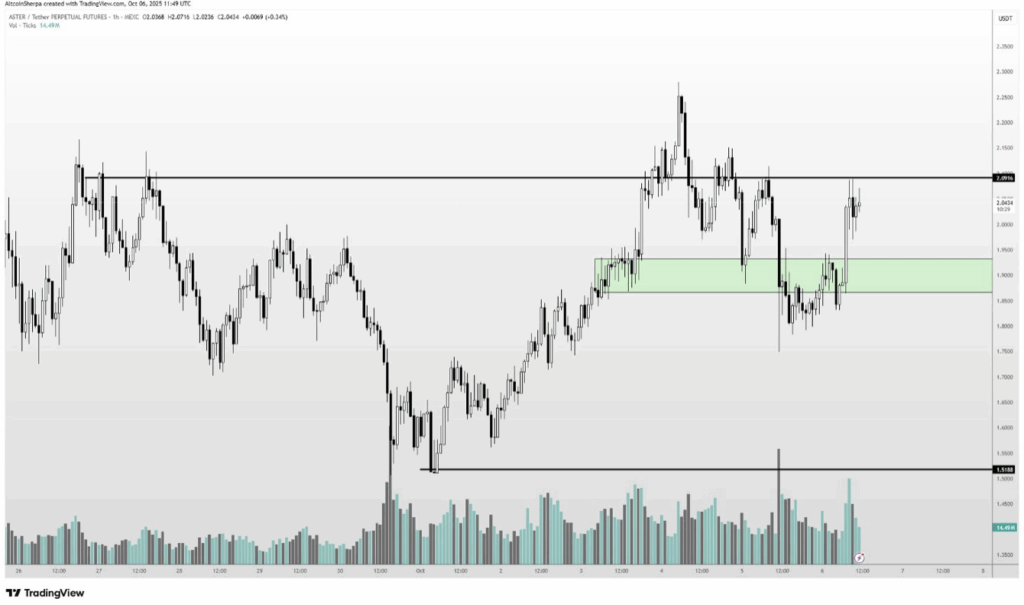

Altcoin Sherpa, a dealer recognized for his short-term setups, mentioned ASTER “seems to be pretty robust” proper now however pressured that reclaiming $2.10 is a should. On the hourly chart, the token has been smacked down a number of instances at that actual stage, making it the pivot level for the subsequent transfer.

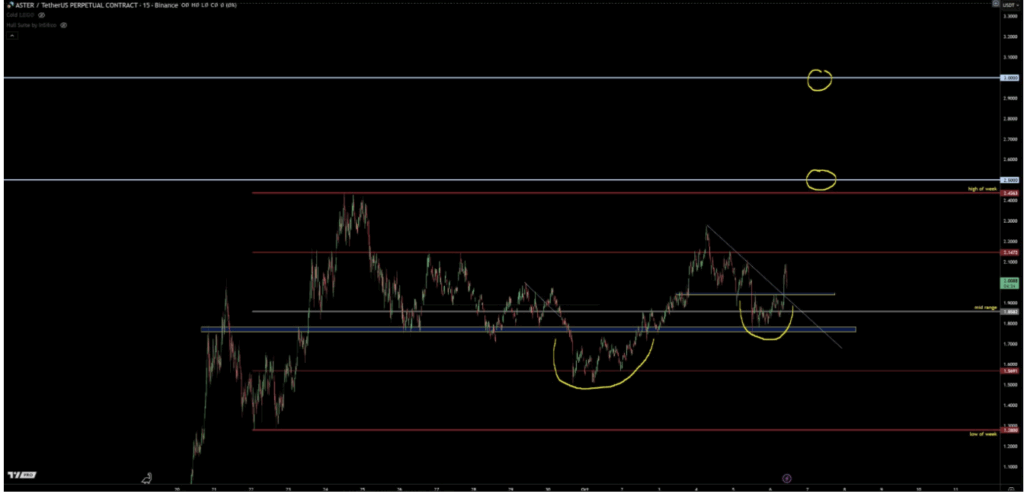

TraderSZ added his map of resistances: $2.14, $2.43, and a weekly excessive at $2.50. Beneath that, an accumulation zone sits close to the mid-$1.90s, with deeper help round $1.86. That band, he famous, can be the “security internet” if worth motion turns ugly.

In the meantime, Captain Faibik outlined a bullish breakout construction with eyes set on $3.55, however as soon as once more, the $2.10 reclaim is the set off everybody’s watching.

ASTER Crypto Forecast: Whale Strikes, and Resistance Ranges

On-chain sleuths caught a whale scooping up about $6 million price of ASTER across the itemizing, bumping their stack to almost $12.5 million earlier than transferring the lot to Binance. Strikes like this may imply two issues: both prepping for a giant promote into liquidity or fueling market-making. Both manner, it thickens order books and makes worth discovery extra unstable proper after an inventory.

For now, the roadmap appears fairly clear: maintain $1.90–$1.96 on dips, push above $2.10, then check $2.43 and $2.50. A day by day shut above the weekly excessive may wipe out lots of overhead provide and set the stage for a correct run towards $3, possibly stretching into $3.40–$3.60 if momentum merchants pile in.

The FUD Storm Round ASTER

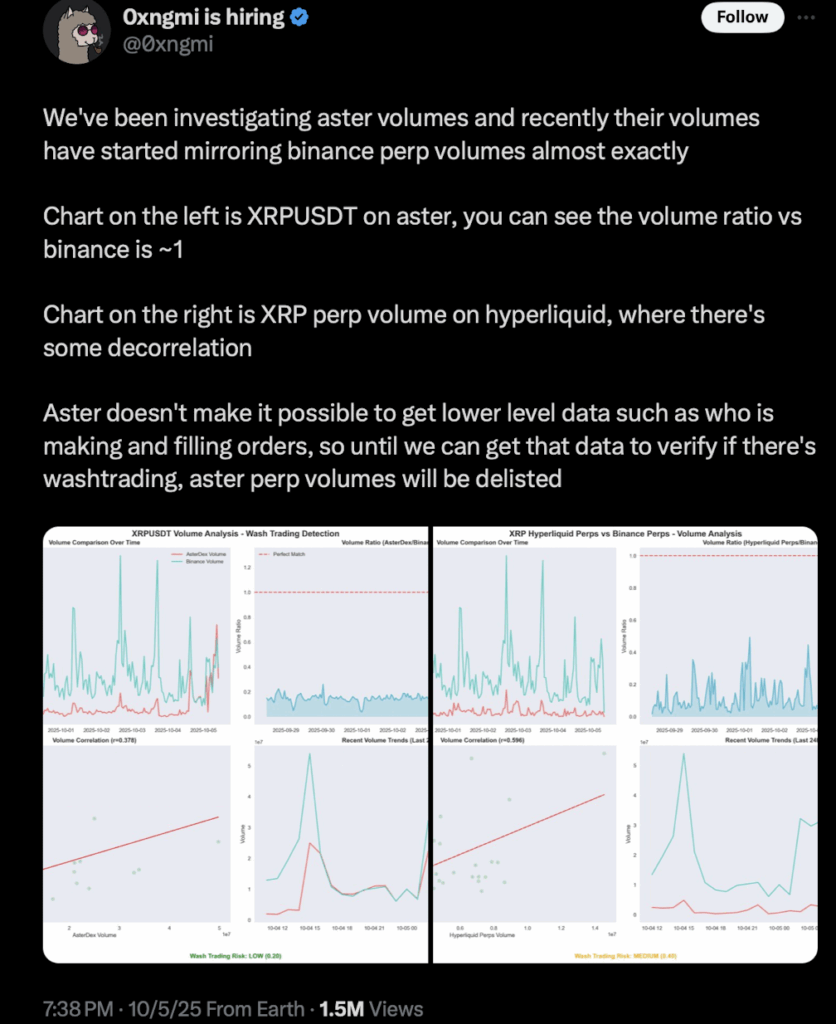

After all, no rally comes with no dose of drama. Crypto Rover claimed ASTER was being hit with a coordinated FUD marketing campaign, proper as DefiLlama’s co-founder 0xngmi introduced they’d delist ASTER perpetual volumes from their platform. The problem? The reported perp numbers have been monitoring Binance’s knowledge virtually too completely, elevating suspicions of wash buying and selling.

0xngmi defined that it wasn’t about selecting sides, nearly knowledge integrity. In his phrases: “we did this earlier than… beforehand ASTER income knowledge didn’t exclude rebates… folks got here up with conspiracy theories anyway.” The spat stirred neighborhood chatter, however merchants know the deal — separate the noise from the charts.

Binance listings have traditionally been double-edged: they widen publicity and liquidity, however generally additionally give early whales a clear exit ramp. Meaning ASTER may nonetheless face promoting stress even whereas retail curiosity grows.

Aster Value Outlook 2025: Will Bulls Drive ASTER Towards $3.55?

Within the close to time period, the playbook is simple. Energy lives above $2.10–$2.14, with affirmation at $2.50. Weak spot exhibits if ASTER loses $1.90, probably trapping the value again right into a messy mid-range and stalling the $3 dream.

For now, momentum is alive, liquidity is flowing, and ASTER’s chart construction is tight sufficient to maintain each merchants and whales glued to their screens.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.