The worth of Pi Community dropped greater than 90% off the height, and rug pull so claims emerged because the community misplaced 18B of worth. Shareholders are floundering with the shortage of liquidity and insider points.

The worth of the token of the Pi Community has fallen greater than 90 % since its peak in February 2025, with the launch of the mainnet. In six months, this dramatic decline erased over 18 billion of market worth.

Supply –X

Many buyers who mined Pi as an alternative of buying tokens have suffered a grotesque loss regardless of their preliminary pleasure. The token worth is at present round 26 cents, in comparison with the highs of about 3 per Pi.

This sharp crash has introduced again allegations by sections of the neighborhood that the downfall of Pi Community is much like a rug pull.

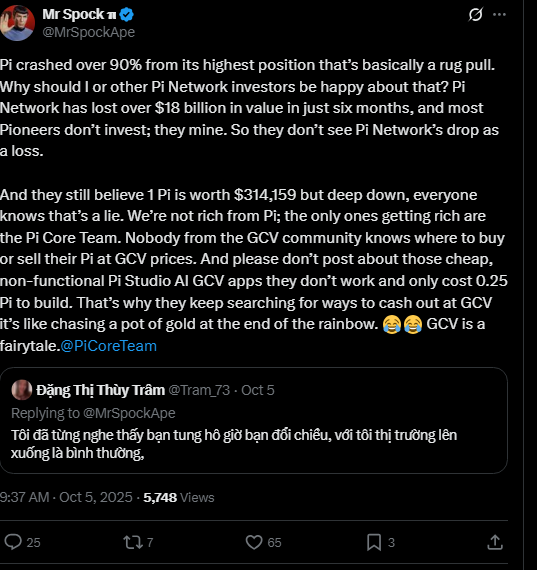

A social media analyst popularly termed the crash a rug pull, noting that the one winners appear to be the Pi Core Group, however not common customers who mined tokens over time.

Customers report that there’s a lack of liquidity, and it’s virtually not possible to promote Pi on the official costs proclaimed by the venture. This has prompted buyers to hunt elusive returns in what some could time period a fairy story ecosystem.

Pi Core Group and Insider Promoting Scrutinized

The Pi Core Group holds a big quantity of tokens (round 90 billion cash), which will be centralized.

Considerations are that insider promoting of tokens has occurred behind the scenes, which has additionally led to the autumn in pricing.

Blockchain information in current months signifies that enormous volumes of tokens have been offered, a indisputable fact that provides to skepticism in regards to the existence of an insider dump plotting the autumn.

Though supporters of the workforce declare that no preliminary funding was raised, and subsequently there was technically no “rug pull” in any respect, the excessive degree of focus of tokens within the fingers of the Pi Basis stirs up considerations of manipulation.

Major trade platforms similar to Binance and Coinbase haven’t listed Pi, citing considerations about transparency and centralization, which additional undercuts worth prospects.

Demand was additionally influenced by the exit of an nameless whale who had amassed greater than 383 million Pi cash. The truth that this whale has stopped buying has eradicated the important help to the value of the token, additional exerting downward strain.