Bitcoin has surged to a brand new all-time excessive, reaching $126,000, earlier than coming into a brief consolidation section as merchants await affirmation of a breakout into uncharted territory. The transfer marks one other milestone in Bitcoin’s relentless uptrend, fueled by optimism throughout each institutional and retail segments. Nevertheless, the market now faces a crucial check — whether or not bulls can maintain momentum above this key psychological stage and push the value towards increased valuations.

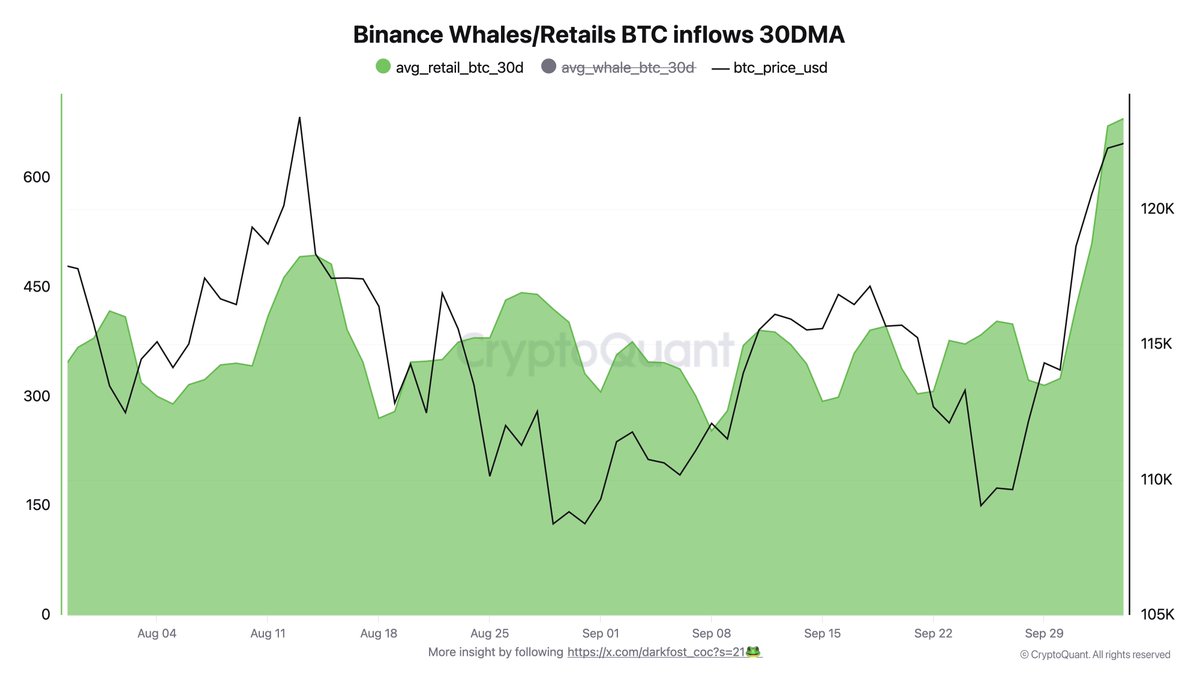

Prime analyst Darkfost shared new knowledge suggesting a notable behavioral shift amongst smaller buyers. In accordance with on-chain flows, BTC inflows to Binance from addresses holding lower than 1 BTC have risen sharply, signaling a resurgence of retail exercise. This class of buyers had been largely dormant throughout earlier phases of the rally, when institutional demand dominated value motion.

The renewed participation of retail merchants means that confidence is returning to the market, a standard attribute seen in late-stage bullish phases. Whereas the whole quantity from these smaller addresses stays modest in comparison with institutional flows, their rising exercise usually amplifies volatility and momentum. With Bitcoin consolidating slightly below its document highs, the approaching days might outline whether or not this retail revival fuels the following leg of the rally or triggers short-term profit-taking.

Retail Exercise Returns As Establishments Maintain Regular

In accordance with Darkfost, the most recent onchain knowledge reveals a transparent resurgence of retail participation within the Bitcoin market. He highlights that the month-to-month common of BTC inflows to Binance from wallets holding lower than 1 BTC has climbed to ranges not seen in months. Whereas the whole transferred quantity from this group stays comparatively small in comparison with institutional flows, the development marks a significant behavioral shift amongst smaller buyers who’re re-entering the market as Bitcoin trades round its new all-time excessive.

This renewed retail exercise comes after months of low engagement, when market dynamics had been largely dictated by institutional gamers and company treasuries steadily accumulating Bitcoin. Darkfost notes that whereas massive holders preserve a disciplined, long-term accumulation technique, retail merchants are displaying indicators of traditional cyclical conduct — responding rapidly to cost surges and momentum slightly than long-term worth metrics.

Curiously, this divergence between institutional accumulation and retail hypothesis usually defines key levels in Bitcoin’s market cycles. Traditionally, retail re-entry close to earlier highs tends to extend volatility but in addition strengthens liquidity and market depth, permitting for bigger value expansions.

Institutional and treasury demand continues to offer structural help, whereas the revival of retail enthusiasm provides gas to Bitcoin’s bullish momentum. If each forces stay aligned, the mixture might set the stage for an prolonged transfer increased — however analysts additionally warn that extreme retail euphoria can precede short-term corrections. In both case, the return of smaller buyers underscores renewed confidence in Bitcoin’s long-term narrative and the broader market restoration underway.

Value Consolidation Under $125K

Bitcoin is presently buying and selling round $124,100, consolidating slightly below its latest all-time excessive at $125,000. The chart exhibits that BTC has entered a short cooling section after a pointy 15% rally from the $109,000 area earlier this month. Regardless of minor retracements, the general market construction stays strongly bullish, with value motion comfortably above the 50-day and 200-day transferring averages, indicating sustained upward momentum.

The $125,000 stage is now performing as a psychological barrier and short-term resistance. A clear breakout and each day shut above this mark would affirm continuation into value discovery, doubtlessly concentrating on $130,000–$135,000 within the coming weeks. On the draw back, the $117,500 zone — the earlier resistance and now a confirmed help stage — stays a key space to look at if volatility will increase.

The broader sentiment stays bullish as each institutional and retail demand develop in parallel. With whale promoting strain easing and smaller buyers changing into extra lively, Bitcoin’s short-term development seems wholesome, setting the stage for an additional breakout try if patrons preserve management above $120,000.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.