Be part of Our Telegram channel to remain updated on breaking information protection

Michael Saylor is urging widespread YouTuber Jimmy Donaldson, also called MrBeast, to purchase Bitcoin at the same time as Technique hits the brakes by itself BTC accumulation.

Saylor’s message to the YouTube megastar got here after MrBeast posted concerning the speedy progress of AI on X, which he says poses a possible risk to YouTubers’ revenue.

“When AI movies are simply pretty much as good as regular movies, I ponder what that can do to YouTube and the way it will affect the hundreds of thousands of creators at present making content material for a residing,” MrBeast mentioned. ”Scary occasions.”

Saylor, a long-time advocate for Bitcoin, replied by saying, “Purchase Bitcoin MrBeast.”

Purchase Bitcoin MrBeast.

— Michael Saylor (@saylor) October 5, 2025

Technique Pauses Its Bitcoin Accumulation As BTC Trades Close to ATH

Technique is the most important company holder of Bitcoin, and is well-known for pioneering the crypto treasury development when it began accumulating BTC again in 2022. Since then, 344 entities have amassed 3.88 million BTC collectively.

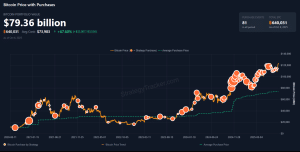

SaylorTracker information exhibits that Technique has 640,031 BTC valued at $79.36 billion.

Technique Bitcoin holdings (Supply: SaylorTracker)

The corporate’s most up-to-date buy was on Sept. 29, when it purchased 196 BTC. Previous to this acquisition, the agency had bought BTC for eight consecutive weeks.

However the firm is taking a break from its Bitcoin shopping for, as indicated by a latest X put up by Saylor.

“No new orange dots this week,” Saylor wrote in a put up on X, signaling that there won’t be a brand new BTC buy announcement this week.

No new orange dots this week — only a $9 billion reminder of why we HODL. pic.twitter.com/P84m14WF3G

— Michael Saylor (@saylor) October 5, 2025

The choice to pause the corporate’s BTC accumulation comes because the main crypto soared to a brand new all-time excessive (ATH) above $125K on Oct. 5.

The crypto king has since pared features and trades at $123,841.96 as of seven:17 a.m. EST, in accordance with CoinMarketCap information. On the present value, Technique’s unrealized year-to-date (YTD) achieve on its BTC place stands at round $14.42 billion.

Bitcoin Alternate Flows Drop To Six-Yr Low As ETF Inflows Soar

If MrBeast decides to behave on Saylor’s advice, it might result in some extra shopping for stress on BTC’s value.

Upside stress on Bitcoin is already sturdy, with spot BTC ETFs (exchange-traded funds) pulling of their second-biggest weekly inflows final week. Throughout this era, buyers poured greater than $3.2 billion into the funds, information from Farside Traders exhibits.

Most of these inflows have been into IBIT, the spot BTC ETF belonging to asset administration big BlackRock. Final week, round $1.8 billion flowed into the product, accounting for greater than half of the inflows seen for spot Bitcoin ETFs through the interval.

That sturdy demand can also be accompanied by a lower within the variety of Bitcoin that’s that can be purchased on exchanges. On-chain information from Glassnode exhibits that there’s simply 2.83 million BTC on centralized trade platforms, marking a six-year low within the accessible quantity.

The final time that there have been fewer cash saved on exchanges was early June 2019. Again then, BTC was buying and selling at $8,000 and was within the depths of a bear market.

“Listening to exchanges are out of Bitcoin,” wrote VanEck’s head of digital asset analysis Matthew Sigel on X. “Monday 9:30am may be the primary official scarcity.”

Listening to exchanges are out of Bitcoin.

Monday 9:30am may be the primary official scarcity.

Not monetary recommendation… simply: it’d make sense to get some. https://t.co/yNSMEw2oms

— matthew sigel, recovering CFA (@matthew_sigel) October 3, 2025

MrBeast Might Be Shopping for ASTER

It’s unclear whether or not MrBeast will take Saylor’s recommendation and purchase Bitcoin, however a number of on-chain monitoring corporations have highlighted shopping for exercise round Aster (ASTER) that they imagine is linked to the YouTuber.

A type of corporations is PRIME X, which alleged that the YouTuber spent $320,000 on ASTER tokens. In keeping with the report, the acquisition introduced MrBeast’s whole holdings to roughly $1.28 million.

One other on-chain analytics agency, Lookonchain, additionally revealed that wallets linked to MrBeast had deposited $1 million in Tether’s USDT stablecoin earlier than buying over 500,000 ASTER tokens at a mean value of $1.87.

MrBeast(@MrBeast) purchased 538,384 $ASTER($990K) over the previous 3 days.

He deposited 1M $USDT into #Aster utilizing public pockets 0x9e67 and new pockets 0x0e8A, then withdrew 538,384 $ASTER.

The typical shopping for value was seemingly ~$1.87.https://t.co/Gm7MPrUqEk pic.twitter.com/cntXZ9XEQP

— Lookonchain (@lookonchain) September 26, 2025

The YouTuber rapidly denied the transactions in an X put up.

“By no means heard of that coin, and that’s not my pockets,” he wrote on X.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection