Bitcoin has seen a pullback under the $121,000 mark up to now day. Right here’s the place the subsequent help degree might lie, based on on-chain information.

Bitcoin Has Witnessed A Quick Plunge Throughout The Final 24 Hours

Bitcoin appeared to be coming into into an prolonged all-time excessive (ATH) exploration mode because it set a number of new data over the weekend and Monday, however the market has been delivered a Tuesday shock because the cryptocurrency has seen a fast crash again under $121,000.

In comparison with the brand new ATH round $126,200, Bitcoin is now down greater than 4%. The altcoins have additionally taken a success throughout the previous day, with many prime cash even printing returns worse than the primary digital asset. 24-hour losses stand at 5% for Ethereum and 6% for XRP. BNB is the one cryptocurrency among the many massive caps that has managed a constructive return of 5%.

With Bitcoin now sliding down, one query naturally arises: how a lot decrease can the asset go? Whereas markets are unpredictable, there can nonetheless be some elements value keeping track of. One such issue could also be on-chain help clusters.

BTC CBD Exhibits Assist Cluster Round $117,000

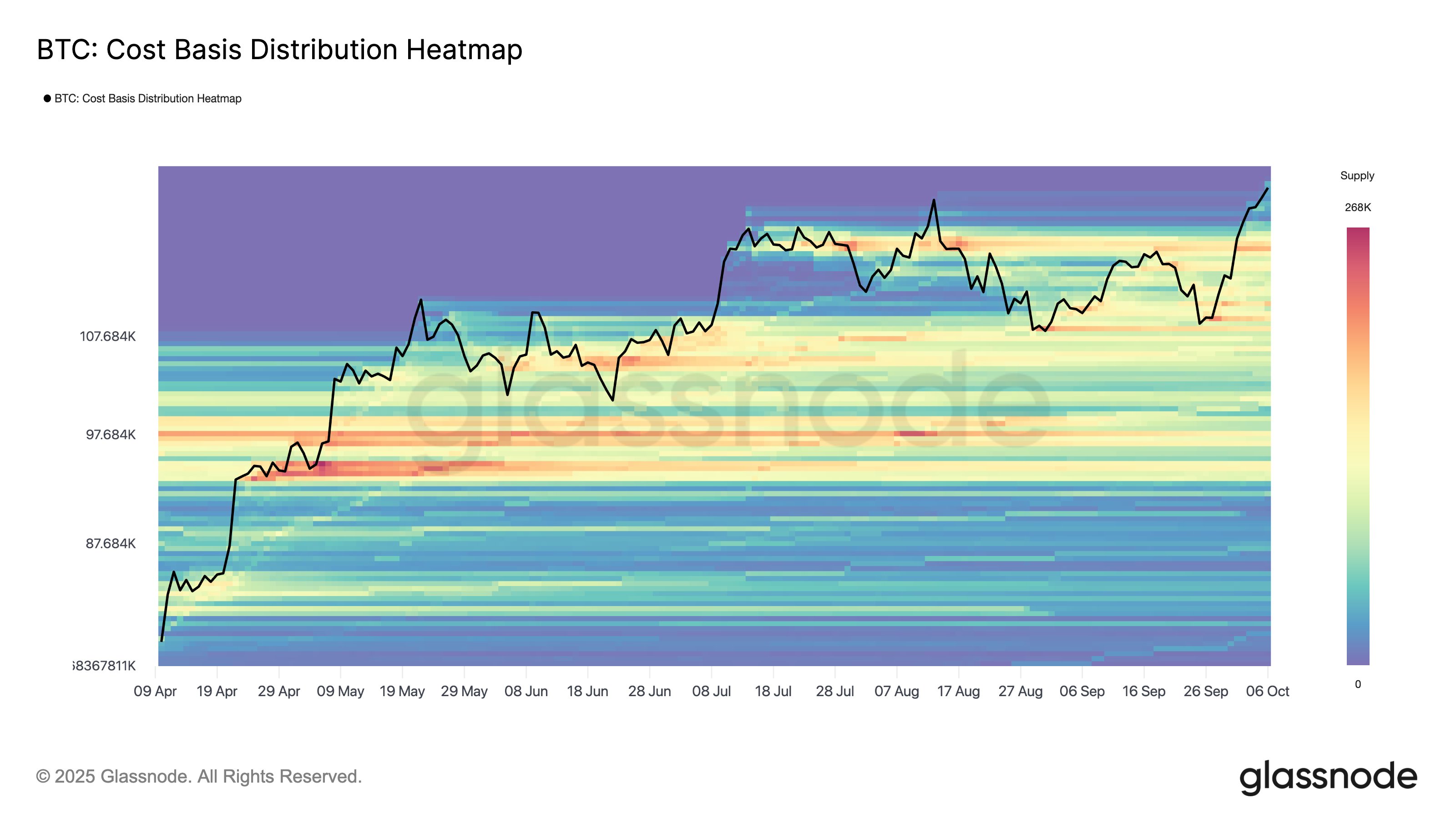

In a brand new put up on X, on-chain analytics agency Glassnode has talked about how the Price Foundation Distribution (CBD) is searching for Bitcoin. The CBD is an indictor that tells us about what number of tokens of the cryptocurrency have been final acquired on the varied spot worth ranges.

Under is the chart for the metric shared by Glassnode.

As displayed within the above graph, the $120,000 to $121,000 vary, which the cryptocurrency is retesting proper now, carries the price foundation of a skinny quantity of provide.

In on-chain evaluation, investor price foundation is taken into account an essential matter as a result of holders are inclined to react in a particular method every time their break-even degree is retested. The extra provide that was final bought at a specific degree, the stronger is the market’s response to a retest.

When traders face a retest of their profit-loss boundary from the above, they might determine to purchase extra, believing the drawdown to be a “dip” or for merely defending their price foundation.

On condition that the present vary incorporates the price foundation of some traders, some extent of accumulation might occur, nevertheless it solely stays to be seen whether or not will probably be sufficient for a backside.

Within the situation that BTC declines additional, the subsequent key help cluster to look at is situated close to $117,000, the place a notable 190,000 BTC was acquired. “A pullback into this space might entice demand as latest patrons defend the extent,” explains the analytics agency.