Bitcoin is coming into a pivotal part because it hovers close to key resistance ranges, with merchants anticipating an expansive transfer that would outline the subsequent leg of the market cycle. The broader macro backdrop provides complexity to this second—gold continues to rise, signaling mounting stress throughout conventional monetary methods and renewed curiosity in exhausting property. Traditionally, such strikes in gold have preceded related reactions in Bitcoin, usually serving as a number one indicator of capital rotation into digital shops of worth.

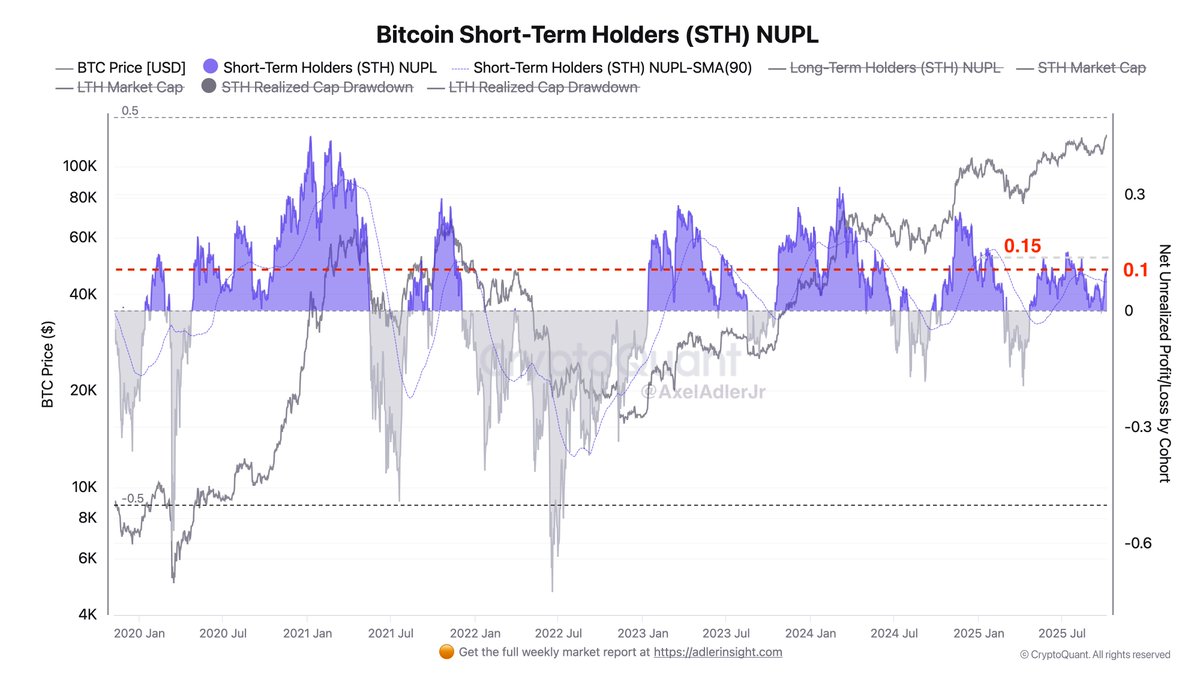

Amid this setup, on-chain knowledge from CryptoQuant reveals an necessary dynamic amongst short-term contributors. The Brief-Time period Holder Unrealized Revenue metric has began to rise, displaying that latest consumers are sitting on rising paper positive aspects. This conduct usually serves as an early sign of market rigidity—both previous a wave of profit-taking or marking the start of an accelerated bullish part.

Analysts are divided: some see parallels with earlier pre-breakout durations when BTC consolidated earlier than large upside expansions, whereas others warn that extreme unrealized income may set off a short-term correction. In both case, the info factors to an more and more energetic market construction, the place each macro catalysts and onchain sentiment align for what might be Bitcoin’s most decisive second since its final all-time excessive.

Bitcoin Brief-Time period Holders Sign $131K Goal

Analyst Axel Adler shared onchain insights suggesting that Bitcoin could also be on the verge of one other main transfer. In accordance with Adler, Brief-Time period Holders’ (STH) unrealized revenue has now risen to 10%, reflecting rising optimism amongst latest market contributors. This stage of profitability has traditionally coincided with heightened volatility, as merchants start to determine between locking in positive aspects or driving the development larger. Adler highlighted that earlier this 12 months, when unrealized income reached 15%, the market skilled a wave of promoting stress — triggering a short lived correction earlier than resuming the uptrend.

Adler’s evaluation locations the subsequent crucial threshold round $131.8K per BTC, the place short-term holders could once more be incentivized to take income. Nevertheless, this stage additionally marks a possible acceleration level if demand from establishments and ETFs continues to soak up provide effectively. The market’s construction means that BTC might be getting ready for a big breakout after weeks of consolidation close to the $125K area.

Whereas warning stays warranted attributable to elevated unrealized positive aspects, the broader macro backdrop — together with rising gold costs and liquidity rotation into danger property — helps the view that Bitcoin’s bullish cycle stays intact. Many analysts count on a robust push towards new highs within the coming weeks if momentum persists and short-term promoting stays restricted.

Bulls Maintain Floor Close to All-Time Excessive

Bitcoin is at the moment buying and selling round $124,316, consolidating slightly below its all-time excessive close to $126,000 after a robust multi-week rally from the $109,000 area. The chart reveals BTC holding above key help at $117,500, a stage that acted as main resistance all through August and September. Its profitable breakout and subsequent retest affirm a shift in market construction towards a sustained bullish development.

The 50-day, 100-day, and 200-day transferring averages at the moment are trending upward, reinforcing the constructive outlook. Value motion reveals tightening candles close to resistance, an indication of equilibrium between consumers and short-term profit-takers. If BTC manages to shut decisively above $125,000, it may set off an acceleration towards $130,000–$132,000, aligning with the subsequent key Fibonacci extension ranges.

Nevertheless, momentum seems to be cooling barely after an prolonged run, suggesting a possible short-term consolidation part earlier than one other impulse. So long as the worth stays above $120,000, the broader bullish construction stays intact. The continued energy in gold and renewed inflows from ETFs present a supportive macro backdrop, hinting that Bitcoin may quickly enter worth discovery if bulls preserve management and short-term holders resist the urge to comprehend income prematurely.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.