Be part of Our Telegram channel to remain updated on breaking information protection

BlackRock’s IBIT is now the asset supervisor’s most worthwhile ETF (exchange-traded fund) by a large margin because the fund nears $100 billion in web belongings.

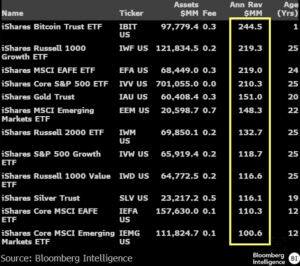

Over the previous yr, IBIT has generated nearly $245 million in charges. This efficiency beats the iShares Russell 1000 Progress ETF (IWF) and the iShares MSCI EAFE ETF (EFA) by $25 million in annual income, in accordance to Bloomberg ETF analyst Eric Balchunas.

Across the center of July, IBIT was nonetheless ranked beneath IWF and EF by way of income, earlier X posts from Balchunas present.

Different Prime BlackRock ETFs Took A Decade To Get To Their Present Standing

Blachunas additionally famous that each different BlackRock ETF within the agency’s high 12 record of funds by way of charge income took roughly greater than a decade to get to their present standing.

In his publish, Blachunas shared a screenshot of the ages of BlackRock’s high 12 ETFs and their respective annual income in {dollars}. This screenshot exhibits that aside from IBIT, the remainder of the highest 5 BlackRock ETFs are throughout 20 years previous.

Prime 12 BlackRock ETFs (Supply: X)

“Take a look at the ages of the remainder of the Prime 10. Absurd,” Balchunas wrote in his publish.

IBIT Might Change into The Quickest ETF To Hit $100B In Belongings

In a remark beneath his publish, Balchunas went on to notice that BlackRock’s IBIT is closing in on the $100 billion in asset milestone regardless of launching lower than a yr in the past. If the present development continues, his publish means that IBIT might turn out to be the quickest ETF in historical past to realize the milestone.

Right here’s the quickest ETFs hit to $100b chart. $VOO present greatest at 2,011 days. $IBIT at 435 days however w $2b to go. By way of @JackiWang17 pic.twitter.com/IrGLgrz2dr

— Eric Balchunas (@EricBalchunas) October 6, 2025

The present document holder is the Vanguard S&P 500 ETF (VOO), which achieved the milestone in 2,011 days. In the meantime, IBIT has solely been buying and selling for 435 days and is $2 billion away from reaching the milestone, based on the Bloomberg ETF analyst.

NovaDius Wealth President Nate Geraci additionally commented on IBIT probably reaching the $100 billion milestone. To place the spot Bitcoin ETF’s efficiency into perspective, Geraci stated that solely 18 of the greater than 4,500 ETFs presently available in the market have over $100 billion in belongings beneath administration (AUM).

Btw…

Solely 18 of 4,500+ ETFs have > $100bil AUM.

Learn that once more.

— Nate Geraci (@NateGeraci) October 6, 2025

US Spot Bitcoin ETFs Lengthen Influx Streak, Belongings Hit $169B

BlackRock’s robust efficiency comes as traders proceed to flock to US spot Bitcoin ETFs. After notching their second-highest weekly inflows final week of greater than $3.3 billion, traders continued to pour capital into the merchandise within the newest buying and selling session.

In accordance with knowledge from SoSoValue, the funds pulled in $1.19 billion on Oct. 6. A lot of those inflows had been recorded by IBIT, which noticed $969.95 million added to its reserves on the day. The subsequent-biggest inflows of $112.32 million had been posted by Constancy’s FBTC.

IBIT has been the dominant US spot Bitcoin ETF because the funds’ inception final yr, with its cumulative inflows topping $63 billion. FBTC is subsequent with its cumulative inflows thus far standing at $12.73 billion.

Total, the Bitcoin funds have seen their collective AUM attain $169 billion, based on Bloomberg ETF analyst James Seyffart.

US Spot Bitcoin ETFs now have ~$169 billion in belongings…

these charts and about 20 extra can be found in my chart pack for Bloomberg terminal purchasers: https://t.co/JxGH5v7Eos pic.twitter.com/uB4Dxyslc7

— James Seyffart (@JSeyff) October 6, 2025

The robust inflows into spot Bitcoin ETFs have helped the crypto market chief obtain back-to-back all-time highs (ATHs). The primary document peak above $125k was reached on Oct. 5. Simply 24 hours later, BTC then went on to set a brand new ATH of $126,198.07, CoinMarketCap knowledge exhibits.

BTC value (Supply: CoinMarketCap)

BTC has since retraced to commerce at $124,574.69 as of 1:40 a.m. EST.

BlackRock Exploring Information Methods To Make Cash From Bitcoin

BlackRock is seeking to broaden on its Bitcoin ETF providing to traders as nicely, and lately filed to register a Delaware belief firm for its proposed Bitcoin Premium Revenue ETF.

The asset supervisor’s proposed product would promote coated name choices on Bitcoin futures. It’s going to then accumulate premiums to generate yield.

Nevertheless, the common distributions would scale back any potential upside from investing in IBIT.

In accordance with Blachunas, the transfer signifies that BlackRock chooses to slightly broaden on its Bitcoin and Ethereum (ETH) choices and never take part within the altcoin ETF frenzy, not less than for now.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection