- XRP is forming a year-long ascending triangle with breakout potential between Sept–Dec 2025.

- Worth stays above all key EMAs, displaying sturdy long-term help.

- Merchants are eyeing $3.05–$3.10 because the breakout set off zone, whereas $2.70 acts as crucial near-term help.

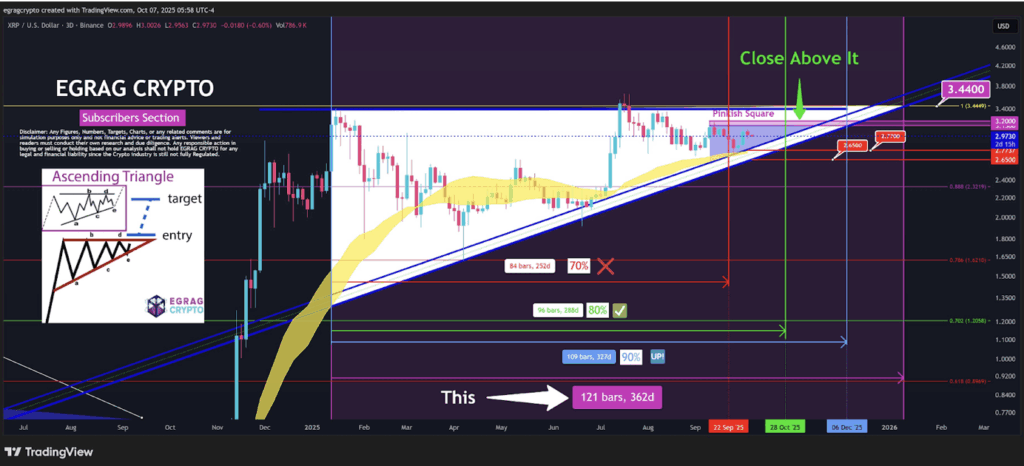

XRP’s worth remains to be shifting inside a long-term ascending triangle, a construction that merchants know usually precedes explosive strikes. Analyst EGRAG CRYPTO has been monitoring the setup intently, noting that it’s been constructing for almost 362 days — a reasonably lengthy stretch by crypto requirements. In accordance with his math, the breakout window lands someplace between late September and early December 2025.

If the sample performs out, the 70% completion mark factors to September 22 as an early breakout shot, whereas the 80% mark extends that timeline to October 28. For individuals who like to attend till the very edge, the 90% completion indicators December 6 because the final attainable pivot date.

The formation matches the broader technical backdrop: XRP has been consolidating tighter and tighter, a habits that normally sparks volatility enlargement as soon as the coil lastly snaps.

XRP Holds Robust Above Key Shifting Averages

In the meanwhile, XRP is buying and selling round $2.87, slipping about 3.3% over the previous week. Even with that dip, it’s nonetheless holding effectively above its 20-week EMA at $2.78, which has acted as dependable help. Under that, the 50, 100, and 200 EMAs sit at $2.33, $1.79, and $1.29. They’re all neatly stacked in ascending order, a textbook signal that the long-term pattern remains to be firmly intact.

This layering of shifting averages exhibits resilience even when costs wobble short-term. Merchants appear to be steadily accumulating throughout these small corrections, constructing what seems like a affected person higher-low construction on the weekly chart.

Momentum Alerts Impartial However Leaning Optimistic

Taking a look at momentum indicators, XRP seems to be in a cooling-off stage earlier than its subsequent transfer. The RSI sits at 54, principally proper in impartial territory — not overbought, not oversold. This suits the concept the market is simply biding time, with patrons and sellers balancing one another out for now.

The MACD, however, nonetheless exhibits a slight bearish tilt, because the sign line edges above the primary line. However the hole between them is narrowing, which regularly indicators momentum loss from sellers. A correct crossover might flip sentiment shortly.

Key Ranges to Watch Going Ahead

For merchants, the large resistance sits between $3.05 and $3.10. A clear breakout there might open the door to $3.50 and presumably past. But when XRP can’t keep above $2.70, strain may drag it again down towards $2.33 and even $1.79, each of which stay bigger structural helps.

Total, the triangle setup, regular EMAs, and impartial indicators all counsel XRP is quietly gearing up for its subsequent large transfer — the one query is when it decides to interrupt unfastened.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.