Jack Ma’s fintech community deepens ETH push

Anthea Holding Restricted, a Bermuda-based crypto insurance coverage agency, has raised $22 million in Collection A financing led by Yunfeng Monetary Group, a Hong Kong-listed fintech firm co-founded by Alibaba founder Jack Ma.

Anthea stated the brand new capital will fund the launch of its first Ethereum-based life insurance coverage product, alongside growth into the Asian market.

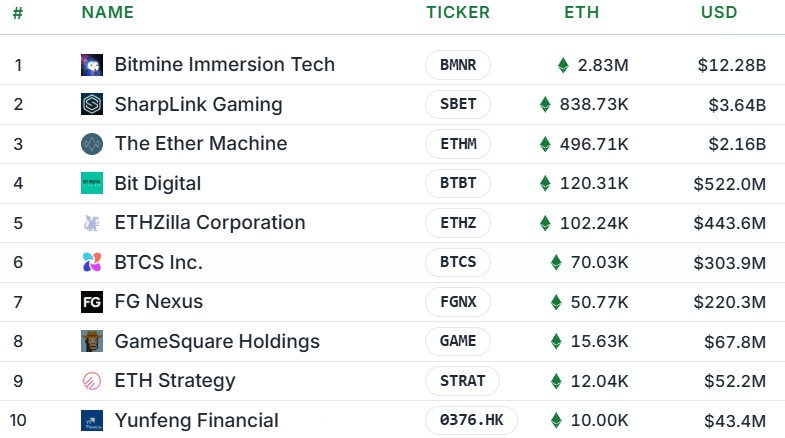

The funding comes simply over a month after Yunfeng Monetary bought 10,000 ETH (about $44 million), which serves as a strategic reserve for real-world asset tokenization and DeFi-linked insurance coverage purposes.

Yunfeng’s deepening engagement with Ethereum displays a broader evolution within the crypto stance of Ma’s monetary community. Ma referred to as Bitcoin a bubble in 2018, however persistently championed blockchain know-how.

After Ma’s high-profile fallout with Chinese language regulators and the halted Ant Group IPO in 2020, his public presence diminished. However just lately, his offshore funding automobiles have change into more and more energetic in regulated digital asset markets past mainland China.

Japan’s finance titans are turning to crypto

Two of Japan’s most influential monetary powerhouses are deepening their push into cryptocurrency by means of main bulletins remodeled the previous week.

The primary got here from Nomura Holdings, a part of Nomura Group, Japan’s largest funding banking and brokerage conglomerate. Its Switzerland-based digital asset arm, Laser Digital, stated it’s in pre-consultation talks with Japan’s Monetary Providers Company (FSA) to use for a license to serve institutional crypto traders. A joint Nomura–Laser Digital survey in June discovered that 54% of funding managers in Japan plan to realize crypto publicity inside the subsequent three years.

The second got here from PayPay, the cell fee platform co-founded by SoftBank Group, Japan’s tech and funding large. PayPay introduced on Thursday that it had acquired a 40% stake in Binance Japan, enabling fiat-to-crypto onramps that enable Binance customers to buy digital belongings straight by means of PayPay. The platform, which utilized for a US itemizing in August, has greater than 60 million customers domestically.

Learn additionally

Options

How the crypto workforce modified within the pandemic

Options

Hong Kong isn’t the loophole Chinese language crypto companies suppose it’s

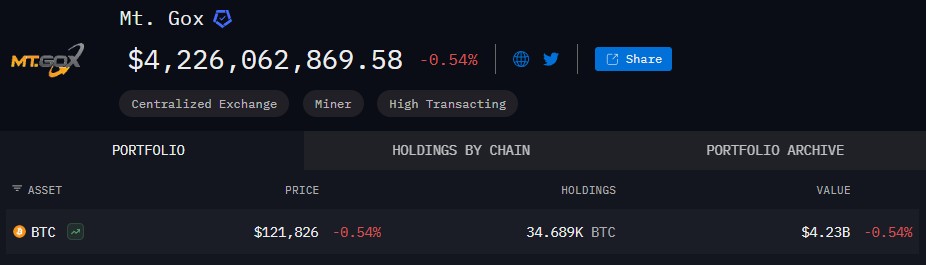

Japan is among the world’s earliest crypto markets and was dwelling to Mt. Gox, as soon as the biggest cryptocurrency trade globally. The 2014 Mt. Gox hack prompted the FSA to take a stricter stance on digital belongings, nevertheless it additionally paved the way in which for early regulation. Japan launched its Cost Providers Act (PSA) in 2017, establishing a licensing framework for exchanges, and later turned the primary main financial system to implement stablecoin guidelines by means of amendments to the PSA.

In latest months, Japan’s crypto narrative has regained momentum, with the JPYC stablecoin drawing international consideration and main monetary establishments formalizing their entry into the sector. Policymakers have additionally proposed lowering the crypto tax price from 55% to a flat 20%.

Including to the shifting panorama, Sanae Takaichi gained the Oct. 4 election to change into Japan’s new prime minister. Whereas she has but to stipulate her stance on digital belongings, her management is broadly seen as a possible enhance for the nation’s evolving crypto financial system.

South Korean whales characterize over 90% of the native market

Knowledge launched to the media by lawmaker Lee Hunseung, citing figures from the Monetary Supervisory Service, confirmed that the highest 10% of cryptocurrency traders accounted for six.55 trillion gained (roughly $4.7 trillion) in buying and selling quantity throughout the nation’s 5 largest exchanges, representing 91.2% of all home transactions over the previous 18 months.

When narrowing the scope to Bitcoin, Ethereum, and XRP, the buying and selling share of the highest 10% surged to 95%. Change-level knowledge confirmed related patterns, with the highest 10% accounting for 91.2% of buying and selling on Upbit, 96% on Bithumb and practically 99% on Gopax.

The findings comply with an earlier 2024 report from lawmaker Ahn Do-gul, which targeted on crypto asset possession quite than buying and selling quantity. That evaluation of seven.7 million energetic accounts throughout Upbit and Bithumb confirmed that the highest 1% of traders managed about 70% of complete crypto holdings.

Ahn’s report additionally revealed that high-value accounts exceeding 1 billion gained had been primarily held by middle-aged traders of their 40s and 50s, with a mean stability of 9.45 billion gained. In contrast, 92% of accounts held lower than 10 million gained. Ahn prompt that if the federal government’s 20% crypto capital good points tax — at present postponed till 2027 — had been applied, it may generate as much as 1 trillion gained in annual tax income.

Learn additionally

Options

Gen Z and the NFT: Redefining Possession for Digital Natives

Options

Memecoins are ded — However Solana ‘100x higher’ regardless of income plunge

The Philippines orders World App to halt knowledge processing

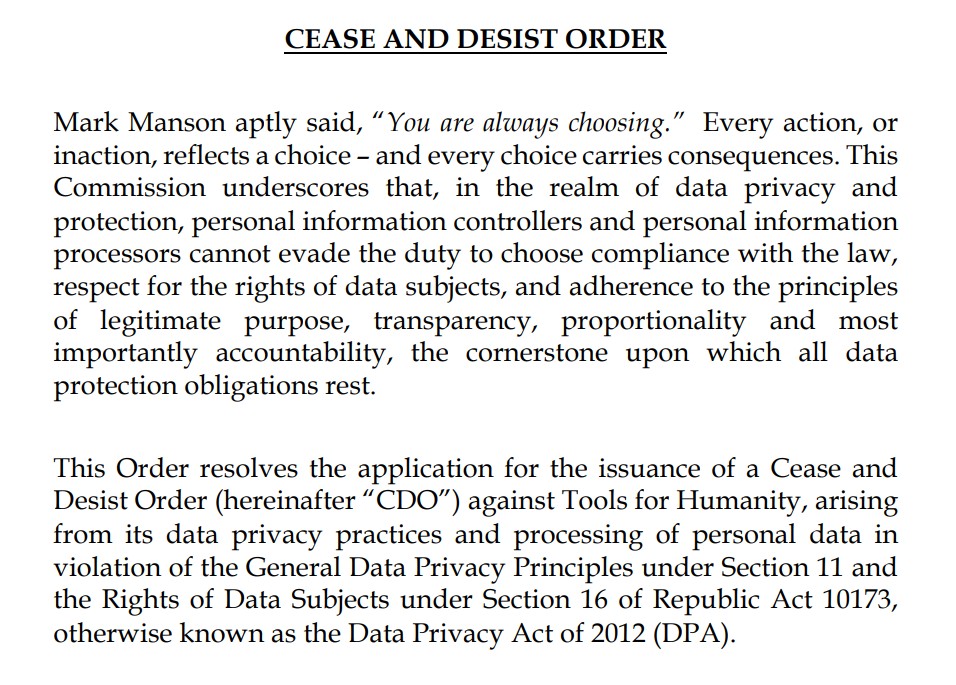

The Nationwide Privateness Fee (NPC) has ordered Instruments for Humanity (TFH), the developer of World App and the Orb biometric machine, to stop and desist from processing private data within the Philippines.

The regulator discovered that World App’s biometric knowledge assortment practices violated native privateness legal guidelines, citing invalid consent, extreme assortment of retinal and iris scans, and dangers of identification theft or cloning. The order adopted complaints that TFH had gathered delicate knowledge throughout a cybersecurity and monetary literacy occasion earlier this yr.

Additionally learn: Worldcoin’s much less ‘dystopian,’ extra cypherpunk rival — Billions Community

TFH countered that it doesn’t gather names or addresses and that the Orb solely converts eye photographs into encrypted “iris codes” saved domestically on person units. The NPC, nevertheless, dominated that the exercise nonetheless posed potential hurt to people given the sensitivity of biometric data.

World App is a part of Worldcoin, an identity-focused crypto mission co-founded by OpenAI’s Sam Altman. The mission has confronted related regulatory actions globally, together with a cease-operation order in Hong Kong and a high-quality in South Korea for violating privateness legal guidelines.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist overlaying blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has coated Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.