Key Takeaways

- Arthur Hayes claims the four-year Bitcoin cycle is lifeless because the market has advanced previous that part.

- Chinese language policymakers have all the time had an influence on the crypto market, however the market has grown to outlive with out them.

- The crypto market would nonetheless expertise bull cycles; nonetheless, historic information from the previous 4 years would have little impact available on the market primarily based on adoption.

The four-year crypto bull cycle has all the time attracted an adrenaline rush from merchants, traders, and crypto specialists who’ve witnessed Bitcoin (BTC) carry out extraordinarily effectively over the previous few years, with hypothesis of its bull cycle making waves within the crypto house.

Nevertheless, BitMex co-founder Arthur Hayes believes the present market is completely different and will sign the tip of BTC’s four-year cycle, which has seen costs rally to new all-time highs. He claims the market has grown past historic information and patterns that might point out a bull market or market high.

His arguments are primarily based on three references to previous historic information and the way the present shift in microeconomic and institutional influx of cash suggests the present cycle could be completely different from the previous.

Genesis Cycle and the World Monetary Disaster

In 2008, the world confronted the worldwide monetary disaster, which impacted monetary establishments globally. Governments labored tirelessly to abate the scenario, exploring varied insurance policies.

Nevertheless, China performed a key position in assuaging the scenario through the use of credit score to gas infrastructural spending and a bid to save lots of the economic system. At the moment, cash flowed into actual property, Bitcoin, and Gold, resulting in the BTC crash.

The world survived these robust occasions because the crypto market began seeing some development, main as much as the Preliminary coin providing (ICO) bubble.

ICO Cycle

This era was marked by the expansion of ICOs within the crypto house, with Ethereum going stay and good contracts fueling this development. This led to the rally of Bitcoin as soon as extra from the ashes because the Yuan foreign money was devalued towards the USD. BTC noticed its worth hit new highs because of extreme Yuan within the economic system, resulting in one of many largest bull cycles ever witnessed, however later noticed its worth crash round late 2017.

The crypto market skilled fewer actions till COVID-19, when the market crashed to a cheaper price level earlier than experiencing one other rally from 2017 to 2021.

COVID-19 Bitcoin Worth Motion and Past

COVID-19 was a scare for a lot of, taking hundreds of thousands of lives and resulting in countless insurance policies by the federal government to discover a answer. The US authorities provided palliatives to residents, and the injection of cash into the economic system led to a growth within the crypto market on the time, with each crypto asset, together with memecoin, being “UP ONLY”.

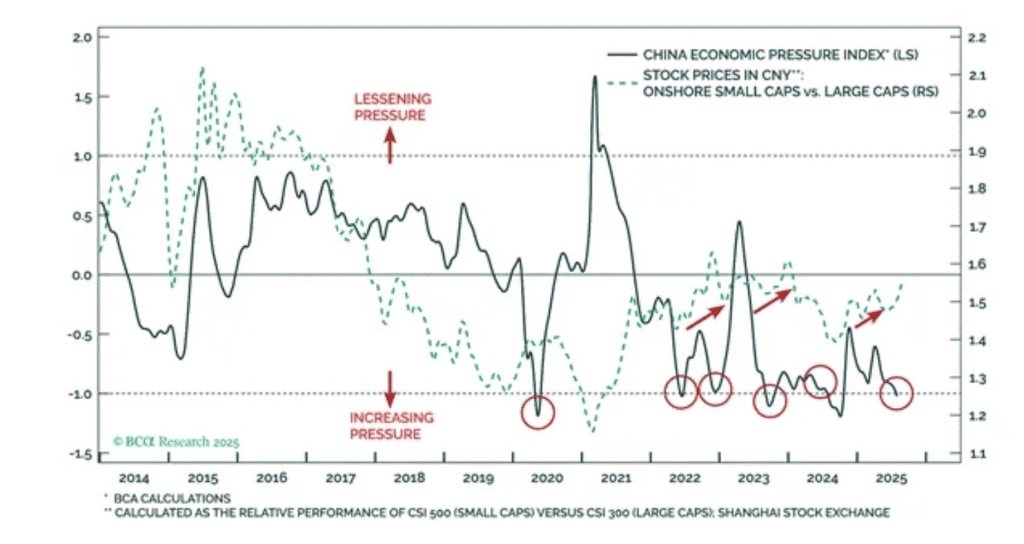

Supply – Chinese language Policymakers Print Cash to Ease Market Rigidity

At the moment, the Chinese language authorities was centered on tackling COVID-19 by means of insurance policies that had little influence on the crypto house. Nevertheless, these financial occasions have considerably impacted the crypto market over time because the US authorities, by means of Trump’s administration, has change into more and more thinking about it.

The emergence of institutional gamers, Alternate-traded funds (ETFs), and favorable insurance policies may redefine the following crypto cycles.

In accordance with Hayes, crypto bull cycles will nonetheless be current out there, however he strongly believes the market has advanced past the Bitcoin 4-year bull cycles, as insurance policies, governments, and monetary establishments now affect market occasions.

FAQs

What’s the 4-year cycle in crypto?

The four-year crypto cycle has been marked by key occasions which have formed the overall market, together with Bitcoin.

Does crypto go up each 4 years?

Following BTC’s four-year halving, the market is predicted to rally to new all-time highs with altcoins performing extraordinarily effectively.

What occurs each 4 years with Bitcoin?

BTC experiences halving each 4 years, together with its block mining, which has been a daily prevalence for years now.

Associated Learn

Gold and Silver Hit New Highs as BTC Struggles – Is the Prime In?