- BNB Chain has flipped Solana in 24-hour DEX quantity for 3 straight days.

- Meme coin exercise, new listings, and institutional inflows are fueling file development.

- BNB’s rising dominance might reshape Layer-1 competitors heading into This fall.

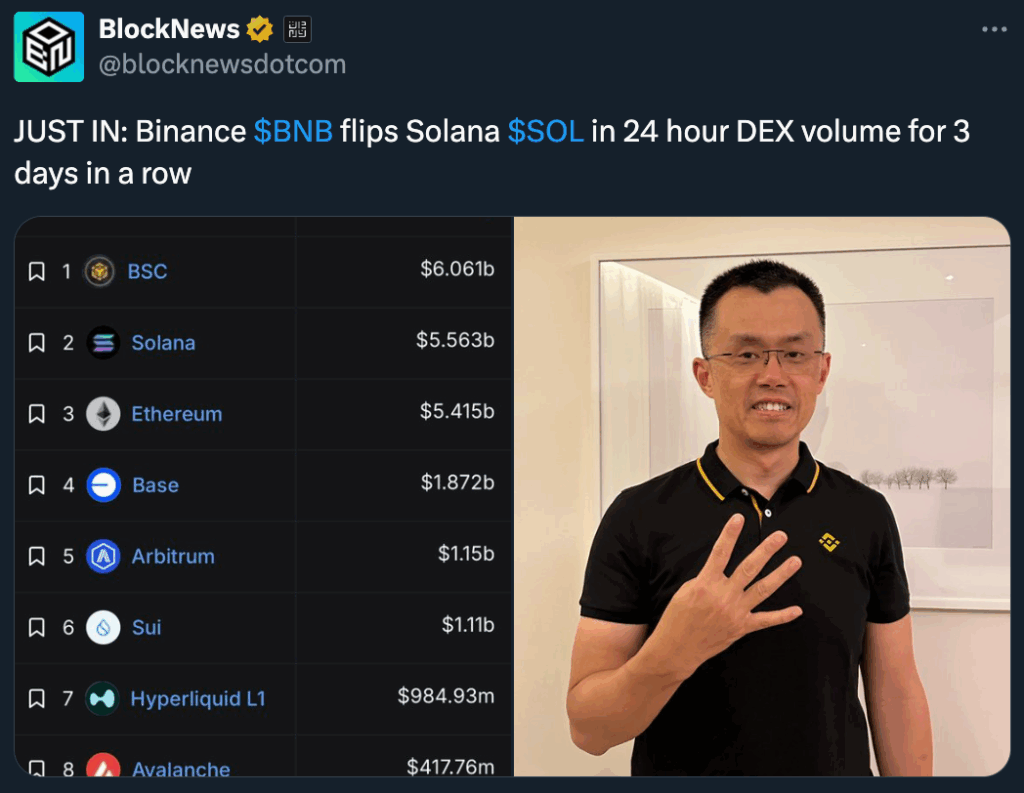

In a serious shift throughout decentralized exchanges, BNB Chain has overtaken Solana in 24-hour DEX buying and selling quantity for 3 consecutive days—signaling a breakout second for Binance’s ecosystem.

In line with information from LunarCrush, BNB’s DEX quantity reached $9.03 billion on October 8, surpassing Solana’s $7.10 billion. The surge comes amid heavy meme coin buying and selling, sturdy on-chain engagement, and rising institutional curiosity.

BNB’s momentum extends past buying and selling quantity. Its worth has climbed to a brand new all-time excessive of $1,330.51 up 47% over the previous month, whereas market cap surged to $183.7 billion, overtaking XRP for the #3 place. Analysts credit score the rally to the continued “BNB meme season” and profitable listings like $ASTER and $4 on Aster DEX, which alone have generated greater than $2 trillion in cumulative quantity.

Additional fueling the growth, CZ’s YZi Labs unveiled a $1 billion builder fund geared toward increasing DeFi, AI, and RWA improvement on BNB Chain—signaling Binance’s deeper push into next-generation blockchain sectors.

Solana Nonetheless Sturdy, However Stress Builds

Solana stays a formidable competitor, buying and selling at $222.30 with a $121 billion market cap and a well-established DEX ecosystem. But, BNB’s ultra-low charges (0.05 Gwei) and entry to Binance’s 460 million customers are attracting merchants in droves. On-chain participation has grown by over 100,000 wallets up to now week, and 70% of latest BNB meme consumers are at the moment in revenue, per Bubble Maps.

As BNB approaches the $1,500 mark, its increasing dominance might reBdefine Layer-1 rivalries heading into 2026. For Solana, the message is obvious—continued innovation and liquidity incentives shall be key to reclaiming momentum.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.