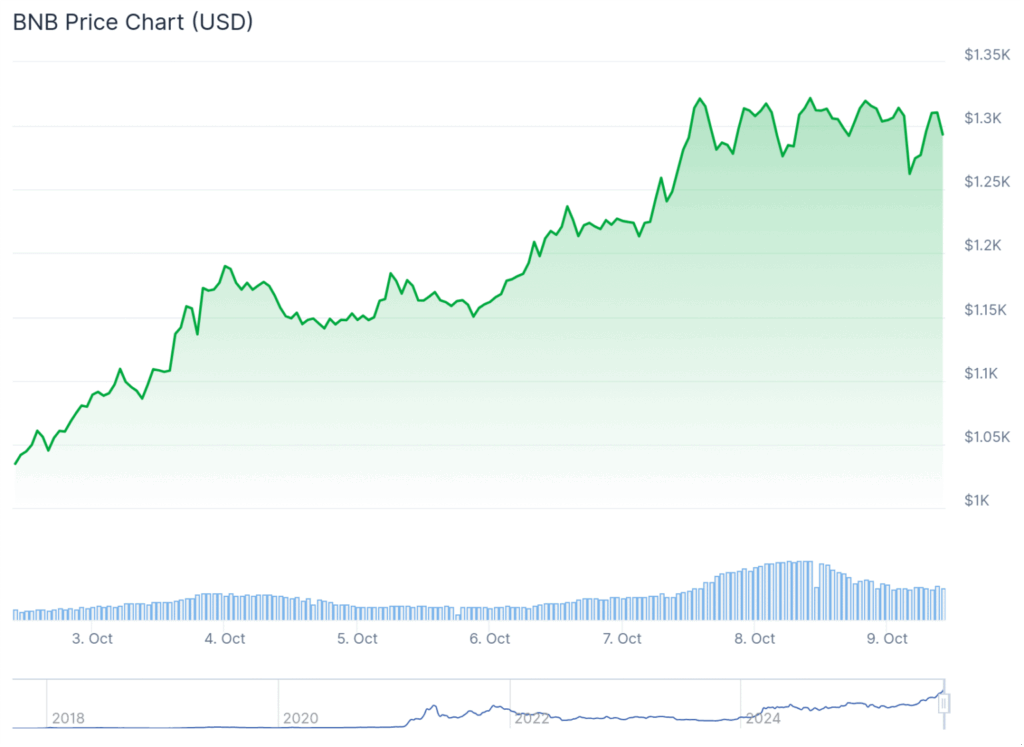

- BNB hit a brand new all-time excessive above $1,330 after YZi Labs launched a $1B builder fund to spice up the BNB Chain ecosystem.

- Community upgrades slashed block occasions to 0.75 seconds and reduce charges to $0.46, driving document exercise and over 73M energetic addresses.

- BNB’s market cap surged to $183B, making it the third-largest crypto as institutional and retail curiosity soared.

BNB is on hearth once more. The token simply hit a contemporary all-time excessive above $1,330 on October 7, racking up 27% good points in only one week. The surge got here proper after CZ’s YZi Labs revealed an enormous $1 billion builder fund geared toward supercharging growth throughout the BNB Chain. From DeFi to AI and funds, the fund’s designed to pour gas on the community’s already fast enlargement.

BNB’s rise has been nothing wanting wild. Its market cap jumped from $140 billion to over $183 billion in just some days, making it the third-largest crypto on the planet—leapfrogging each Tether and XRP. The announcement couldn’t have come at a greater time, using on prime of a wave of optimism after months of constant upgrades and record-breaking on-chain stats.

YZi Labs $1B Fund Sparks Builder Frenzy

YZi Labs, now managing greater than $10 billion globally, mentioned the fund will again long-term initiatives growing on BNB Chain—masking DeFi, real-world property, AI, and different Web3 verticals. The concept is easy: appeal to builders, reward innovation, and maintain the BNB ecosystem thriving. The fund consists of direct investments, incubation, and partnerships, together with the following part of its Most Priceless Builder accelerator.

Beginning October 2025, that accelerator will transfer beneath YZi Labs’ EASY Residency program, the place chosen groups can obtain as much as $500,000 every, plus direct collaboration with core BNB builders. With BNB Chain now serving over 460 million customers and processing greater than 26 million transactions every day, the timing for this enlargement couldn’t be higher.

BNB Chain Upgrades Push Community Efficiency Increased

BNB Chain’s velocity and value effectivity are actually setting business benchmarks. The Maxwell Hardfork earlier this yr reduce block occasions to simply 0.75 seconds whereas slashing fuel charges to 0.05 Gwei. A more moderen improve, which went reside this week, doubled the fuel restrict from 47 million to 100 million per second, paving the best way for greater throughput and bigger transaction masses.vv

FloRight now, the typical transaction charge sits round $0.46—low-cost sufficient to maintain builders and merchants glued to the community. Complete worth locked (TVL) has climbed to $9.26 billion, and energetic addresses spiked previous 73 million final month—the very best in BNB Chain historical past. That’s a reasonably clear signal the chain’s progress isn’t simply hype; it’s useful adoption.

Sentiment and On-Chain Buzz

BNB’s mindshare—the quantity of market consideration it will get—has exploded 251% this week to five.09%, in line with Messari. Analyst Rachael Lucas from BTC Markets mentioned this displays a transparent shift towards quick, low-cost ecosystems. She additionally identified that institutional confidence is rising, citing CEA Industries’ latest treasury allocation to BNB as a powerful vote of belief.

Retail merchants are simply as energetic. Memecoin buying and selling on BNB Chain has gone wild over the previous week, with small-cap tokens seeing large swings and income. On the identical time, decentralized exchanges on the chain have processed over $6 billion in quantity, producing roughly $5.57 million in charges, in line with Lookonchain knowledge. That locations BNB Chain firmly on the prime in each DEX exercise and every day transaction counts.

With momentum constructing, YZi Labs’ $1B builder fund may mark the beginning of one other progress part for the BNB ecosystem. Between the upgrades, adoption, and capital infusion, it’s no marvel analysts are calling BNB essentially the most highly effective altcoin of 2025 thus far.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.