Crypto is shifting via the week with out main drama however with sufficient spikes and flushes to remind merchants that leverage by no means sleeps. The entire market is sitting at round $4.52 trillion in capitalization, Bitcoin is at $121,800, Ethereum is round $4,336 and each of them have been caught briefly ranges after yesterday’s extensive swings.

The motive force that also carries weight is the spot ETF circulate, as a result of on daily basis cash is coming in, and Wednesday was no totally different: Bitcoin funds gained $440.7 million, Ethereum added one other $69 million, and that retains pushing a bid beneath the market even whereas short-term merchants hold getting “rekt.”

On the macro facet, nothing new appeared that would scare traders. The shutdown in america continues to be there, however merchants realized to deal with it as a plus slightly than minus as a result of much less information means fewer surprises, and the Fed minutes confirmed as soon as once more they’re able to hold reducing charges.

The one uncommon factor on the horizon is Friday’s Nobel Peace Prize announcement, which can not seem like a direct market occasion, however at a time when any geopolitical headline can affect oil, vitality or currencies, merchants ought to control it simply in case.

Bitcoin worth caught at $121,800 after failed all-time excessive breakout

Bitcoin is buying and selling at $121,841 after a failed try to carry larger ranges yesterday. The numbers from derivatives add extra element: up to now 24 hours, Bitcoin had $64.8 million value of lengthy positions liquidated and $64.5 million in shorts, nearly equal, which exhibits how balanced the battle has been.

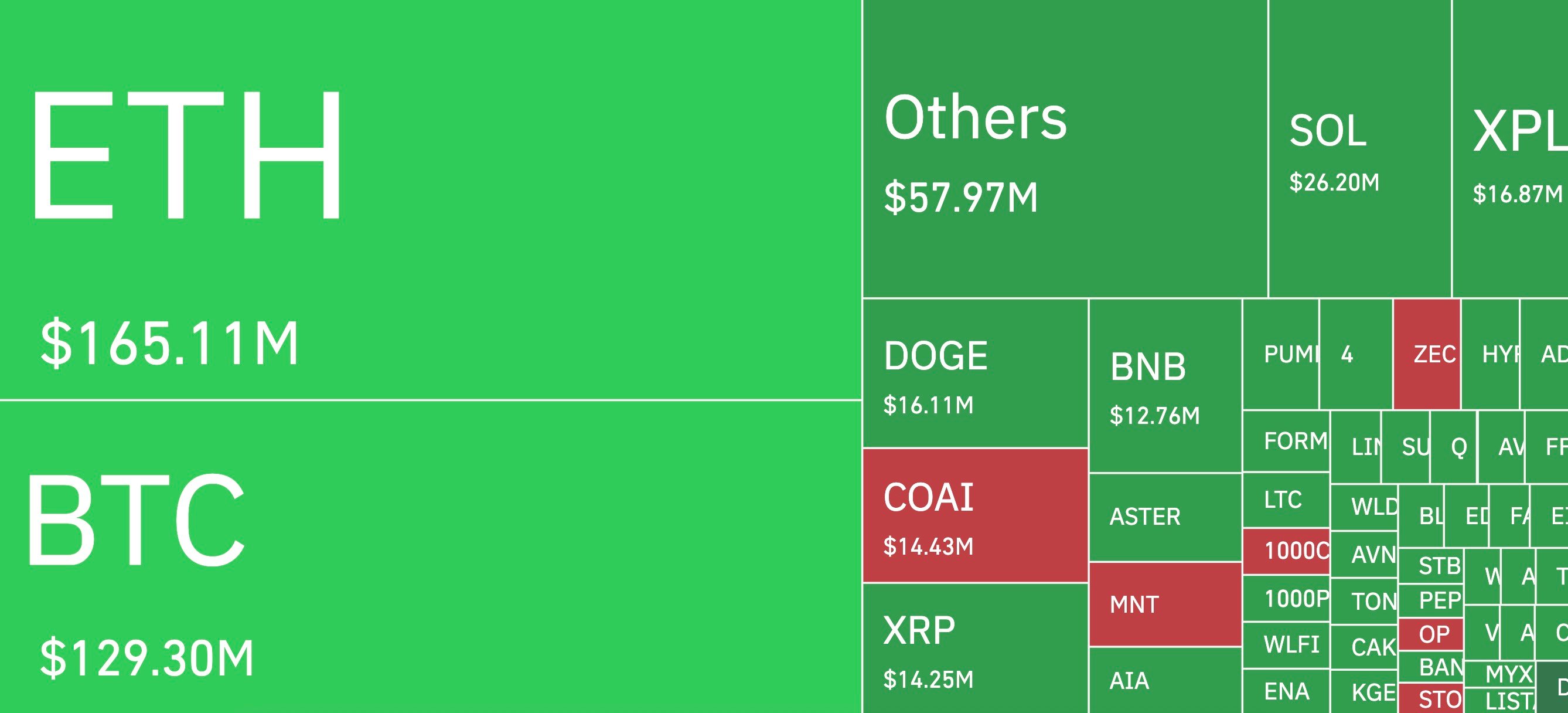

However should you zoom in to the final 12 hours throughout the entire market the image modifications, bulls took many of the ache, with $301.9 million in lengthy liquidations towards $55.4 million in shorts, which principally tells the story of yesterday’s dump.

For right this moment, the important thing level continues to be $121,100, if that stage cracks the chart opens a slide to $119,800, whereas on the upside, solely a break via $122,800 would clear the best way again to $124,500.

Determine of the day: Ripple CEO calls $1 trillion stablecoin period

Ripple’s chief government Brad Garlinghouse was the headline speaker at Pantera Capital’s Blockchain Summit 2025 in New York, the place he mentioned straight out that “this represents the longer term re-wiring of the monetary system.”

The timing of his phrases matches with the report from Normal Chartered that predicted as a lot as $1 trillion might transfer out of banks into rising markets and circulate into dollar-backed stablecoins within the subsequent three years. Ripple’s RLUSD token is being constructed precisely for that circulate, so his comment was not a random soundbite however a sign of the place the corporate needs to face.

Chart of the day: Shiba Inu (SHIB) faces key 2025 flooring take a look at

Shiba Inu (SHIB) is now at $0.00001199 and holding solely a skinny line above help. The token failed a number of occasions close to $0.0000123 and is now proper on the stage that U.As we speak highlighted earlier as essential; if $0.0000120 doesn’t maintain, the subsequent zones are $0.0000115 and $0.0000105, which might erase all of 2024’s positive aspects and successfully mark the token’s backside for 2025.

Technical indicators give no consolation. The value was rejected from the 100 EMA and 200 EMA, and the RSI is parked round 45, which isn’t low sufficient to present oversold reduction, and quantity exhibits promoting continues to be dominant whereas bullish participation retains shrinking.

On the liquidation facet, the token noticed $11.3 million in lengthy positions wiped towards $4.7 million in shorts on the final day, which implies that, as soon as once more, speculators making an attempt to catch a bounce are paying the invoice.

Except patrons present up, the market will possible deal with SHIB as a coin that already performed its hype cycle.

Night outlook

- Bitcoin (BTC): Holding $121,100-$121,200 is the important thing level. If damaged, the subsequent cease is 119,800. Resistance is at $122,800-$123,800. Complete liquidations up to now day: about $129 million.

- Ethereum (ETH): Buying and selling at $4,336 after a 3% drop. Watch $3,180 as the subsequent sturdy help, resistance at $3,320-$3,400. ETF inflows yesterday have been $69 million, lengthy liquidations $122 million.

- XRP: Worth at $2.80, however danger extends to $2.64, which is the 200-day shifting common. Longs value $11.8 million liquidated yesterday.

- Solana (SOL): Quoting $221.7, nonetheless above the $220 deal with. Assist at $218, resistance round $225. Lengthy liquidations about $17.2 million.

- Shiba Inu (SHIB): The pivot stays at $0.0000120, with draw back to $0.0000115 and 0.0000105. Longs liquidated $11.3 million up to now day.

- Macro: Friday’s Nobel Peace Prize announcement stands out as a headline danger occasion that markets will comply with for potential knock-on results.