- Shayne Coplan teased a possible POLY token, hinting it may rank amongst prime cryptocurrencies.

- ICE dedicated $2B to Polymarket at a $9B valuation, cementing institutional confidence.

- A POLY token may drive governance, incentives, and consumer rewards, just like dYdX’s mannequin.

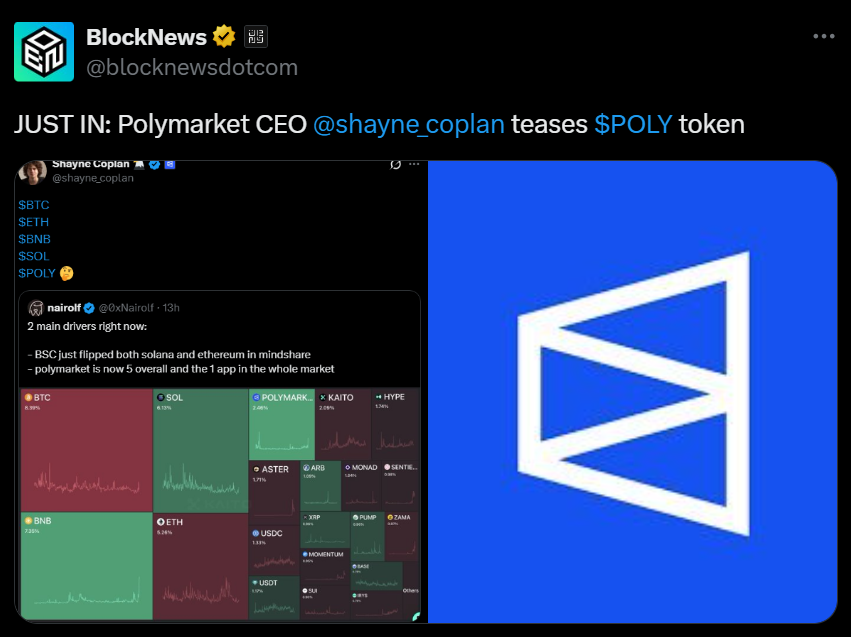

Shayne Coplan, founding father of Polymarket and just lately dubbed the “youngest self-made billionaire” by Bloomberg, dropped a cryptic trace on X concerning the attainable launch of a local POLY token. His publish in contrast POLY alongside Bitcoin, Ethereum, Binance Coin, and Solana, sparking hypothesis that Polymarket’s token may at some point be a part of the ranks of the most important cryptocurrencies by market cap.

This isn’t the primary time the platform has teased a token launch. In late 2024, the official Polymarket account briefly posted “we predict future drops,” resulting in hypothesis about consumer rewards and token incentives. With a rising observe file of hints, the most recent message from Coplan provides contemporary weight to the concept POLY is nearer to actuality.

Main Institutional Backing Fuels Confidence

The timing of the teaser comes simply after Intercontinental Alternate (ICE), guardian firm of the New York Inventory Alternate, pledged a $2 billion funding in Polymarket at a post-money valuation of $9 billion. ICE’s endorsement indicators that prediction markets are transferring from area of interest experiments into mainstream monetary infrastructure.

Earlier the identical day, Coplan revealed that Polymarket had quietly closed two further funding rounds over the past two years, together with a $150 million increase in 2025 led by Founders Fund at a $1.2 billion valuation. The funding historical past reveals a steep progress trajectory, now punctuated by one of many largest institutional bets on a crypto-native platform.

Why a POLY Token Issues

If launched, a POLY token may grow to be central to Polymarket’s ecosystem, powering governance, incentives, and consumer rewards. The mannequin would mirror different decentralized buying and selling protocols like dYdX, which launched token-based governance and liquidity applications forward of its breakout progress.

Hypothesis is mounting that the SEC submitting from Polymarket’s guardian firm, Blockratize, in September — which referenced “different warrants” — could have been an early step towards such a launch. That technique would align with what number of protocols construction pre-launch token rights for traders and insiders.

Polymarket’s Rising Affect

Since its 2020 debut, Polymarket has dealt with practically $19 billion in cumulative buying and selling quantity, establishing itself because the world’s most acknowledged prediction platform. From political outcomes to crypto worth bets, the platform has grow to be a magnet for each retail and institutional customers. With ICE now in its nook and POLY on the horizon, Polymarket seems set to evolve from a speculative playground right into a heavyweight of digital finance.

Ultimate Ideas

A POLY token launch may reshape Polymarket’s trajectory, including one other layer of progress to a platform already flush with institutional help. With a $9 billion valuation and billions in cumulative trades, the stage is about for POLY to hitch the following wave of top-tier tokens — if and when Coplan and his crew make the transfer.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.