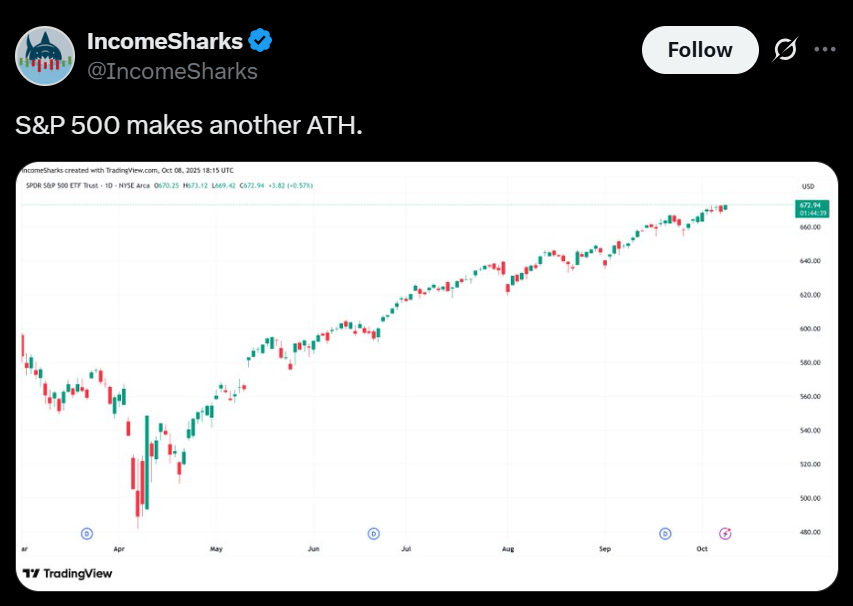

- S&P 500 and Nasdaq hit new all-time highs as markets rebounded.

- Gold surged previous $4,000, whereas Bitcoin rose 2% to $123,800.

- AI-driven tech shares like AMD, Nvidia, and Dell led fairness good points.

U.S. shares bounced again on Wednesday, ending the short-lived dip from the earlier session. The S&P 500 climbed 0.5% to set a brand new all-time excessive, whereas the Nasdaq jumped 0.9% to additionally attain file territory. The Dow Jones Industrial Common inched up 0.1%, extending the market’s bullish streak regardless of ongoing considerations across the authorities shutdown.

Investor focus shifted to the Federal Reserve’s September assembly minutes, which confirmed the central financial institution’s first charge lower since late 2024. Roughly half of surveyed economists anticipate a minimum of two further cuts this yr, a sign that has strengthened bullish sentiment throughout equities.

Gold and Bitcoin Push Larger

Gold prolonged its historic rally, climbing 1.6% to $4,070 per ounce after crossing $4,000 for the primary time on Tuesday. The flight to security displays investor concern over political gridlock in Washington and world macro uncertainty.

Bitcoin additionally steadied after a pointy drop earlier this week. The world’s largest cryptocurrency rose practically 2% to commerce round $123,800, bouncing again from Tuesday’s 3% decline. Analysts counsel digital property are more and more being handled instead hedge alongside gold within the present danger atmosphere.

Tech Giants Lead the Cost

Tech shares as soon as once more fueled market momentum. Nvidia rose 2% after CEO Jensen Huang advised CNBC that demand for computing has surged considerably prior to now six months. Dell Applied sciences jumped 7.5% following sturdy AI-driven progress forecasts, extending its rally from Tuesday.

Superior Micro Gadgets led good points throughout main indexes, hovering 10% after asserting a serious AI chip take care of OpenAI. This follows a outstanding 24% rally on Monday and one other 3.8% rise yesterday. In the meantime, Tesla gained 1.4% after current losses, and Amazon rose 2% after unveiling new prescription merchandising kiosks at One Medical clinics.

Company Movers and Market Highlights

Different notable strikes included:

- AppLovin (APP): down barely after surging 7.6% yesterday.

- Confluent (CFLT): up 10% on experiences it might pursue a sale.

- AST SpaceMobile (ASTS): spiked 10% after inking a Verizon partnership.

- Equifax (EFX): gained 2% after reducing credit score rating costs.

- Honest Isaac (FICO): slid 8% following trade shifts.

In commodities and foreign money, the U.S. greenback index strengthened 0.4% to 98.95, WTI crude rose 1.5% to $62.65 per barrel, and the 10-year Treasury yield held regular at 4.13%.

Ultimate Ideas

Markets proceed to show resilience regardless of political uncertainty and macro dangers. Report-breaking gold costs and surging AI-driven equities underscore investor urge for food for each protected havens and progress performs. With charge cuts on the horizon, momentum throughout shares, crypto, and commodities suggests volatility will stay excessive — however so will alternative.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.