- Status Wealth rebrands to Aurelion Treasury, launching Nasdaq’s first company treasury backed by Tether Gold (XAUT).

- The corporate raised $150 million by means of PIPE financing and debt to amass Tether Gold as its most important reserve asset.

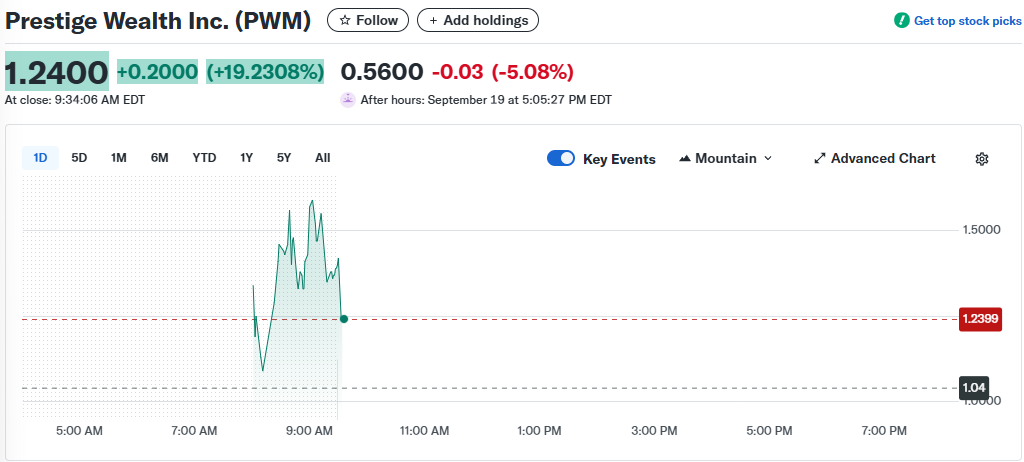

- Aurelion’s inventory jumped 19% after the announcement, with plans to commerce beneath the brand new ticker image AURE on Nasdaq.

In a daring new course, Nasdaq-listed agency Status Wealth is rebranding to Aurelion Treasury—and it’s not only a identify change. The corporate is making historical past as the primary Nasdaq-listed company treasury backed by Tether Gold (XAUT). The announcement follows a $150 million financing spherical that mixes a $100 million PIPE funding and a $50 million senior debt facility from Antalpha Administration. The funds can be used primarily to purchase Tether Gold, turning the token into Aurelion’s major reserve asset.

CEO Björn Schmidtke referred to as the transfer a long-term play on stability within the digital asset house. “I’m bullish on bitcoin,” he stated, “however I believe Tether Gold is the actual digital gold—one thing that may maintain worth and even be used for on a regular basis funds sometime.” The plan, in response to filings with the SEC, is to place Aurelion as a bridge between conventional finance and tokenized commodities.

A Imaginative and prescient for Tangible Digital Property

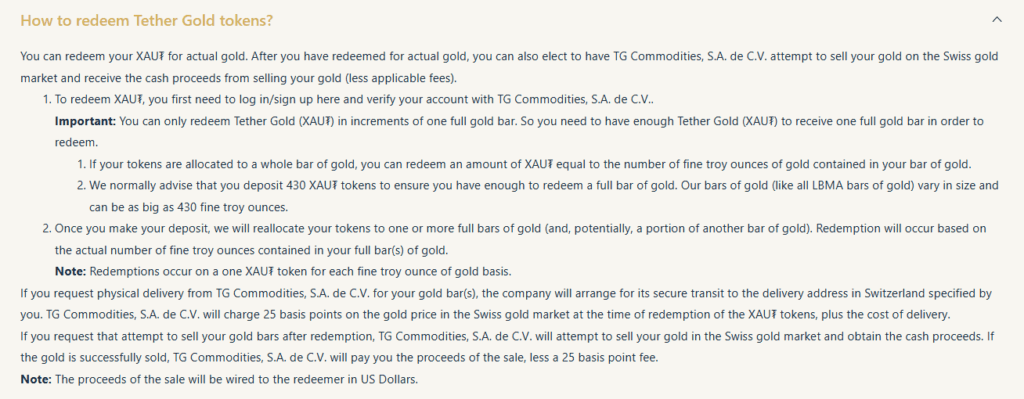

Aurelion’s transfer may change how Wall Avenue views digital reserves. By backing its treasury with Tether Gold, the corporate hopes to make digital belongings really feel extra actual—actually. Paul Liang, CFO of Antalpha (Aurelion’s father or mother firm), stated that over time, XAUT may turn out to be redeemable for bodily gold. “Think about strolling into a jewellery retailer and exchanging your tokens for a gold bar,” he defined, noting that Tether already permits redemptions with a minimal of 430 XAUT for one full bar.

This push to attach bodily and digital belongings comes as buyers more and more search for inflation-resistant shops of worth. Whereas stablecoins like USDT dominate liquidity, tokenized gold presents a novel stability between safety and tangibility—two issues buyers crave in an unsure economic system.

Market Response and Inventory Increase

The market didn’t take lengthy to react. Status Wealth’s inventory (ticker: PWM) jumped 19% after the Tether-backed treasury announcement, signaling optimism concerning the pivot. Nonetheless, the corporate’s shares stay down over 94% since launch, based mostly on Yahoo Finance knowledge. Aurelion expects to formally commerce beneath its new ticker, AURE, beginning Monday, pending regulatory approval.

Even with the drop in long-term efficiency, this new course may mark a turning level. Buyers are watching carefully to see if Aurelion’s technique sparks a pattern amongst different publicly listed corporations exploring tokenized gold as a company reserve.

A New Period for Company Treasuries

Aurelion’s shift isn’t only a PR transfer—it’s a glimpse into what the following era of company treasuries would possibly appear like. Backing reserves with tokenized commodities may redefine stability sheet methods, providing transparency and liquidity whereas tying belongings to one thing tangible. It’s a part of a broader shift the place blockchain and conventional finance proceed to blur collectively.

Whether or not it turns into a blueprint or only a daring experiment, one factor’s clear—Aurelion has set the bar (fairly actually, in gold) for a way companies can undertake tokenized belongings in a regulated, public framework.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.