Bitcoin is presently consolidating under the $125,000 stage after a pointy correction that pushed the value all the way down to $120,000, a key psychological and technical space of help. Regardless of the current volatility, bulls are displaying resilience, holding worth ranges that counsel the broader uptrend stays intact. Nevertheless, uncertainty persists as some analysts warn {that a} deeper correction towards decrease demand zones might nonetheless happen earlier than the following leg increased.

Apparently, onchain information offers a extra optimistic sign. Metrics point out that Bitcoin miners will not be in a rush to promote, suggesting sturdy conviction available in the market’s long-term trajectory. This stability from miners — traditionally one of many largest sources of promoting strain — displays rising confidence within the sustainability of present worth ranges.

Because the market navigates this section of consolidation, merchants are watching whether or not Bitcoin can reclaim $125K and set up a brand new base for continuation. For now, the mix of miner confidence and secure demand suggests the market is getting ready for its subsequent decisive transfer moderately than signaling exhaustion.

Bitcoin Miners Stay Sturdy

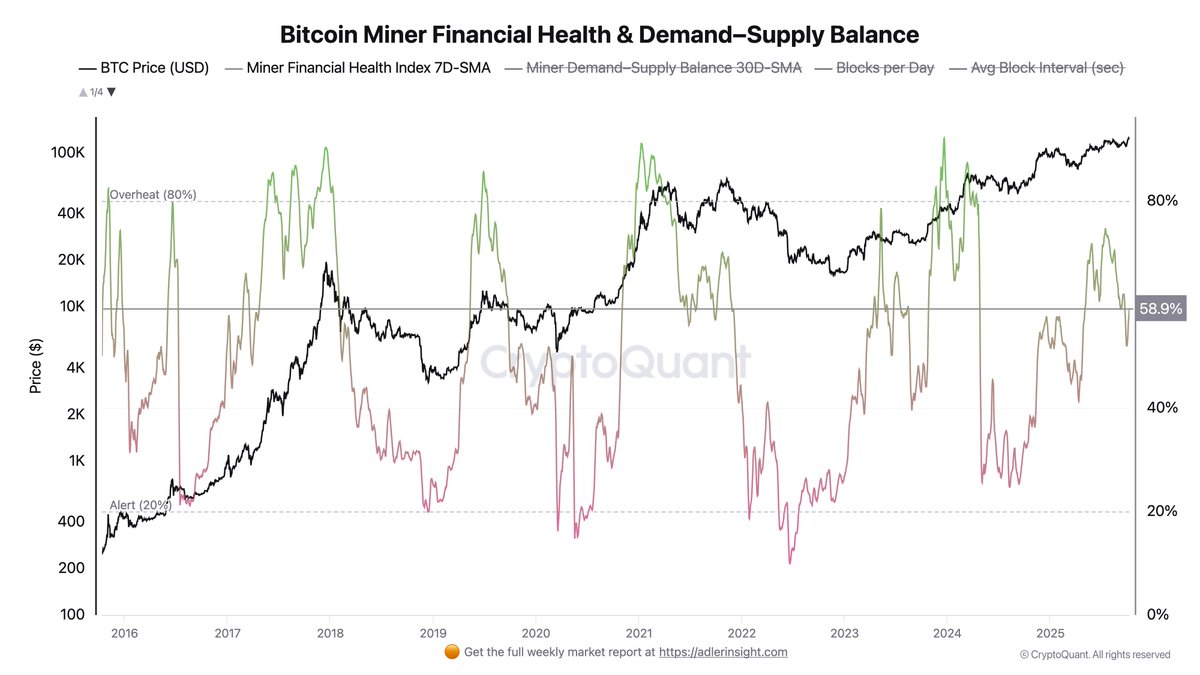

High onchain analyst Axel Adler shared new insights into the state of the Bitcoin mining economic system by means of the Miner Monetary Well being Index — a composite metric designed to measure the monetary situation of miners by accounting for hashprice, block revenue, price share, and general money stream. In accordance with Adler, the index presently stands at 59%, which represents a wholesome, neutral-to-bullish mining economic system.

This studying signifies that miners are working in a secure setting with balanced profitability and no indicators of misery. Importantly, the absence of extreme stress or euphoria means that miners will not be underneath strain to liquidate holdings, an element that always contributes to market stability. Traditionally, durations when the index stays throughout the 50–65% vary have coincided with regular worth progress, as miners are inclined to accumulate or maintain their rewards moderately than promoting into rallies.

Adler notes {that a} sharp rise above 80% would mark the start of a distribution section, usually related to elevated miner promoting as income peak. For now, the reasonable studying highlights that the present cycle nonetheless has room for progress earlier than reaching overheated ranges.

This perception aligns with different onchain indicators displaying sturdy community exercise and robust miner confidence, reinforcing the notion that Bitcoin’s current correction stays a wholesome consolidation section moderately than an indication of structural weak spot. So long as miners proceed to function profitably and chorus from large-scale promoting, Bitcoin’s underlying market basis stays agency — setting the stage for potential renewed momentum as soon as worth volatility subsides.

Bitcoin Value Evaluation: Bulls Defend $120K Help

Bitcoin (BTC) is buying and selling round $121,400, consolidating after a quick pullback from the $126,000 all-time excessive. The each day chart exhibits BTC holding above key help ranges, with the 50-day (blue) and 100-day (inexperienced) transferring averages trending upward — confirming that the broader construction stays bullish.

The $120,000–$121,000 zone is rising as a short-term help space, the place patrons have stepped in to defend in opposition to additional draw back. A sustained transfer above $123,500 might open the door for a retest of $125,000, whereas a breakdown under $120,000 would seemingly expose BTC to a deeper correction towards the $117,500 stage, a serious horizontal help that beforehand acted as resistance in September.

Momentum indicators counsel the market is in a cooling section after an prolonged rally, permitting for potential re-accumulation earlier than the following main transfer. The current consolidation aligns with on-chain information displaying miners sustaining confidence and no important promoting strain.

Bitcoin stays structurally bullish, so long as worth holds above $117,500. Merchants will look ahead to a breakout above $125,000 to substantiate renewed momentum and probably push BTC into worth discovery territory as soon as once more.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.