High Tales of The Week

Bitcoin plummets to $102K on Binance as Trump proclaims 100% tariffs on China

US President Donald Trump introduced a 100% tariff on China on Friday, sending the value of Bitcoin reeling beneath $110,000 on the time of writing.

Trump stated the tariffs had been in response to China making an attempt to position export restrictions on uncommon earth minerals, that are essential for creating pc chips. Trump wrote on Reality Social:

“It has simply been realized that China has taken a very aggressive place on Commerce in sending an especially hostile letter to the World, stating that they had been going to, efficient November 1, 2025, impose large-scale Export Controls on nearly each product they make.”

‘Debasement commerce’ is now not a debate, and TradFi is aware of it: Execs

Monetary establishments are shortly waking as much as the “debasement commerce,” in accordance with commentators, which could possibly be a boon for belongings similar to gold and Bitcoin.

Establishments have a brand new idea to cling to known as the “debasement commerce,” which would be the factor that protects them, stated entrepreneur Anthony Pompliano in a podcast on Thursday.

It’s the identical factor that goldbugs and Bitcoiners have been speaking about for years, and now establishments have simply realized that “nobody is ever going to cease printing cash,” he added. “This now seems like there isn’t any longer a debate about this. Individuals understand the greenback and bonds are going to have plenty of hassle transferring ahead, and subsequently Bitcoin and gold are positively benefiting.”

Polymarket founder Coplan joins billionaire membership after NYSE guardian funding: Report

Shayne Coplan, the founding father of prediction market Polymarket, is as soon as once more within the limelight, as prediction markets shift from regulatory bans in the US to authentic monetary markets with institutional backing.

Bloomberg named Coplan among the many world’s billionaires following a $2 billion funding in Polymarket by New York Inventory Alternate guardian Intercontinental Alternate.

Coplan launched the platform in 2020 when he was 21 after dropping out of New York College. He typically labored on the platform from the toilet in his New York condo, he stated.

Ethereum DATs are the subsequent Berkshire Hathaway: Consensys founder

Impressed by Michael Saylor’s Bitcoin playbook, Joseph Lubin says Ethereum treasury corporations can present outsized returns on yield and funding alternatives to their Bitcoin counterparts.

Talking completely to Cointelegraph at Token2049 in Singapore, the Ethereum co-founder and Consensys CEO unpacked his thesis for why Ether digital asset treasuries (DATs) current superior alternatives to the Bitcoin treasury motion popularized by Saylor’s Technique Bitcoin play.

“I’d a lot moderately have one thing that probably has extra influence. It actually is as strong as Bitcoin, and I’d argue extra strong due to the performance and the natural demand for it to pay for transactions and storage,” Lubin stated.

US Bitcoin reserve funding ‘can begin anytime’ — Senator Lummis

Crypto-friendly US Senator Cynthia Lummis has confirmed that buying funds for the US Strategic Bitcoin Reserve (SBR) can “begin anytime” now, although legislative crimson tape is holding it again.

In an X publish on Monday, Lummis stated that whereas it stays a “slog” on the legislative facet of issues, due to “President Trump, the acquisition of funds for an SBR can begin anytime.”

Lummis made the feedback in response to a publish from ProCap BTC chief funding officer Jeff Park, who shared a video of himself and Bitcoin bull Anthony Pompliano discussing the potential of the Strategic Bitcoin Reserve.

Park was hypothesizing what would occur if the federal government had been in a position to make the most of its $1 trillion price of paper beneficial properties from gold to reinvest into Bitcoin.

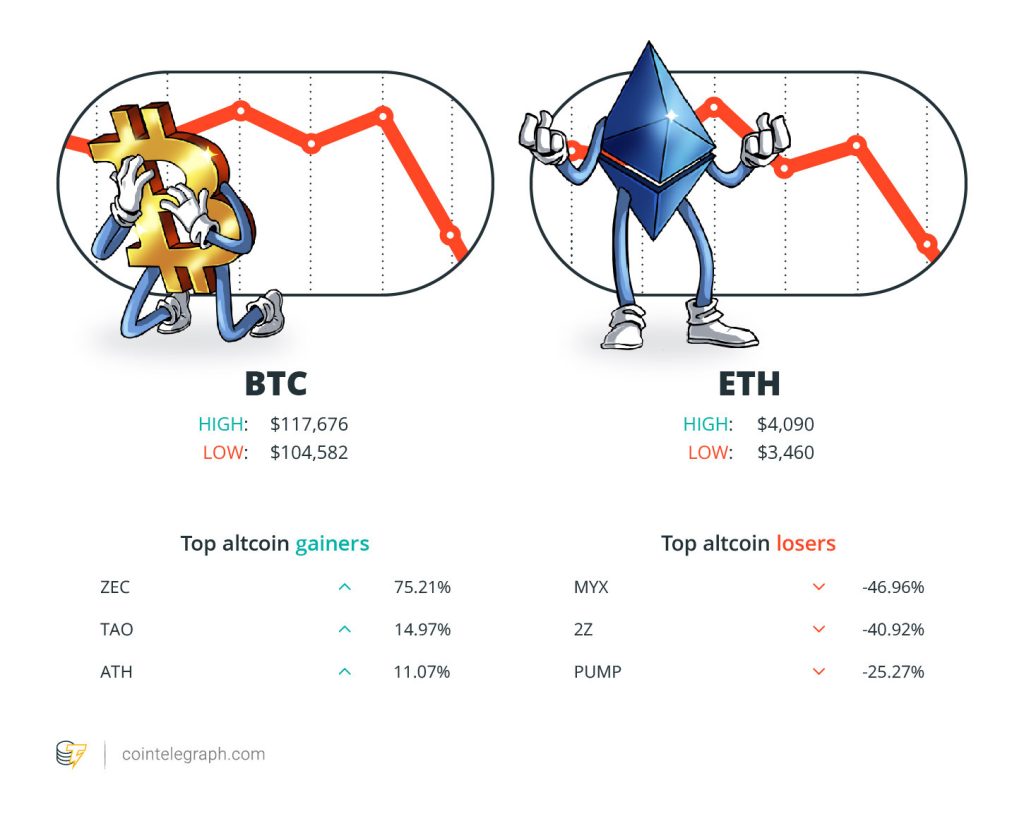

Winners and Losers

On the finish of the week, Bitcoin (BTC) is at $117,676 Ether (ETH) at $4,090 and XRP at $2.72. The overall market cap is at $4.00 trillion, in accordance with CoinMarketCap.

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are ZCash (ZEC) at 75.21%, Bittensor (TAO) at 14.97% and Aethir (ATH) at 11.07%.

The highest three altcoin losers of the week are MYX Finance (MYX) at 46.96%, DoubleZero (2Z) at 40.92% and Pump.enjoyable (PUMP) at 25.27%.

For more information on crypto costs, ensure to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“What was as soon as the promise of the free change of knowledge is being became the last word instrument of management.”

Pavel Durov, founder and CEO of Telegram

“We wish Bitcoin to be on a regular basis cash ASAP.”

Jack Dorsey, founding father of Sq.

“You may form of begin lifting a few of your targets and saying, ‘Nicely, as a result of we’ve confirmed 110, that’s the ground, the place can we go from right here?’”

James Verify, Bitcoin analyst

“Betting in opposition to a cycle that has an ideal three-for-three document shouldn’t be completed with reckless abandon.”

Peter Brandt, veteran dealer

“I’d a lot moderately have one thing that probably has extra influence. It actually is as strong as Bitcoin, and I’d argue extra strong due to the performance and the natural demand for it to pay for transactions and storage.”

Joseph Lubin, co-founder of Ethereum

“On the onset of the pandemic, I fairly actually had nothing to lose: 21, working out of cash, 2.5 years since I dropped out, and nothing to point out for it, however I knew we had been coming into an period the place methods to search out reality would matter greater than ever.”

Shayne Coplan, founder and CEO of Polymarket

High Prediction of The Week

Bitcoin could get ‘dragged round a bit’ amid Trump tariff fears: Exec

Swan Bitcoin CEO Cory Klippsten stated Bitcoin’s worth volatility will not be over after the cryptocurrency briefly fell to $102,000 on Friday, following US President Donald Trump’s announcement of a 100% tariff on Chinese language imports.

“If the broader risk-off temper holds, Bitcoin can get dragged round a bit earlier than it finds help and begins to decouple once more,” Klippsten informed Cointelegraph on Friday.

Learn additionally

Asia Specific

Stablecoin for cyber-scammers launches, Sony L2 drama: Asia Specific

Options

5 risks to beware when apeing into Solana memecoins

Klippsten stated that Bitcoiners ought to anticipate some turbulence over the approaching days. “Macro-driven dips like this normally wash out leveraged merchants and weak arms, then reset positioning for the subsequent leg up,” Klippsten stated.

“We’ve acquired a bit panic within the markets proper now, basic macro whiplash. Trump and China are buying and selling tariff threats, equities are off, and merchants are scrambling to derisk,” Klippsten added.

High FUD of The Week

Dealer loses $21M on Hyperliquid after personal key leak: Learn how to keep protected

On Thursday, a single consumer on the decentralized buying and selling platform Hyperliquid misplaced about $21 million after a non-public key leak led to an exploit involving the platform’s Hyperdrive lending protocol.

In line with blockchain safety firm PeckShield, the attacker focused 17.75 million DAI and three.11 million SyrupUSDC, an artificial model of the USDC stablecoin used inside Hyperdrive, and subsequently bridged the stolen funds to Ethereum.

PeckShield has not confirmed how the personal key was compromised.

Main crypto betting platform Shuffle proclaims consumer information breach

Shuffle, a number one crypto betting platform, suffered an information breach after its third-party customer support supplier was compromised, exposing the info of most of its customers.

In line with a Friday X publish from Shuffle founder Noah Dummett, the corporate’s buyer relationship administration service supplier, Quick Monitor, suffered an information breach that uncovered its customers’ information. Shuffle used the service in query for “programmatic e-mail sending and varied communications with customers,” suggesting that these messages and e-mail addresses had been probably among the many uncovered information.

Learn additionally

Options

Coinbase hack exhibits the regulation in all probability received’t shield you: Right here’s why

Options

Are You Unbiased But? Monetary Self-Sovereignty and the Decentralized Alternate

“Sadly, it appears that evidently their breach has impacted nearly all of our customers,” Dummett wrote. He stated that the corporate was investigating how the breach came about and “the place this information ended up.”

South Korea ramps up crypto seizures, will goal chilly wallets

South Korea’s Nationwide Tax Service (NTS) is increasing its crackdown on tax evasion, warning that even crypto belongings saved in chilly wallets might be topic to seizure.

In line with a report from native information outlet Hankook Ilbo, an NTS official stated the company is ready to conduct dwelling searches and confiscate arduous drives and chilly pockets gadgets if it suspects that tax delinquents are hiding their crypto belongings offline.

“We analyze tax delinquents’ coin transaction historical past via crypto-tracking packages, and if there may be suspicion of offline concealment, we are going to conduct dwelling searches and seizures,” the NTS spokesperson reportedly stated.

Below the nation’s Nationwide Tax Assortment Act, the NTS can request account data from native exchanges, freeze accounts from tax delinquents and liquidate their belongings at market worth to cowl their unpaid taxes.

High Journal Tales of The Week

EU’s privacy-killing Chat Management invoice delayed — however combat isn’t over

Europe’s Chat Management proposal would make end-to-end messaging encryption ineffective. Cypherpunks say the battle isn’t over but.

Alibaba founder’s Ethereum push, whales are 91% of Korean market: Asia Specific

Japan is making a bid to reclaim the crypto crown with finance gamers on its facet, whereas Jack Ma’s fintech empire retains backing Ethereum-linked ventures and extra.

Worldcoin’s much less ‘dystopian,’ extra cypherpunk rival: Billions Community

World isn’t as dystopian as critics make out, however there are different approaches to combating AI accounts extra aligned with cypherpunk beliefs.

Subscribe

Essentially the most participating reads in blockchain. Delivered as soon as a

week.

Editorial Workers

Cointelegraph Journal writers and reporters contributed to this text.