Be a part of Our Telegram channel to remain updated on breaking information protection

The crypto market plunged greater than 10% after US President Donald Trump introduced 100% tariffs on China’s exports beginning Nov. 1, triggering $19 billion in liquidations.

Solana slid 16%, XRP 14%, Ethereum 12%, Bitcoin 9%, and Dogecoin 22% as merchants rushed to unwind leveraged positions.

Knowledge from CoinGlass confirmed many of the $19 billion in liquidations got here from lengthy positions as markets turned risk-off. One dealer estimated that it was ”probably the most important liquidation occasion, in $ phrases, in crypto historical past.”

Trump’s actions got here in response to what he mentioned was an “terribly aggressive” stance by China after it unveiled sweeping export controls on uncommon earths which are essential to merchandise from automobiles to sensible telephones.

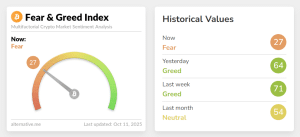

The announcement despatched buyers fleeing from threat belongings because the Crypto Concern & Greed Index collapsed from a “Greed” studying of 64 to a “Concern” degree of 27 in a single day as markets braced for an escalating confrontation between the world’s two largest economies.

Crypto Concern & Greed Index (Supply: Various.me)

“It has simply been realized that China has taken a very aggressive place on Commerce in sending a particularly hostile letter to the World, stating that they have been going to, efficient November 1, 2025, impose large-scale Export Controls on nearly each product they make, and a few not even made by them” Trump wrote in a put up on Fact Social.

He added that the US will additionally impose export controls on “any and all important software program.” Trump initially indicated he’d pull out of a gathering with China President Xi Jinping. Later, nonetheless, he mentioned the assembly was not cancelled however that he didn’t know whether or not ”we’re going to have it.”

The S&P 500 inventory index dropped 2.7%, the Nasdaq 100 plunged 3.5%, and the value of oil slumped to its lowest degree since Might. Gold climbed virtually 1.5% as buyers sought safe-haven belongings.

Fears Of A Reignited Commerce Conflict See Traders Go Danger-Off

Knowledge from CoinGlass exhibits that $16.81 billion of liquidations have been from lengthy positions, bets that crypto costs would rise. The remaining $2.50 billion was worn out from quick positions.

Trades for crypto market leaders Bitcoin and Ethereum took the most important hits, with $5.36 billion in longs being erased from BTC longs and $3.85 billion worn out from ETH lengthy positions.

As unhealthy as Bitcoin appears, Ethereum appears even worse. Whereas Bitcoin is simply down about 10% from its report excessive priced in U.S. {dollars}, Ether is down 21%. It’s now buying and selling close to $3,900. If it breaks help round $3,350, a fast transfer all the way down to $1,500 is an actual threat. Get out now!

— Peter Schiff (@PeterSchiff) October 10, 2025

Meme Coin Sector Hammered

The meme coin sector was among the many hardest-hit because it market capitalization plunged virtually 20% to $57.08 billion. Among the many high 10 largest meme cash, Dogwifhat (WIF) slumped 28%, Floki plunged 22%, and Official Trump, Bonk and Pepe all dropped greater than 21%.

Amongst sub classes measured by CoinMarketCap, Chinese language-themed meme cash tumbled 39% whereas AI-themed memes dropped virtually 30%.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection