The gasoline charges of Ethereum are at historic lows after the Dencun replace, however they continue to be topic to variations associated to community congestion and Layer 2 exercise.

Key Factors

- The gasoline charge of Ethereum measures the computational price of every operation on the community.

- After the Dencun replace, the typical charges plummeted by 95%.

- Transactions now price on common lower than $0.50, however stay variable.

- Layer 2 proceed to alleviate mainnet visitors, lowering prices.

- Elements reminiscent of MEV, contract complexity, and congestion affect the fluctuations.

What’s the Ethereum gasoline charge and the way does it work

The gasoline of Ethereum represents the unit that measures the quantity of computation required to carry out operations on the blockchain: transfers of ETH, DeFi interactions, or execution of sensible contracts.

After the reform launched by the EIP-1559, every transaction consists of two foremost parts:

- Base charge, computerized and burned at each block;

- Precedence charge (or tip), an optionally available incentive for validators.

The associated fee components is subsequently:

Value = Gasoline used × (Base charge + Precedence charge)

The potential extra over the consumer’s set max charge is refunded, enhancing the predictability of bills.

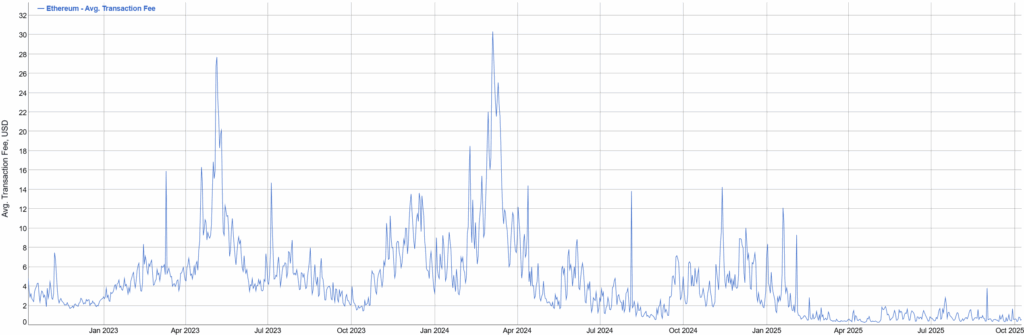

Ethereum Gasoline Charges At the moment: Report Decline in Numbers

After the Dencun replace in March 2024, the community skilled an unprecedented drop within the common transaction price.

- The each day common of gasoline has dropped from 72 gwei to 2.7 gwei, with a financial savings of 95%

- In financial phrases, a typical transaction has gone from $86 to roughly $0.39.

- Based on YCharts, the typical gasoline worth fluctuates as we speak round 3 gwei, with a block restrict of roughly 45 million models.

- BitInfoCharts signifies that the common charge on the time of writing is equal to 0.00012 ETH, or about $0.52.

These are the bottom ranges recorded because the transition to Proof-of-Stake in 2022.

Why Ethereum Gasoline Charges Fluctuate: Key Elements

- Community congestion

When transactions improve — for instance, throughout a token launch or an NFT growth — the base charge rises. - Complexity of operations

Heavier sensible contracts require extra gasoline in comparison with easy ETH transfers. - Chosen precedence stage

Customers can provide the next tip to hurry up the affirmation. - Function of Layer 2

Options like Arbitrum, Optimism, and zk-Rollups are diverting visitors from Layer 1, protecting charges low and the community extra scalable. - MEV Exercise and Transaction Reordering

The methods of front-running or sandwich buying and selling affect the distribution of charges and the inducement of validators.

When to Use Ethereum

- Really useful time slots: nighttime UTC and weekends, when international exercise is diminished.

- Actual-time monitoring: instruments like Etherscan Gasoline Tracker or Blocknative will let you test congestion.

- Layer 2 Options: for swaps or frequent transactions, rollups scale back charges by 10-50 instances.

Optimizing Gasoline Charges for Builders and Customers

Builders can scale back prices by avoiding redundant capabilities or inefficient loops in Solidity contracts.

Evaluation instruments like PeCatch establish areas of “gasoline waste” and permit saving as much as 30% of transaction prices.

Customers, then again, can use wallets that robotically estimate the optimum charge based mostly on the community (e.g., MetaMask or Rabby).

Evaluation: Ethereum Cheaper however Nonetheless Delicate to Demand

The drop in charges after Dencun marks a historic milestone for the community’s sustainability.

Nonetheless, Ethereum gasoline stays a dynamic metric, topic to sudden spikes in case of market hype or intensive buying and selling exercise.

The structural price discount, mixed with the growth of Layer 2, is bringing Ethereum nearer to a technological maturity section: extra environment friendly, however nonetheless strongly correlated to utilization demand.

At the moment, Ethereum gasoline prices lower than ever, with transactions below a greenback and a extra scalable community.

Nonetheless, volatility stays a relentless: congestion, MEV, and DeFi visitors can nonetheless double the charges in a matter of minutes.

Ethereum thus continues its run in direction of a steadiness between financial effectivity and decentralization, paving the best way for the following wave of Web3 adoption.