A wave of heavy market exercise on October 10 despatched shockwaves via each conventional and digital markets, exposing the bounds of main centralized crypto exchanges.

The turbulence started moments after US President Donald Trump introduced a 100% tariff on Chinese language imports. The coverage shock spooked international buyers, triggering a sell-off that unfold from equities to digital belongings inside minutes.

Sponsored

Sponsored

Trump’s Tariff Shock Exposes Cracks in Main Crypto Exchanges

Following the announcement, crypto merchants responded in two distinct methods. Some rushed to chop their losses, whereas others scrambled to “purchase the dip.”

The simultaneous surge in orders overloaded a number of exchanges, together with Binance, Coinbase, Gemini, Kraken, and Robinhood.

In consequence, a number of social-media customers reported frozen dashboards, mismatched costs, and failed trades as buying and selling engines struggled to maintain up with demand.

Nevertheless, Binance and Coinbase later mentioned the disruptions had been brought on by excessive person exercise slightly than safety breaches.

Though most platforms restored regular service inside hours, the episode raised debate over whether or not centralized exchanges may scale quick sufficient throughout main volatility occasions.

Whereas centralized platforms struggled to remain on-line, decentralized finance (DeFi) protocols largely operated with out interruption.

Sponsored

Sponsored

Aave founder Stani Kulechov described the market crash as “the biggest stress check in DeFi historical past.” Through the interval, the lending platform liquidated roughly $180 million in collateral inside an hour with out downtime or transaction errors.

Chainlink’s neighborhood liaison, Zach Rynes, attributed that efficiency to dependable on-chain worth feeds that allowed automated liquidations to execute in actual time.

Equally, Hyperliquid, a high decentralized derivatives trade, reported zero latency regardless of document site visitors volumes. It credited its HyperBFT consensus system for sustaining throughput and solvency.

On Ethereum, Uniswap processed an estimated $9 billion in each day buying and selling quantity—considerably above its norm—with out notable slowdowns.

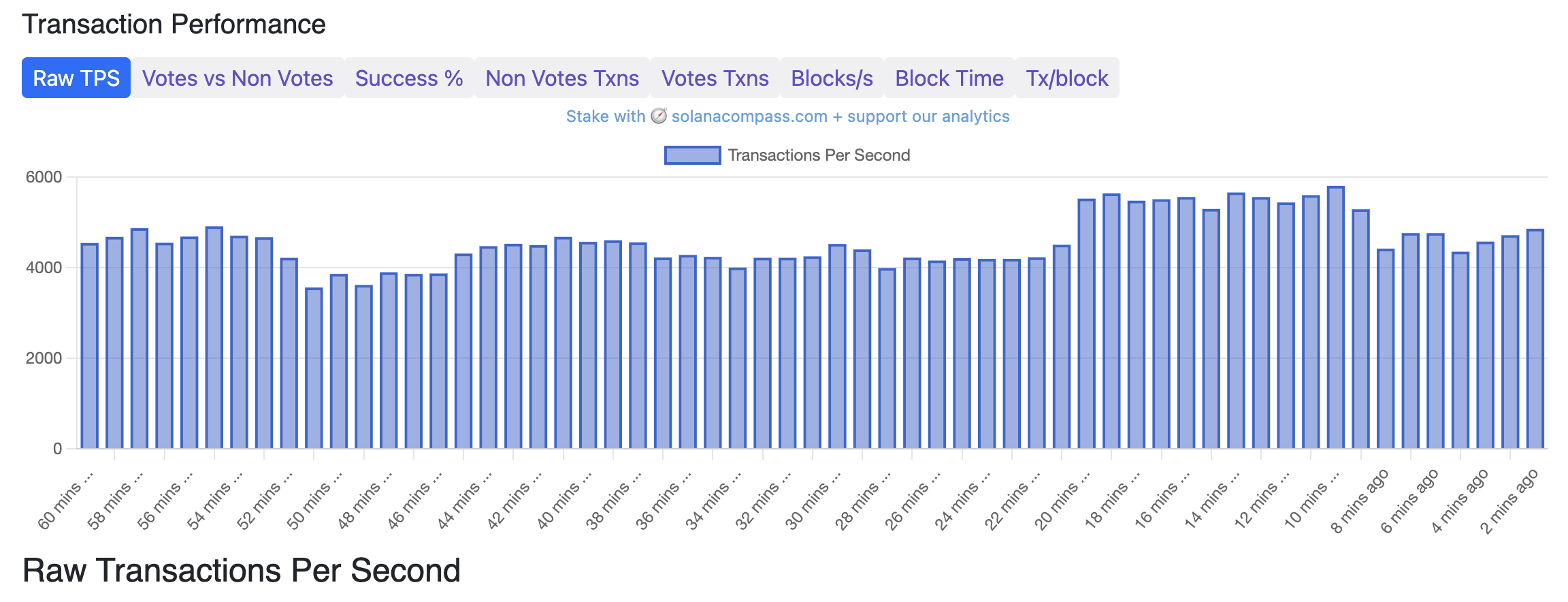

In the meantime, the resilience prolonged to Solana’s ecosystem, the place Kamino Finance confirmed zero unhealthy debt whereas the community itself dealt with as much as 10,000 transactions per second.

Talking about these DeFi protocols’ robust efficiency, Paul Frambot, CEO of Morpho Labs, mentioned DeFi’s resilience highlights why open, programmable monetary infrastructure might ultimately outlast conventional intermediaries.

Antonio Garcia Martinez, an government at Coinbase’s Base community, echoed related views, whereas including that:

“The very fact you may have monetary infrastructure managing billions that runs as literal code in a decentralized approach throughout machines owned by strangers who don’t belief one another is without doubt one of the nice tech miracles of our time. There are cathedrals in every single place for these with eyes to see.”