Be part of Our Telegram channel to remain updated on breaking information protection

Luxembourg’s sovereign wealth fund has change into the primary within the Eurozone to spend money on Bitcoin after it allotted 1% of its $730 million portfolio to identify BTC ETFs (exchange-traded funds).

The funding follows a revision of a mandate for the Intergenerational Sovereign Wealth Fund (FSIL), which permits it to speculate as much as 15% of its portfolio into different property, together with crypto. It may possibly additionally purchase into different different property corresponding to actual property and personal fairness.

The FSIL was launched in 2014 and is meant to construct up a reserve for future generations. Most of its capital is allotted to high-quality bonds.

World‘s 4th richest nation turns into first Eurozone member to spend money on #Bitcoin. 🇱🇺

Luxembourg’s Intergenerational Sovereign Wealth Fund (FSIL) has allotted 1% of its $730 million portfolio to #Bitcoin.

Stack accordingly. pic.twitter.com/K9beRQjrDY

— Carl ₿ MENGER ⚡️🇸🇻 (@CarlBMenger) October 9, 2025

Symbolic Weight

Whereas the funding is just value about $7.3 million, it carries symbolic weight and will additionally encourage different sovereign wealth funds within the Eurozone to spend money on the biggest crypto by market cap.

“Some may argue that we’re committing too little too late; others will level out the volatility and speculative nature of the funding,” mentioned Bob Kieffer, Director of the Treasury, Luxembourg.

“But, given the FSIL’s specific profile and mission, the Fund’s administration board concluded {that a} 1% allocation strikes the proper steadiness, whereas sending a transparent message about Bitcoin’s long-term potential,” Keiffer added.

The current transfer comes amid “measured confidence in a maturing digital-asset market,” based on Luxembourg Finance Company communications head, Jonathan Westhead.

He mentioned that Bitcoin ETFs provide a approach for the fund to achieve regulated publicity to BTC, with out the operational and technical complexity of custodying cash immediately. In keeping with Westhead, the funding merchandise additionally provide “innovation with accountability.”

European nations together with Finland, Georgia, and the UK presently maintain Bitcoin. Nevertheless, most of this crypto was sourced by means of felony seizures, knowledge from Bitbo reveals.

US Spot Bitcoin ETFs Proceed Their Inflows Streak

The funding from the FSIL into Bitcoin ETFs comes amid a multi-day positive-flow streak for the funding merchandise within the US.

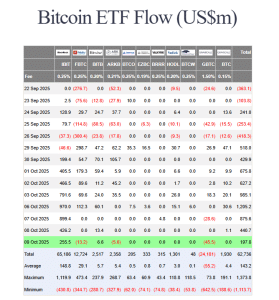

After $197.8 million flowed into the US funds on Oct. 9, the merchandise’ inflows streak has been prolonged to 9 days, based on knowledge from Farside Buyers.

Spot Bitcoin ETF flows (Supply: Farside Buyers)

The inflows within the newest session had been led by BlackRock’s IBIT, which pulled in $255.5 million on the day.

IBIT is now on the verge of hitting the $100 billion property beneath administration (AUM) milestone as properly, based on Bloomberg ETF analyst Eric Balchunas. In a current X publish, he famous that IBIT’s AUM is round $99 billion. He additionally mentioned that IBIT managed to overhaul “an ETF legend,” VIC, to change into the Nineteenth-biggest ETF total when it comes to AUM.

IBIT WATCH: misplaced a little bit of aum yesterday bc of btc value decline however made it up w inflows. Nonetheless at $99b. So shut but thus far. Simply handed $VIG (an etf legend) to take the Nineteenth spot in total aum. pic.twitter.com/w5Lto2OaTP

— Eric Balchunas (@EricBalchunas) October 9, 2025

Bitwise’s BITB was the one different US spot Bitcoin ETF to report web optimistic every day flows yesterday, with $6.6 million added to its reserves.

In the meantime, Constancy’s FBTC, ARK Make investments’s ARKB, and Grayscale’s GBTC all recorded web outflows on Oct. 9. FBTC noticed $13.2 million outflows, whereas ARKB and GBTC noticed respective outflows of $5.6 million and $45.5 million.

The remaining funds recorded no new flows on the day.

Following yesterday’s inflows, the US spot Bitcoin ETFs have pulled in over $5.9 billion since Sept. 29.

World Crypto ETFs Entice File Inflows

The continued inflows for US spot Bitcoin ETFs follows a report week for crypto funding merchandise globally.

Within the week ending on Oct. 4, the worldwide inflows for the crypto merchandise hit $5.95 billion. US-based merchandise attracted nearly all of this capital, with $5 billion of that influx.

Nevertheless, there have been additionally inflows of $563 million in Switzerland, and $312 million in inflows in Germany. Each had been new data.

Breaking the inflows down by crypto reveals that BTC drew essentially the most. Bitcoin’s inflows reached $4.55 billion. Ethereum noticed the next-biggest inflows of $1.48 billion, whereas Solana and XRP pulled in $706.5 million and $219.4 million, respectively.

12 months-to-date inflows for crypto merchandise additionally just lately surpassed the whole quantity seen in 2024, based on James Butterfill, head of analysis at CoinShares.

Now we have simply seen international digital asset fund flows surpass final yr’s complete inflows with US$48.67bn year-to-date. Inflows into altcoins appear to be confined to SOL and XRP at current. pic.twitter.com/FvGC9ZkDjr

— James Butterfill (@jbutterfill) October 9, 2025

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection