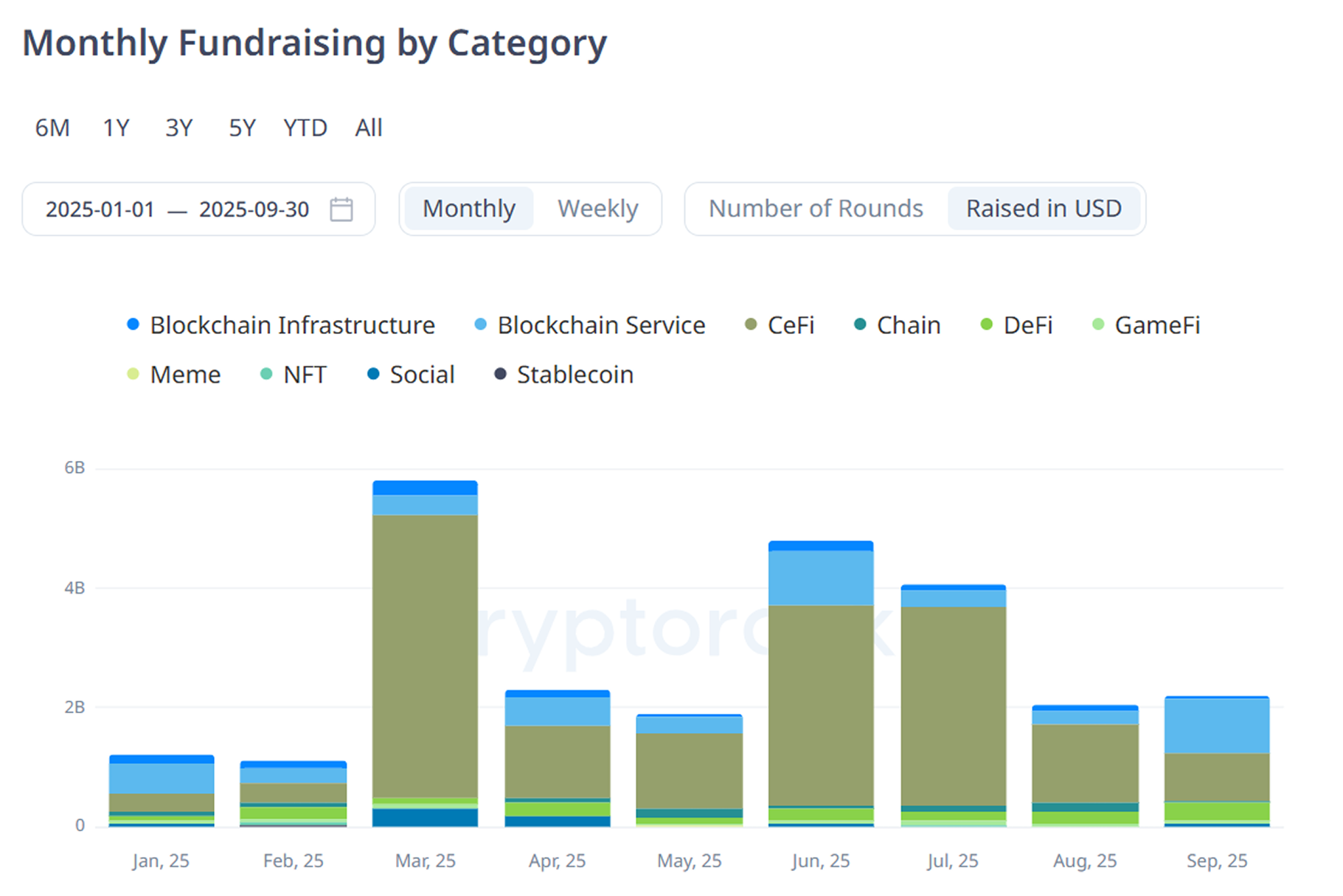

Complete crypto VC funding hit $8 billion in Q3 2025, powered not by hype however by coverage stability. The Trump administration’s pro-crypto stance and tokenization’s rise turned regulation from a headwind into alpha.

For traders, the shift alerts predictable frameworks, institutional exits, and a market now not dominated by hypothesis — a structural reset that makes compliance a supply of efficiency.

Sponsored

Why Coverage Grew to become the Catalyst

Why Necessary

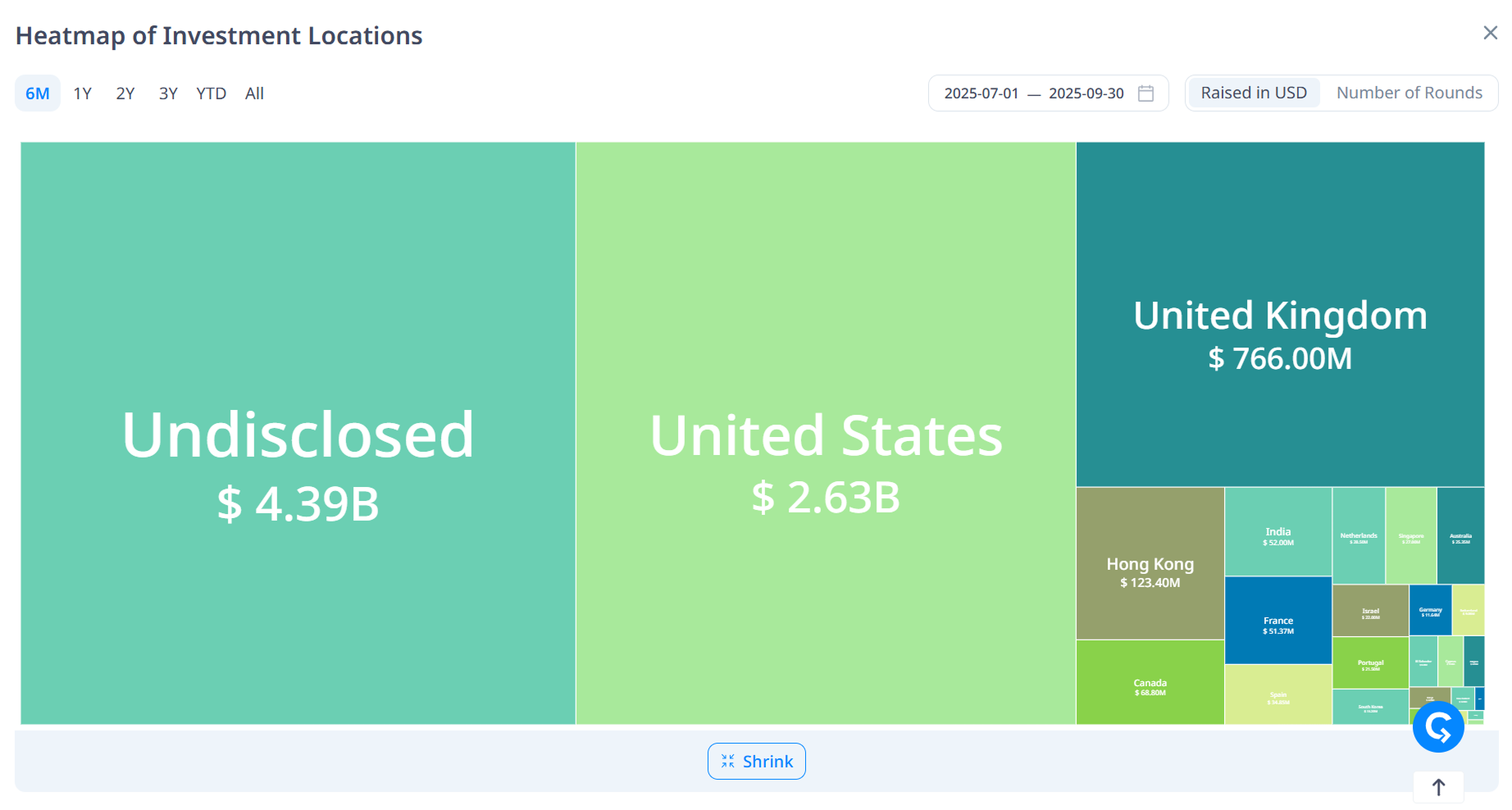

CryptoRank knowledge present US-based funds drove one-third of crypto VC exercise in Q3. Federal readability on stablecoins, taxation, and compliance drew establishments again, producing the strongest quarter since 2021. The figures affirm that US regulation—somewhat than liquidity—now shapes enterprise momentum.

Crypto VC Confidence Returns

Newest Replace

The Silicon Valley Enterprise Capitalist Confidence Index posted one in all its steepest drops in twenty years, earlier than rebounding in Q2 as tariff nervousness eased. Capital rotated into tokenization, compliance, and AI–crypto convergence — seen as resilient amid uncertainty. The rebound suggests traders are recalibrating, not retreating, buying and selling hype for fundamentals as coverage replaces sentiment as the principle compass for threat.

State Road discovered that 60% of establishments plan to double their digital-asset publicity inside three years, with over half anticipating 10–24% of portfolios to be tokenized by 2030. Tokenized personal fairness and debt have gotten the “first cease” for liquidity-seeking allocators, although LP-token fashions stay legally grey. Tokenization institutionalizes the enterprise itself, turning personal markets into programmable, tradable capital.

Behind the Scenes

Llobet famous that funds like a16z, Paradigm, and Pantera now use tokenized facet autos, letting LPs commerce fund shares on compliant platforms. DAO treasuries and decentralized swimming pools are rising as rivals to conventional VC funding, exhibiting how crypto now funds itself by means of its personal rails.

Sponsored

Background

Regulatory opacity as soon as stored allocators away. “Authorized uncertainty and illiquidity constrained blockchain finance,” as famous by Llobet’s 2025 research. That modified when Washington accepted a nationwide stablecoin framework and tax incentives for compliant entities, legitimizing crypto for pensions and sovereign funds.

International Repercussions

Wider Affect

CryptoRank’s Q3 knowledge present 275 offers, two-thirds underneath $10M — clear proof of self-discipline over hypothesis.

CeFi and infrastructure absorbed 60% of capital, whereas GameFi and NFTs fell under 10%. Buyers are re-rating threat by means of money circulation somewhat than hype — a trademark of market maturity.

Sponsored

| Metric | Q3 2025 | Supply |

|---|---|---|

| Complete VC Funding | $8B | CryptoRank |

| Avg Deal Dimension | $3–10M | CryptoRank |

| Institutional Allocation | +60% deliberate improve | State Road |

| Confidence Index | 3.26 / 5 | SSRN / SVVCCI |

State Road expects tokenized funds to be customary by 2030, whereas CryptoRank tasks $18–25B in 2025 inflows — a sustainable, compliance-driven cycle. Regulation now features much less as a constraint than as a aggressive edge.

Crypto VC Faces Its First Actual Stress Take a look at

Dangers & Challenges

Ray Dalio warned that US debt, now about 116% of GDP, mirrors pre–World Battle II dynamics and will erode threat urge for food if fiscal restore stalls.

Sponsored

Dalio’s “deficit bomb” and SVVCCI knowledge recommend commerce volatility may delay IPOs. Ackerman of DataTribe warned AI euphoria could type a “bubble” that resets valuations and diverts capital from Web3. Coverage could anchor sentiment, however macro debt and AI hypothesis will take a look at whether or not the sector’s new self-discipline can maintain.

“Institutional traders are transferring past experimentation; digital belongings at the moment are a strategic lever for progress,” mentioned Joerg Ambrosius, State Road.

“Commerce volatility will restrict exits quick time period, however AI and blockchain stay the dual pillars of recent worth creation,” famous Howard Lee, Founders Fairness Companions.

“Crypto VC has institutionalized. Tokenized funds are the brand new customary for liquidity,” mentioned Marçal Llobet, College of Barcelona.

Crypto VC has entered a disciplined, institutional part. Regulatory readability and tokenization are increasing entry whereas decreasing volatility. But continued progress depends upon macro stability and measured risk-taking. If predictability holds, 2025 could also be remembered because the yr compliance grew to become alpha.