- Sui (SUI) crashed practically 87%, plunging from $3.80 to $0.50 after a $144 million token unlock collided with Trump’s shock 100% China tariff announcement.

- The occasion triggered over $7 billion in crypto liquidations, with $100 million from SUI positions alone, earlier than the token partially recovered to round $2.76.

- Analysts warn that Sui should maintain assist close to $2.8 to keep away from additional drops, whereas RSI ranges counsel short-term oversold situations that would spark a rebound.

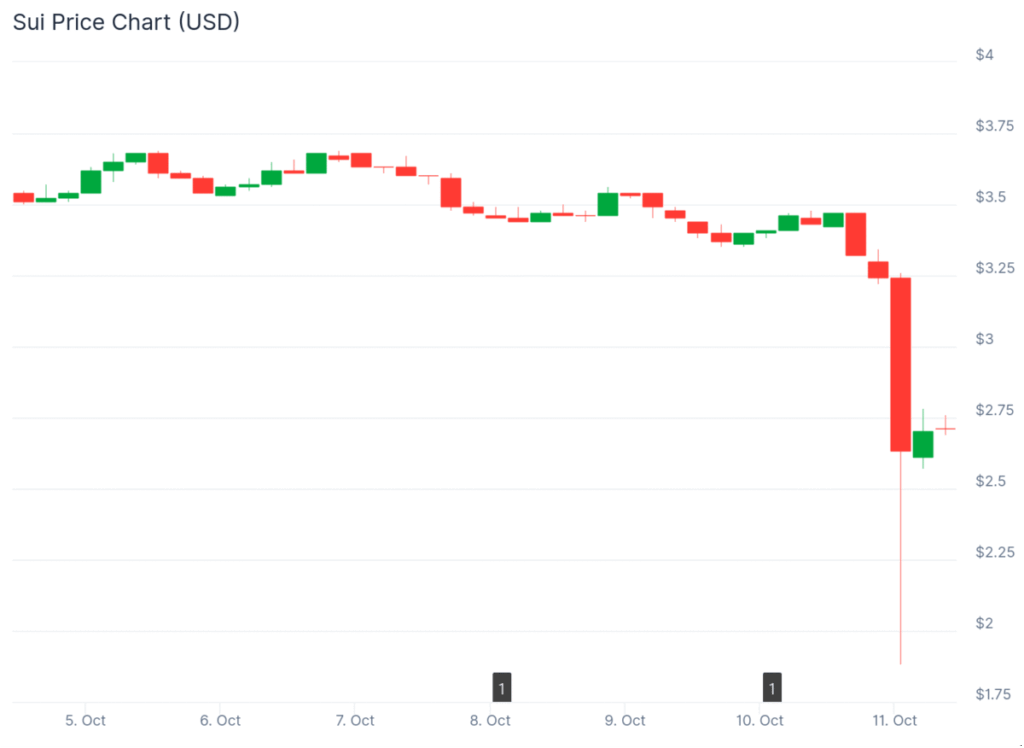

The Sui market simply went by absolute chaos. In one of many sharpest crashes seen this yr, the token nosedived practically 87%, tumbling from $3.80 to simply $0.50 in minutes. The timing couldn’t have been worse — an enormous $144 million token unlock hit the market proper as Trump introduced new 100% tariffs on China. What adopted was a domino impact that liquidated billions throughout crypto.

By the point the mud settled, over $7 billion in positions had been worn out industry-wide. Bitcoin slipped beneath $110,000, Ethereum cratered under $3,700, and Sui — nicely, it took the worst of it.

Token Unlock Sparks Chain Response

The principle set off was the unlock of roughly 44 million SUI tokens, price over $144 million on the time. These tokens hit exchanges like Binance and Coinbase abruptly, flooding skinny order books and setting off a series of panic gross sales. As soon as the primary stops hit, automated liquidations kicked in, and costs began freefalling sooner than anybody may react.

In complete, round $500 million in crypto liquidations had been tied on to the Sui crash, with practically $100 million from SUI futures alone. Buying and selling volumes surged 294%, reflecting merchants scrambling to exit earlier than getting caught within the washout.

Sui managed to claw its method again from the $0.50 low to round $2.40, nevertheless it nonetheless closed the day down greater than 20%. On the time of writing, SUI trades close to $2.76, with a market cap of roughly $10 billion — down over $2.5 billion from only a day earlier.

The Broader Market Will get Hit Onerous

The chaos wasn’t restricted to Sui. When Trump’s tariff submit went reside late Friday, the complete crypto market reacted immediately. Bitcoin dropped $3,000 inside minutes, plunging under $110,000. Ethereum sank 16%, whereas Solana, XRP, and Dogecoin every misplaced between 20–30%. Cardano, Chainlink, and Aave noticed even steeper declines, with some crashing as a lot as 40%.

The entire liquidation depend topped $7 billion — a stage not seen because the COVID-19 market meltdown again in March 2020. Dealer Bob Loukas even described it as “COVID-level nukes,” calling the transfer a “mom of all shakeouts.”

Technical Breakdown & What’s Subsequent

From a technical angle, the harm was brutal. SUI broke by its 7-day transferring common at $3.40, slicing cleanly under Fibonacci assist at $3.26. As soon as that stage was gone, algorithmic promoting took over, slamming the value right down to $2.82 earlier than the eventual bounce.

The RSI now sits round 28 — deep in oversold territory — which may sign a short-term rebound if consumers step again in. That stated, if the token fails to carry the $2.82 flooring, analysts warn the subsequent robust assist lies close to $2.11.

To flip bullish once more, SUI would want to reclaim $3.26 and maintain above it with quantity. However proper now, open curiosity in SUI derivatives has dropped 15%, suggesting merchants are staying on the sidelines till volatility calms down.

For now, all eyes are on two issues — whether or not consumers can defend present assist, and the way the market reacts to ongoing U.S.-China tensions. It’s a brutal reminder that even the strongest rallies can unravel in seconds when macro shocks collide with token unlocks.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.