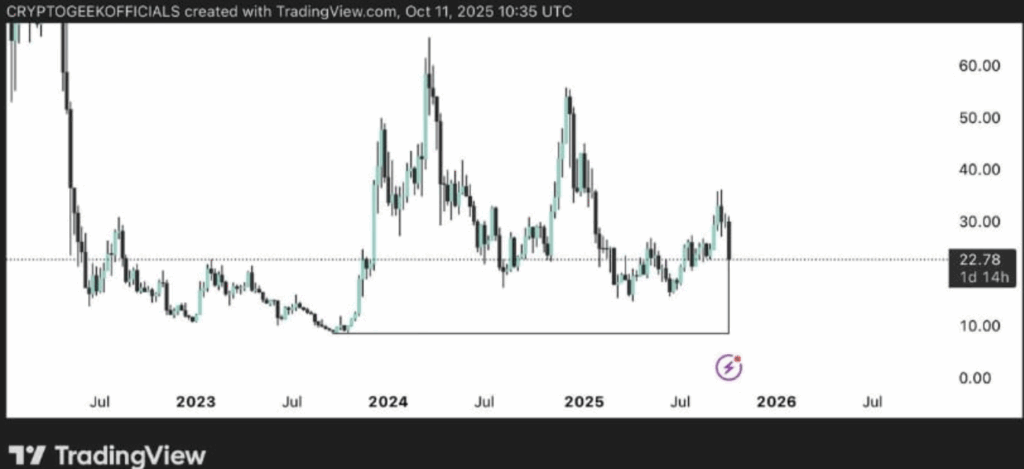

- AVAX plunged 70% earlier than rebounding from its 2023 assist zone.

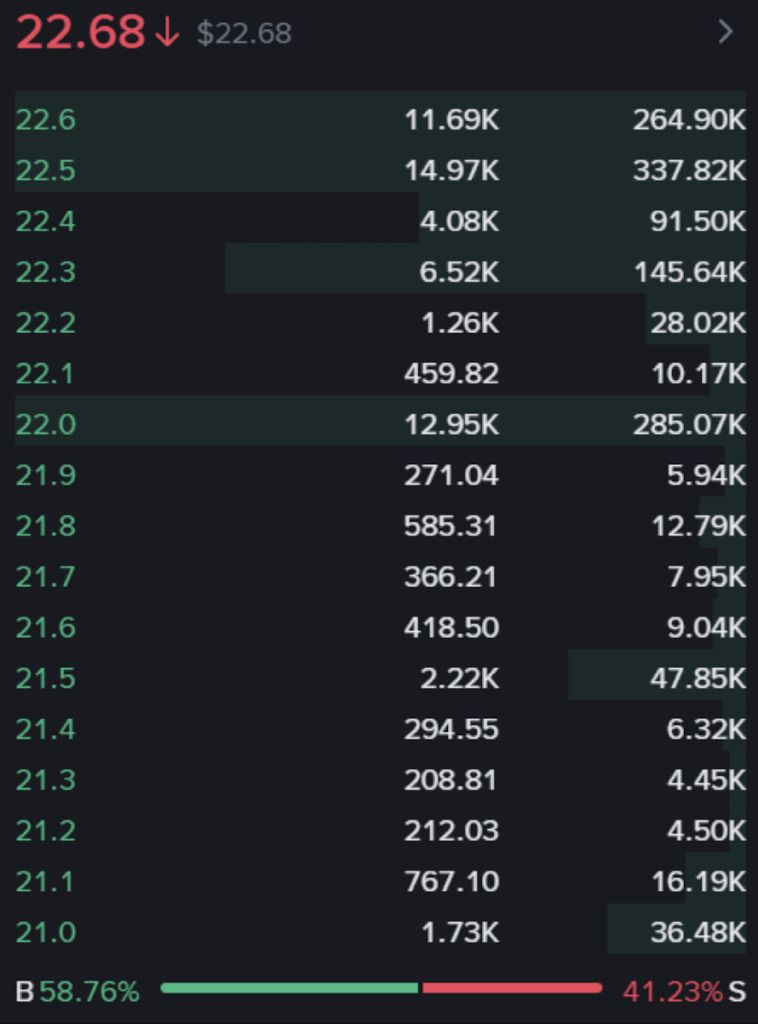

- Purchase orders dominate 60/40, signaling accumulation at $22.

- Reclaiming $25 might ignite a rally towards $30–$32 within the close to time period.

Avalanche had considered one of its wildest buying and selling days in current reminiscence. The value of AVAX plunged almost 70% in a single day earlier than bouncing proper again from its 2023 bear market lows — virtually prefer it hit a springboard. The transfer was chaotic, but it surely additionally confirmed how shortly consumers stepped in as soon as value tagged a important assist zone that’s held sturdy in previous cycles.

On the time of writing, AVAX was hovering close to $22.6, down about 19.8% on the day. However beneath all of the noise, the setup appears much more fascinating than it appears on the floor.

Revisiting 2023’s Assist Zone

Through the crash, Avalanche revisited the $12–$10 zone — the identical demand space that marked the underside of the final bear market. It’s a stage that’s confirmed itself a number of occasions, and as soon as value touched it once more, the response was instant. Consumers flooded in, driving AVAX again up with drive.

Technically, this space is important. It aligns with long-term horizontal assist and sits proper alongside the decrease fringe of the macro vary. The bounce was sharp sufficient to shift short-term sentiment, however for bulls to actually acquire traction, AVAX must construct a greater low above $22 and maintain that stage intact.

Bulls Eyeing a Fast Restoration Towards $25

Regardless of the large drop, merchants don’t appear too shaken. Analyst Pound famous that Avalanche might bounce again towards $25 inside 48 hours, stating that traditionally, AVAX tends to rebound quick as soon as main liquidation zones are flushed out.

From a technical viewpoint, it’s not far-fetched. Early absorption indicators are forming close to the $22 area, and momentum oscillators present promoting stress is dropping steam. If the value pushes above $23.80, it will verify {that a} short-term backside is already forming.

The subsequent key resistances line up at $25.3, $27.5, and $30, which is able to possible act as checkpoints for the subsequent leg up.

Purchase Orders Tip the Scales Towards the Bulls

Contemporary information from Jesse Peralta exhibits purchase orders outweighing promote orders by about 60/40. That’s not only a blip — it’s a transparent signal that good cash is treating this crash as an opportunity to load up, not exit.

Deep bid clusters have appeared across the $22 vary, suggesting that merchants view this zone as high-value territory. When the order e book leans this closely bullish, it usually units the muse for explosive recoveries. Avalanche has a monitor document of sharp rebounds when consumers dominate order circulate like this — and this may simply be one other a type of moments.

Outlook: The Defining Rebound Zone

Proper now, Avalanche sits at a crossroads. The $22 zone is appearing as a make-or-break demand area. Sentiment is slowly shifting from worry to quiet accumulation, and that’s usually the place the very best rallies start.

If AVAX can reclaim $25 and keep above it, momentum might snowball shortly, pushing towards $30–$32 within the coming days. Holding this construction wouldn’t solely verify power but in addition sign that Avalanche is perhaps gearing up for its subsequent main uptrend because the market cycle resets.

For now, all eyes are on that $22–$25 pocket — it’s the zone the place panic might flip into alternative.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.