As an aftermath of the October 10 market crash, the place Bitcoin’s worth reached ranges as little as $101,500, the market is exhibiting a recognizable bearish on-chain construction. Whereas the promoting momentum appears to be slowing down, giving a sliver of hope to potential market members, latest on-chain evaluation appears to level in the direction of warning because the extra appropriate sentiment to have within the brief time period.

Realized Income Climb As Excessive As $2.25 Billion

In an October 11 put up on social media platform X, technical and on-chain analyst Darkfost revealed that loads of Bitcoin buyers may nonetheless be taking earnings from their final buys.

Associated Studying

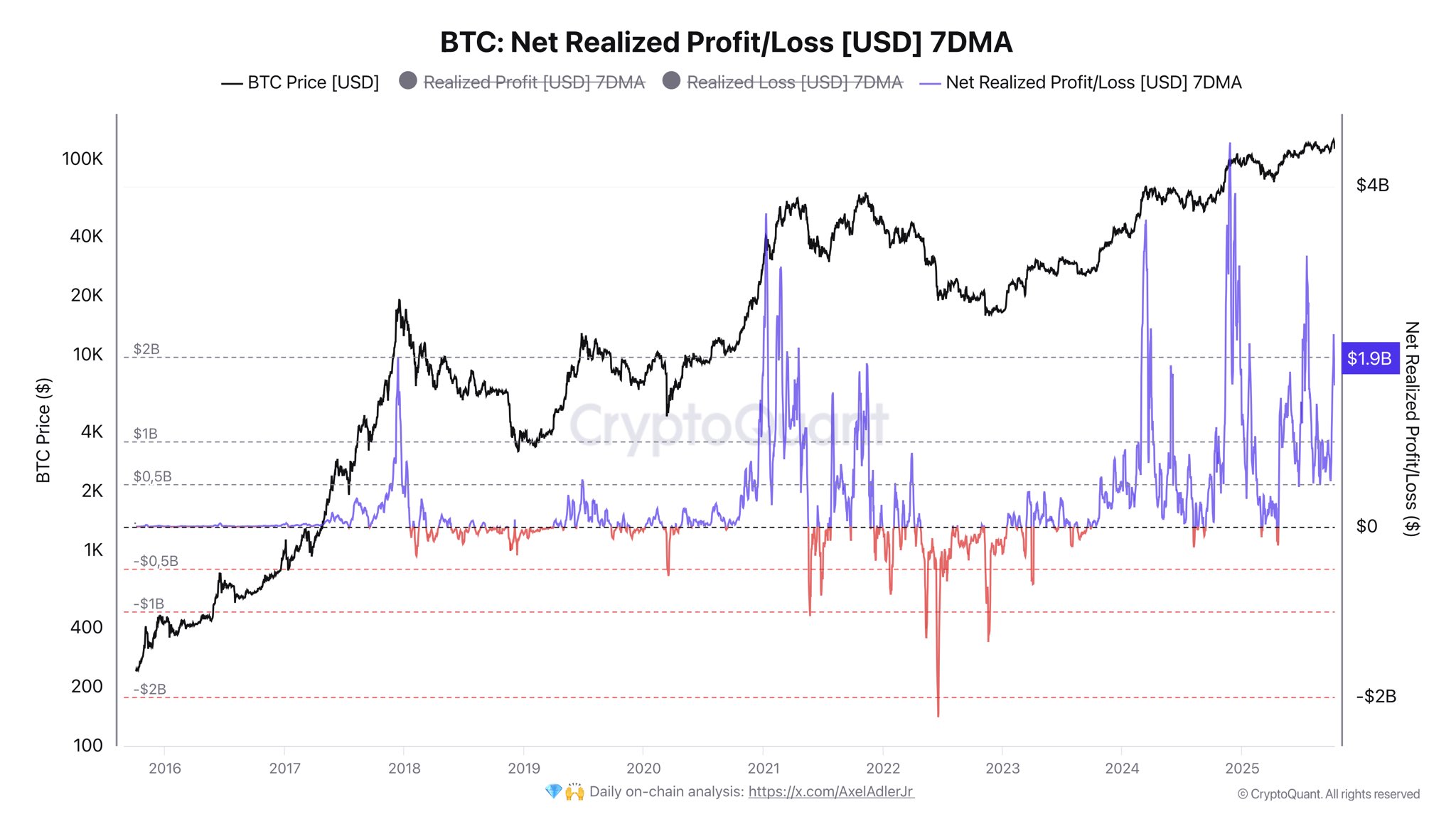

Within the put up on X, Darkfost cited outcomes obtained from the Web Realized Revenue/Loss [USD] 7 Day MA indicator. This metric retains tabs on the typical every day distinction between the overall quantity of realized earnings and losses of transactions over the previous seven days.

For context, realized earnings check with the overall quantity in USD of Bitcoin bought at costs greater than the degrees of buy, exhibiting that buyers are promoting within the inexperienced. Then again, realized losses mirror the overall Greenback price of Bitcoin bought under their value of buy.

The analyst put it out that the 7-day shifting common of the Web Realized Revenue/Loss metric not too long ago reached a peak of $2.25 billion, the fourth-highest stage seen within the present market cycle. In the meantime, the metric’s weekly common holds nicely above $1.6 billion, indicating that profit-taking remains to be at a excessive stage.

Darkfost famous that if the Bitcoin market continues to witness this magnitude of profit-taking, it is perhaps some time earlier than the premier cryptocurrency switches from its present bearish sentiment to a extra optimistic one.

$99,000-$104,000 Could Be The Subsequent Worth Assist

In one other put up on X, cryptocurrency pundit Ted Pillows identified the $99,000-$104,000 area as the subsequent potential help if the Bitcoin worth have been to maintain sliding.

In keeping with the analyst’s put up on X, this worth vary has an honest quantity of spot bids sitting inside it, sufficient to behave as a help zone to maintain the Bitcoin worth afloat.

The subsequent market trajectory thus appears to rely upon whether or not investor profit-taking would stay excessive. Within the state of affairs the place it does, the $99,000-$104,000 worth vary is perhaps the subsequent zone to maintain an eye fixed out for.

In an upside state of affairs, Pillows defined that the $119,000 worth stage and different zones above maintain a lot of the promote orders presently available in the market.

As of this writing, Bitcoin is price roughly $111,772, reflecting an over 1% acquire previously 24 hours.

Associated Studying

Featured picture from iStock, chart from TradingView