- BlackRock bought $80 million in Ethereum, sparking a 14% drop earlier than ETH rebounded above $3,800.

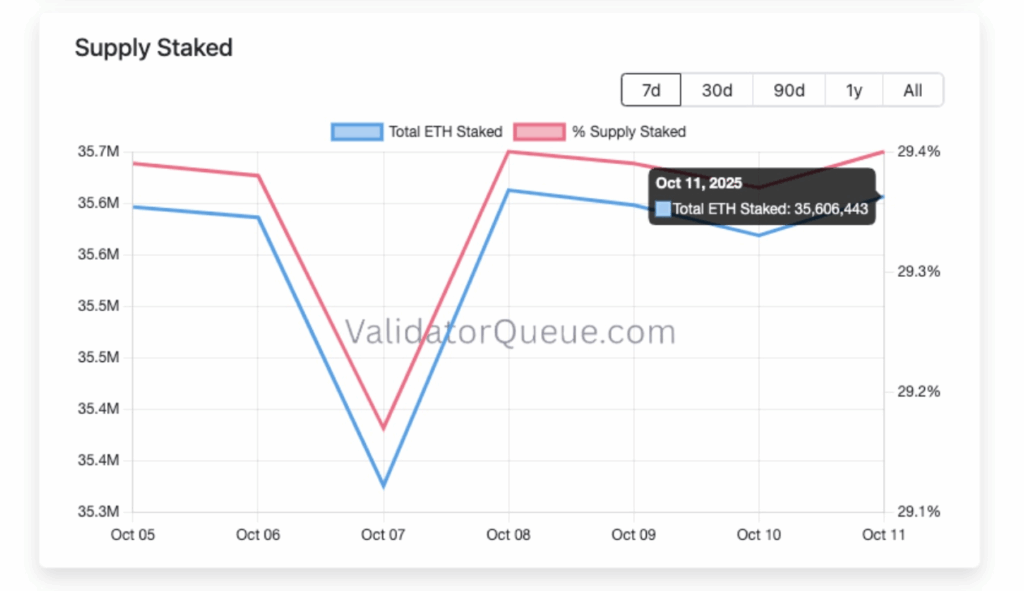

- Regardless of ETF outflows, staking deposits surged by $114 million, exhibiting rising long-term confidence.

- Validator exercise elevated as fewer customers exited staking, hinting that ETH holders are staying bullish.

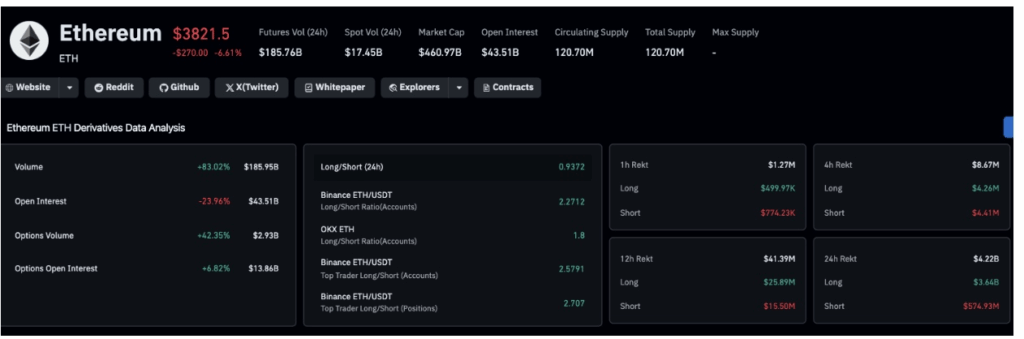

Ethereum had a wild weekend. The value plunged to $3,500 on Saturday after BlackRock reportedly bought off round $80 million value of ETH, triggering a wave of liquidations throughout the market. Bitcoin slipped too, however not as badly—dropping simply 7% whereas Ethereum tumbled over 14%. By late Saturday, ETH managed to claw its method again above $3,800, thanks partly to a shocking $114 million surge in staking inflows that steadied the decline.

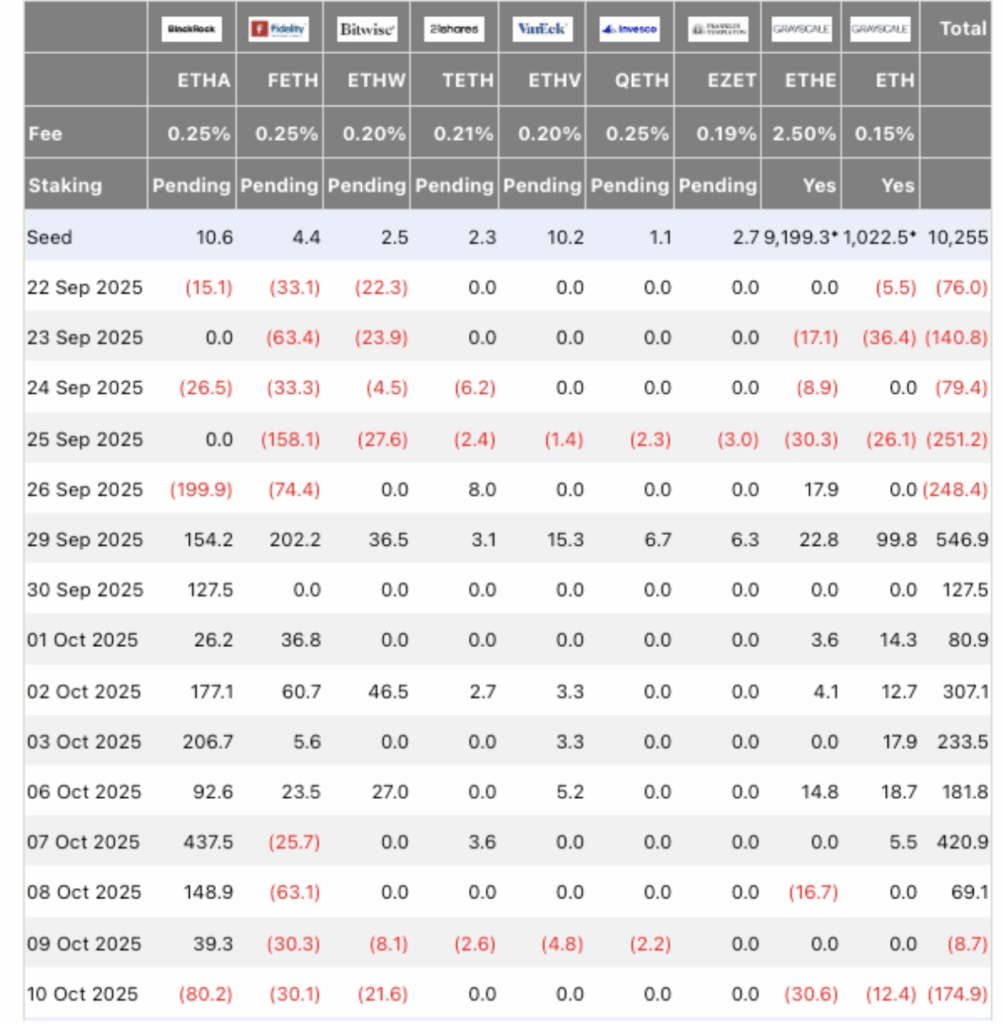

Information from Farside Traders confirmed that Ethereum ETFs noticed outflows of $174 million on Friday, with BlackRock main the exodus. In the meantime, their Bitcoin ETF (IBIT) absorbed $74 million in new inflows, exhibiting that some establishments had been merely rotating positions from ETH into BTC. The promote stress additionally lined up with broader market chaos after new U.S.-China tariffs spooked buyers, sparking a collection of pressured liquidations that drained billions from crypto markets in a single day.

Derivatives Liquidations and Market Sentiment

The fallout was tough. In keeping with Coinglass, over $3.6 billion in ETH derivatives had been liquidated inside 24 hours, and the lengthy/quick ratio dropped to 0.94—a transparent shift towards bearish sentiment. Merchants rushed to unwind positions as volatility spiked, making a suggestions loop that pushed ETH down even sooner.

Regardless of the panic, Ethereum’s fundamentals didn’t actually falter. The Beacon Chain confirmed an increase in validator deposits whilst ETFs dumped tokens. For each greenback leaving institutional funds, roughly one other was flowing into staking contracts—virtually like retail and long-term holders had been choosing up what huge cash was dropping.

Staking Indicators Confidence

On-chain knowledge from ValidatorQueue painted a really completely different image than the ETFs did. The variety of new deposits jumped by practically 1.35 million ETH, whereas the exit queue dropped from 2.38 million to 2.35 million ETH. Meaning fewer validators are pulling out, and extra are becoming a member of the community. In simply 24 hours, staking deposits rose by round 29,800 ETH (value about $114 million), whereas withdrawals fell by roughly the identical worth.

In brief—it appears like some merchants determined to skip the panic and lock up their ETH for yield as a substitute. This sort of habits often hints at confidence in Ethereum’s long-term energy. It’s just like the market saying, “yeah, short-term ache, however we’re nonetheless in.”

Rebound and What Comes Subsequent

At press time, Ethereum had bounced again to $3,823, exhibiting resilience whilst main ETFs pulled cash out. Analysts assume the present staking demand would possibly cushion the draw back over the following few days, particularly if Bitcoin stabilizes.

BlackRock’s transfer would possibly’ve sparked a sell-off, but it surely additionally highlighted the break up between speculative merchants and long-term believers. As staking continues to develop, Ethereum’s community safety and yield potential might find yourself being the quiet hero holding the ground whereas the whales reshuffle their portfolios.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.