Be part of Our Telegram channel to remain updated on breaking information protection

BlackRock’s spot Bitcoin ETF (exchange-traded fund) IBIT is exhibiting “utopia-esque” returns even after the $19 billion crypto market flash crash.

That’s in line with Bloomberg Intelligence ETF analyst Eric Balchunas, who famous the fund has surged 76% prior to now yr regardless of the latest stoop. It’s additionally up 37% prior to now six months.

In keeping with information from Google Finance, IBIT’s value fell over 3% on Oct. 10 and one other 3% in after-hours buying and selling in response to US President Donald Trump asserting further tariffs of 100% on China’s exports.

IBIT value (Supply: Google Finance)

Buyers Ought to “Zoom Out” To See IBIT’s True Efficiency

IBIT is designed to trace the worth of the main crypto, Bitcoin (BTC), whereas additionally offering buyers with a regulated means to purchase the digital asset.

Commenting on IBIT’s efficiency since its inception final yr, Balchunas mentioned that the fund has proven stellar returns.

He criticized buyers for the entire “angst and whining” across the ETF’s efficiency following the most recent crypto market correction that worn out over $19 billion in trades in a matter of hours.

Throughout that correction, Bitcoin plummeted beneath the $120K mark and trades at $111,338.31 as of 12:32 a.m. EST, CoinMarketCap information reveals. Like IBIT, BTC is up greater than 77% over the previous yr.

$IBIT’s one yr return continues to be 84% after the pullback. A lot angst and whining for what’s utopia-esque returns. Each day value charts are the media’s greatest pal however an investor’s worst enemy. Zoom out. pic.twitter.com/YH6xqUKux8

— Eric Balchunas (@EricBalchunas) October 11, 2025

“Each day charts are the media’s greatest pal however an investor’s worst enemy,” Balchunas mentioned, earlier than telling his over 370.8K followers to “zoom out” once they take a look at the fund’s efficiency so as to see the larger image.

IBIT was closing on $100 billion in property below administration milestone earlier than the flash crash with about $99.5 billion in funds.

“It’s nonetheless inevitable milestone imo however wild simply how shut it bought,” Balchunas wrote. “Two steps ahead, one step again in impact.”

IBIT Pulls In Capital As Different US Spot Bitcoin ETFs Bled On Friday

IBIT has been the spot Bitcoin ETF of alternative for US buyers, and has seen nearly all of cumulative inflows because the funds hit the market final yr.

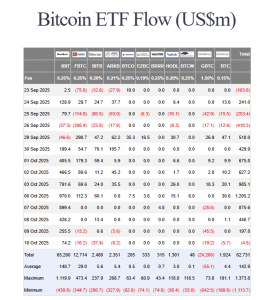

Information from Farside Buyers reveals that IBIT has seen $65.260 billion in cumulative inflows as of Oct. 10, with Bitcoin’s appreciation including about $34 billion to the ETF’s AUM. The following-biggest is Constancy’s FBTC, which has seen $12.714 billion in cumulative inflows.

US spot Bitcoin ETF flows (Supply: Farside Buyers)

IBIT can also be on a nine-day influx’s streak. That is after the funding product pulled in one other $74.2 million on Friday, whereas the opposite funds both recorded outflows or no new flows on the day.

Since Sept. 30, IBIT has seen over $4.4 billion added to its reserves. Its greatest day throughout this era was on Oct. 6, when buyers added $970 million to the product’s reserves.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection