The crypto market suffered one other brutal weekend following President Donald Trump’s announcement of sweeping tariffs on Chinese language imports – a transfer that reignited world commerce tensions and triggered one of many largest liquidation occasions in crypto historical past.

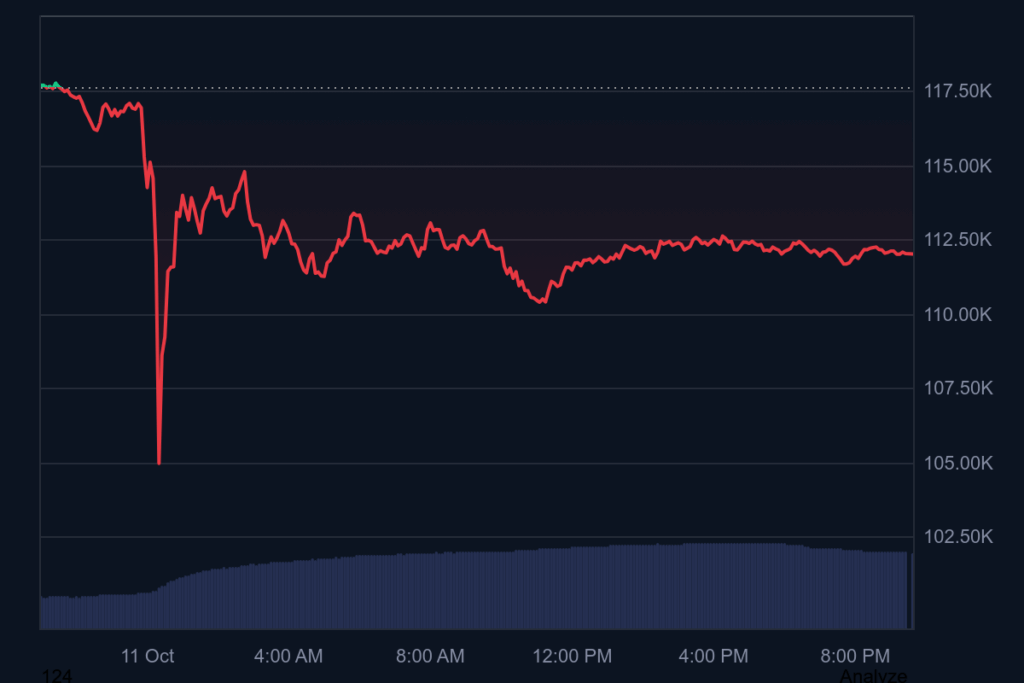

After collapsing practically 10% on Friday, Bitcoin briefly stabilized round $112,000, testing key assist ranges. The drop got here amid a report $20 billion in liquidations, the most important single-day flush ever recorded throughout crypto derivatives markets.

Conventional markets didn’t escape the panic both. The S&P 500 slid 2.7%, whereas gold surged previous $4,000 per ounce as buyers sought refuge from the escalating U.S. – China standoff.

Analysts described the occasion as a “crypto cleanse,” arguing that months of speculative extra had set the stage for a pointy correction. “There’s over 30 million altcoins on the market, most of them junk initiatives,” one dealer wrote on X. “This isn’t the underside – it’s the beginning of a reset.”

On-chain information confirmed excessive market stress. Bitcoin’s relative power index plunged to deeply oversold territory, and change order books revealed skinny liquidity beneath $110,000 – with resistance stacked close to $120,000. Market makers reportedly paused exercise to evaluate injury earlier than re-entering with tighter spreads.

Futures merchants had been hit hardest, as leveraged lengthy positions had been forcefully unwound. Regardless of Binance’s efforts to calm customers, studies prompt the precise liquidation whole might exceed the publicly estimated $20 billion, as many exchanges restrict the frequency of liquidation reporting.

Including to the irony, the official TRUMP token cratered over 30% after the president’s announcement, underscoring how deeply the shock rippled throughout digital property.

The whole cryptocurrency market cap slipped beneath $4 trillion, marking a decline of greater than 6% up to now 24 hours.

With new tariffs set to take impact by early November, buyers now concern the commerce conflict might spill additional into world threat markets. For now, Bitcoin hovers close to its lowest ranges in three weeks – and merchants brace for what might be probably the most consequential market reset of the yr.