13 years is a very long time to do nothing, but one early Bitcoin participant has managed precisely that, sitting on a stash pulled from Mt.Gox again when all the pile was barely the value of a used automobile, and now, with the market shaken and merchants scrambling, he lastly twitched as revealed by Lookonchain.

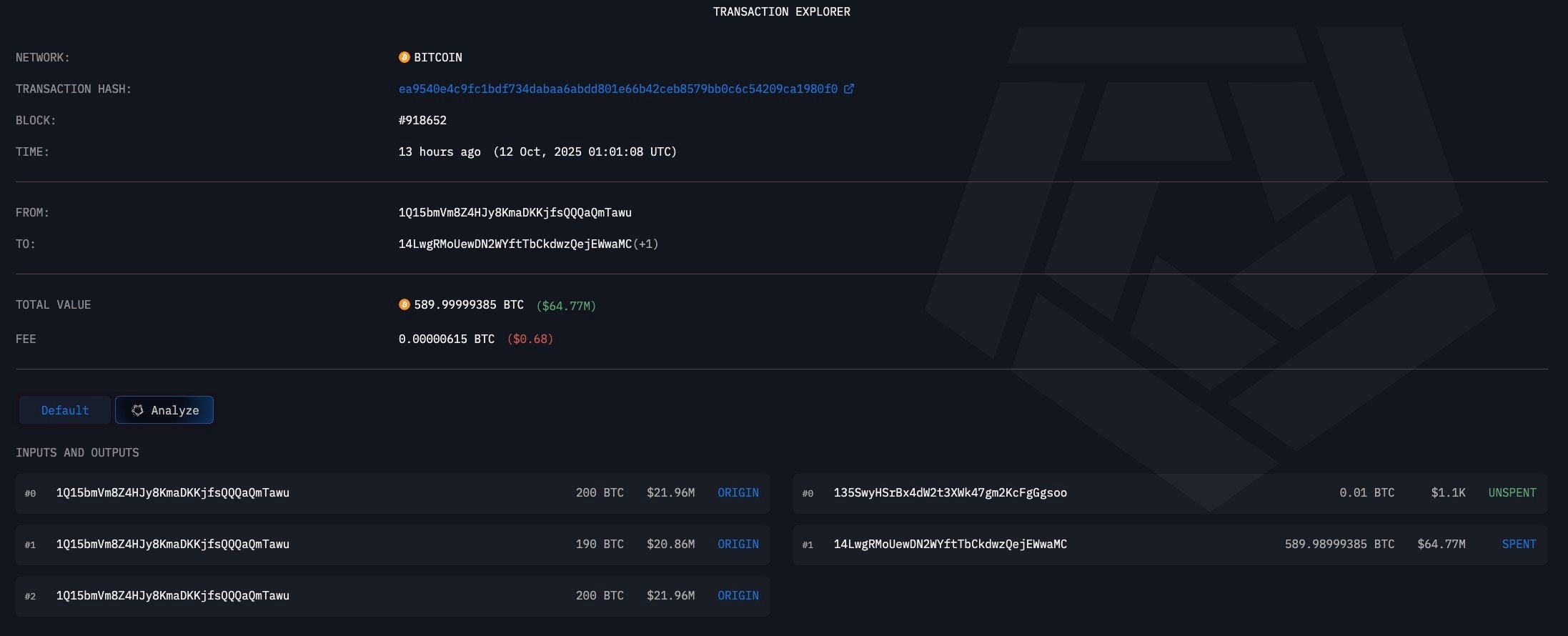

A single push despatched 300 BTC — about $33.47 million — into Binance, and that’s not a paper achieve, that’s the form of transfer that rewrites the mathematics on why anybody ever known as this “magic web cash.”

The numbers are absurd: Cash purchased at $11, complete withdrawal price $8,151 again then, now marked up by greater than 410,624%, and that’s earlier than counting the remaining 590 BTC nonetheless sitting within the authentic cluster of addresses.

This wasn’t random pockets rotation both. Final yr he shuffled 159 BTC into a brand new pockets and left it untouched. This time is one other — precise cash within the alternate pockets, promote button inside attain, historical past folding into the current in a single click on.

Bitcoin market beneath strain

The market background is what’s much more necessary right here as BTC simply took a violent journey all the way down to the $100,600 zone earlier than bouncing again towards $111,900, liquidations piling up $16 billion minimal, merchants wiped huge time, leverage drained.

Into that mess drops an OG with cash older than most exchanges, and whether or not he sells all of it or simply half, the sign is already out: The outdated provide isn’t gone, and the potential harm is immeasurable, as these cash lie dormant deep throughout the blockchain.