- XRP may log its strongest weekly shut ever if it ends above $3.115.

- The token rebounded 148% from its $1.25 low after a tariff-induced crash.

- Q3 2025 marked XRP’s highest quarterly shut, boosting bullish confidence.

Veteran market analyst Patrick L. Riley believes XRP is likely to be on the verge of creating historical past. In line with his newest replace on X, if the token manages to carry its present tempo till the week’s finish, it may print its most bullish weekly candle ever recorded.

Riley defined {that a} weekly shut at $3.115 would set a brand new report for XRP — a milestone that may mark the strongest weekly candle for the reason that token first hit exchanges. The decision comes because the crypto market tries to search out its footing once more after a brutal spherical of volatility that despatched merchants scrambling.

Market Chaos After Tariff Announcement

The timing couldn’t be extra dramatic. Riley’s feedback adopted one of many wildest buying and selling classes in months — a market-wide crash sparked by U.S. President Donald Trump’s announcement of a 100% tariff on Chinese language imports. The information reignited fears of a recent commerce conflict, and each conventional and crypto markets felt the sting instantly.

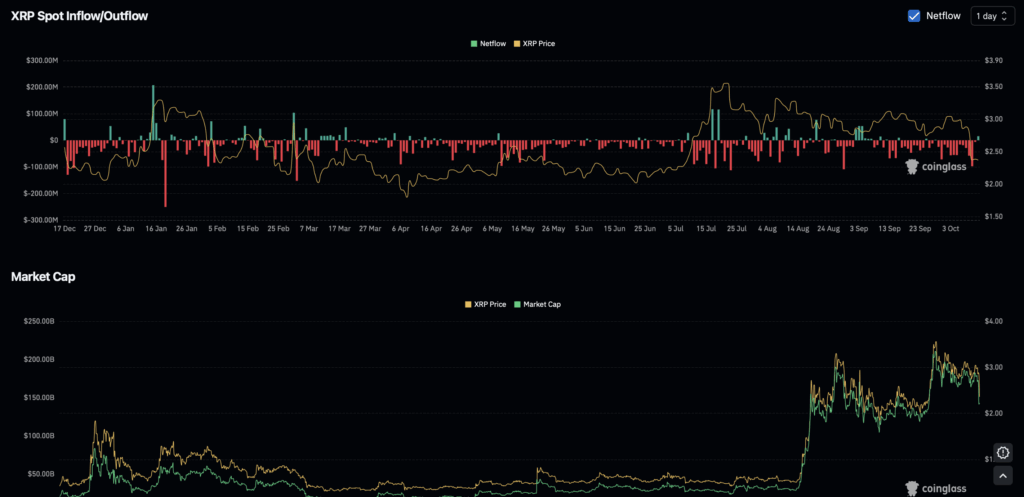

Inside hours, world crypto market capitalization dropped to roughly $3.7 trillion, whereas U.S. equities shed an estimated $1.65 trillion in worth. In line with CoinGlass, over $19 billion in leveraged crypto positions had been liquidated in a single day — one of many largest wipeouts within the business’s historical past.

XRP Tanks 56% Earlier than Snapping Again Exhausting

XRP, caught within the chaos, took one of many hardest hits. On October 10, the token crashed from $2.84 to $1.25 in slightly below 24 hours — a jaw-dropping 56% drop on Binance. However the story didn’t finish there.

Simply as rapidly, XRP clawed its approach again up, rebounding to round $2.47 at press time. The velocity of that restoration turned heads. Some merchants even referred to as it a “shock absorber second,” saying the coin’s fast rebound revealed a shocking stage of energy underneath strain.

Can XRP Shut the Week Above $3.11?

Riley’s evaluation means that if XRP ends the week at $3.115, it might verify the strongest weekly shut within the asset’s lifetime. That will symbolize a 148% rally from this week’s low of $1.25 — a comeback not seen for the reason that early bull runs of 2017.

For perspective, XRP’s largest weekly surge ever occurred in December 2017, when it shot up 215% from $0.23 to $0.71. Whereas this present setup may not beat that transfer percentage-wise, the restoration from such a steep drop may make this week stand out as probably the most dramatic in XRP’s historical past.

At first of the week, XRP was buying and selling close to $2.97. An in depth above $3.11 would technically solely imply a 4.8% weekly achieve, however merchants see it in a different way. To them, the rebound from the lows is what issues — proof that consumers are stepping again in, even when sentiment seems shaky.

XRP’s Sturdy Quarter Provides to Bullish Sentiment

Including to the optimism, XRP additionally locked in a record-breaking quarterly shut on the finish of Q3 2025, ending at $2.846 — up 27% from its Q2 end at $2.23. That’s the highest quarterly shut the token has ever logged.

September 2025 additionally got here in because the third-highest month-to-month shut in XRP’s historical past, behind January ($3.03) and July ($3.02) of this 12 months. With This fall now underway, analysts are quietly hinting that this might be XRP’s strongest quarter but.

Traditionally, This fall has been a sizzling streak for the token — averaging round 140% in beneficial properties, with earlier surges of 240% in 2024 and a jaw-dropping 1,064% in 2017.

So whereas the general crypto market stays messy and unpredictable, XRP’s rebound stands out. Riley’s projection would possibly sound bold, but when the coin retains this momentum by means of the weekend, that record-breaking candle at $3.115 may really occur.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.