The spot Bitcoin ETFs (exchange-traded funds) have been in strong kind over the previous two weeks, laying a basis for the robust worth motion skilled by the premier cryptocurrency lately. In response to market information, the crypto-linked funding merchandise opened the week with a day by day influx file of over $1.21 billion.

As of this writing, with information from Friday’s buying and selling session but to be included, the US-based Bitcoin ETFs are presently on a nine-day streak of optimistic inflows. Nonetheless, a centered look into the inflows development reveals that this information level doesn’t absolutely inform the story.

Do Bitcoin ETFs’ Efficiency Rely On BlackRock’s IBIT?

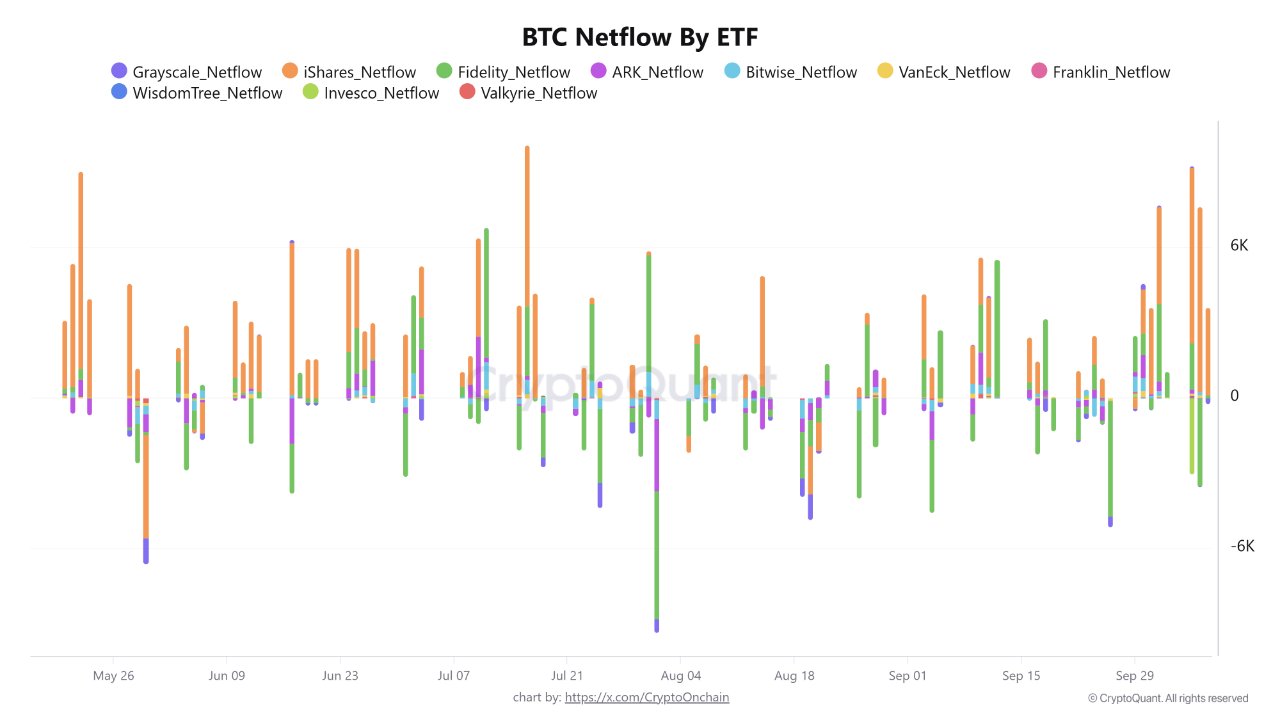

In a current put up on the X platform, market analyst CryptoOnchain acknowledged that the most recent information reveals a serious divergence within the US-based Bitcoin exchange-traded fund market. In response to the on-chain pundit, the capital movement has been principally optimistic due to BlackRock’s iShares Bitcoin Belief (IBIT).

Associated Studying

Breaking down the development with the Bitcoin ETFs, CryptoOnchain labeled BlackRock’s IBIT because the “market’s shock absorber,” mopping up the heavy sell-side liquidity. The most important Bitcoin exchange-traded fund by internet belongings has not posted an outflow day in October, with a $4.21 billion influx to date.

Then again, the second-largest BTC ETF Constancy Sensible Origin Bitcoin Fund (FBTC) has had a blended efficiency in current days, signaling a development of portfolio rebalancing amongst their traders. In the meantime, Grayscale’s GBTC has struggled with muted capital performances, interspersed with some day by day internet outflows.

CryptoOnchain additionally highlighted the Invesco Galaxy Bitcoin ETF (BTCO), which witnessed a serious one-day outflow, which precipitated important market stress. Nonetheless, the online optimistic exercise of BlackRock’s IBIT stored the BTC worth afloat on the time.

CryptoOnchain famous that any slowdown in capital inflows for the iShares Bitcoin Belief may considerably weaken the bullish momentum of the BTC worth. Nonetheless, it’s price mentioning that the Bitcoin worth is presently underneath intense downward stress because of the looming commerce battle between the US and China.

As of this writing, Bitcoin is valued at round $112,143, reflecting an over 7% downturn up to now 24 hours.

Bitcoin Institutional Demand Stays Regular: Glassnode

Earlier than the market downturn triggered by US President Donald Trump’s tariff rumors and eventual announcement, the Bitcoin worth had managed to remain above $120,000. In an earlier October 10 put up on X, Glassnode shared that the Bitcoin ETFs might need helped hold the premier cryptocurrency afloat.

Associated Studying

In response to the on-chain agency, the exchange-traded funds have continued to file capital inflows regardless of BTC’s delicate pullback from its all-time excessive. “This implies structural shopping for remains to be underpinning the market, serving to to soak up volatility and stabilize worth motion,” Glassnode concluded.

Featured picture from iStock, chart from TradingView