- SUI value dropped 22% in 24 hours, buying and selling close to $2.72.

- TVL down 19%, signaling decreased confidence throughout the community.

- Reclaiming $3 might trace at a bullish reversal, however development indicators stay bearish for now.

Sui (SUI) is in a troublesome spot proper now. Although buying and selling exercise has exploded, the worth has tumbled greater than 22% in a single day — an indication that the bears are taking on once more.

On the time of writing, SUI sits round $2.72, slipping quick after what appeared like a promising run earlier this month. And the sharp decline didn’t come quietly. In accordance with CoinMarketCap, buying and selling quantity skyrocketed 350% to $434 million up to now 24 hours. That form of spike normally means one factor — panic available in the market.

The setup paints a transparent image: excessive exercise, low confidence. Merchants appear to be dumping their luggage as concern ripples throughout the ecosystem.

On-Chain Knowledge Paints a Bearish Image

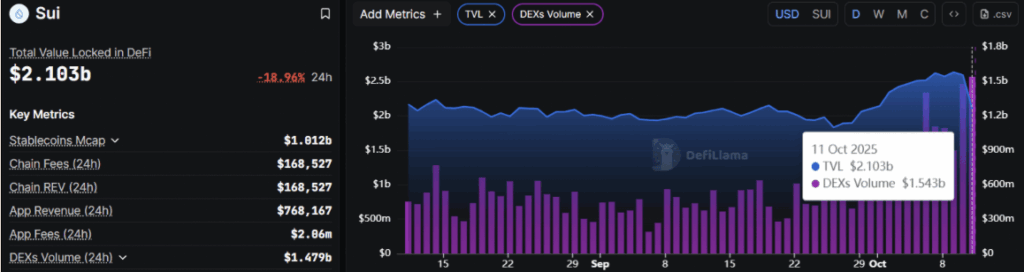

Digging deeper into the chain, issues aren’t trying too nice both. Knowledge from DeFiLlama reveals that SUI’s Complete Worth Locked (TVL) fell by almost 19%, now sitting at round $2.1 billion.

That’s not only a dip — it’s a warning. TVL outflows normally imply buyers are pulling liquidity out of DeFi swimming pools, which regularly alerts declining belief within the community. And although buying and selling quantity on decentralized exchanges has shot as much as a file $1.54 billion, it’s not the form of quantity bulls prefer to see.

It’s panic-driven. Concern-fueled. The form of exercise that reveals extra individuals are making an attempt to get out than get in.

Technical Breakdown: Development Turns Bearish

From a technical standpoint, SUI simply misplaced a vital assist line. After months of driving an ascending trendline that began again in August 2024, the token lastly broke beneath it — a transfer that usually flips the construction from bullish to bearish.

The every day chart reveals SUI caught in a decent vary between $2.52 and $2.81. That’s principally no man’s land. If it will probably’t get well quickly, analysts warn the subsequent cease may very well be $1.65, marking one other 40% slide from present ranges.

On the similar time, the Common Directional Index (ADX) is sitting round 22, which factors to weak development energy. The Supertrend indicator continues to be flashing pink too, perched above the worth — confirming that bearish stress stays heavy.

What Would It Take for a Reversal?

For SUI to shake off the bleeding and flip again to bullish, it must reclaim the $3 zone and break again above that previous ascending trendline. That transfer would sign renewed energy and probably set off a rebound towards earlier highs.

However till that occurs, the market appears extra thinking about promoting than shopping for. For now, merchants are watching to see if this downtrend slows — or if SUI’s newest slip is simply the beginning of a deeper fall.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.