Key Takeaways

- Bitcoin’s value struggles because the crypto asset noticed a market dump in direction of a weekly low, elevating issues of a bear market.

- Value retested a key area of $103,000 as bulls stepped in to assist value rebound in direction of a area of $115,000.

- BTC value should commerce above the important thing resistance of $124,000 for a possible rally to new all-time highs regardless of M2 sentiment.

The crypto market on October eleventh noticed one of many largest market crashes in historical past since COVID-19, wiping out over $15 billion in 24 hours and $7 billion in lower than 60 minutes, as US President Donald Trump introduced a 100% tariff slam on China, resulting in a market crash as Bitcoin (BTC) fell to a low of $103k.

The crypto market was not the one market affected, because the US inventory market additionally noticed over $1.6 trillion worn out, leaving many merchants and buyers blaming Trump and his affect in the marketplace.

In the previous couple of days, Bitcoin and altcoins have struggled to indicate sturdy bullish value motion. Merchants, buyers, and crypto consultants have accused centralised exchanges like Binance of manipulating the market, leading to vital uncertainties in regards to the market’s potential to rally to new highs.

Amid current uncertainties about whether or not the bull market will proceed or whether it is presently at its peak, crypto consultants have insisted that the market hasn’t topped out. They counsel the market is in its early part and has vital potential to rally increased within the coming weeks.

M2 Indicators Recommend Bitcoin (BTC) to New Highs

In accordance with a current evaluation by MaxCrypto, the current crypto market dump is anticipated to be momentary, because the market continues to be on monitor to a historic excessive of $200k primarily based on his M2 BTC indicator. The worth of BTC has, on a number of events, adopted the M2 indicator to new highs.

The crypto professional additional shared a earlier chart exhibiting how Bitcoin has adopted its value. This gained vital consideration on X (previously Twitter), as merchants and analysts imagine that panic will probably be changed by euphoria when the value follows the indicator.

Whereas the present value motion for BTC to $200k stays unsure, Michael Saylor has hinted at extra purchases for Bitcoin, as the corporate has a long-term perception and hypothesis that the BTC value will commerce in direction of a area of $1 million.

Regardless of such an formidable tackle BTC’s potential, what’s the short-term value potential following the current market crash?

BTC Value Evaluation

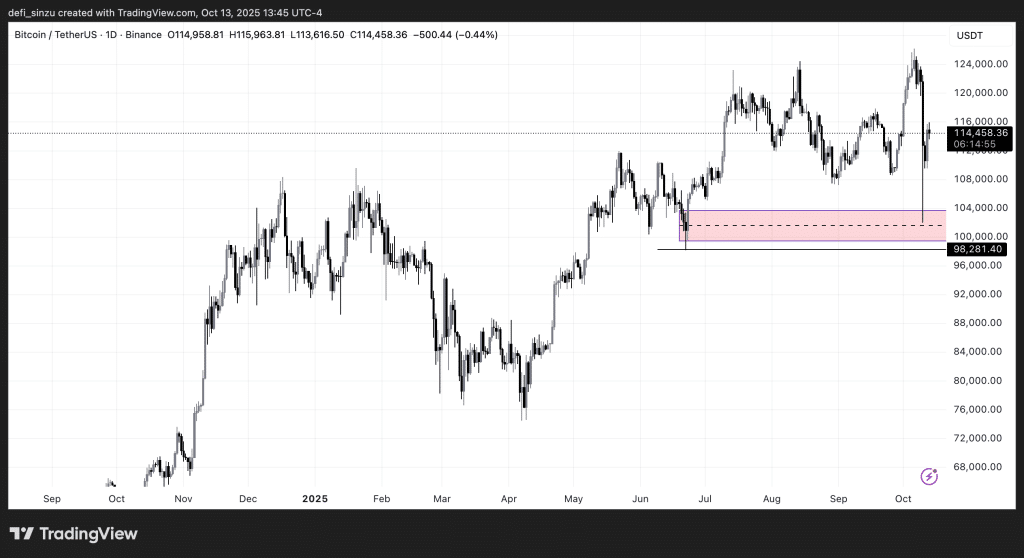

Supply – Bitcoin Each day Value Evaluation from TradingView

Bitcoin noticed a market crash from a area of $126,500 to a low of $103,000, wiping out billions of {dollars} from the market. What appeared like a minor retracement within the value of essentially the most traded cryptocurrency confirmed sturdy bullish value motion in early October, with hype suggesting a spread of $130k to $150k was supreme.

The worth of the crypto asset presently faces vital resistance round $124,000; a breakout above this zone may result in a rally in direction of $130,000 for BTC. Nonetheless, merchants and buyers must be cautious of rejection, which may see the value retest cheaper price zones.

FAQs

Why is the Bitcoin value falling in the present day?

The worth of BTC crashed from a excessive of $124k after a value rejection on this space, buying and selling under $103k following the information of a 100% tariff on China.

What’s M2 Bitcoin?

The M2 BTC indicator shows the cash provide available in the market, and crypto merchants and consultants have utilized it to gauge the extent of liquidity.

What’s international M2 now?

Bitcoin’s international M2 presently trades round $ 92 billion, as the value of the crypto asset has proven a greater correlation over time.

Associated Learn

Crypto Market Crashes Once more – Is it Over for BTC?