BNB seems to be one of the crucial resilient altcoins out there at present. Whereas main tokens are nonetheless down after the weekend crash, BNB worth is up 11% in seven days and over 45% prior to now month, a standout efficiency throughout a unstable interval.

Its rebound appears stable, however on-chain metrics and chart alerts recommend that the subsequent transfer may not be straight up. A brief-term cooldown might come earlier than the subsequent leg greater.

Sponsored

Revenue-Taking Returns as Holders Lock in Positive factors

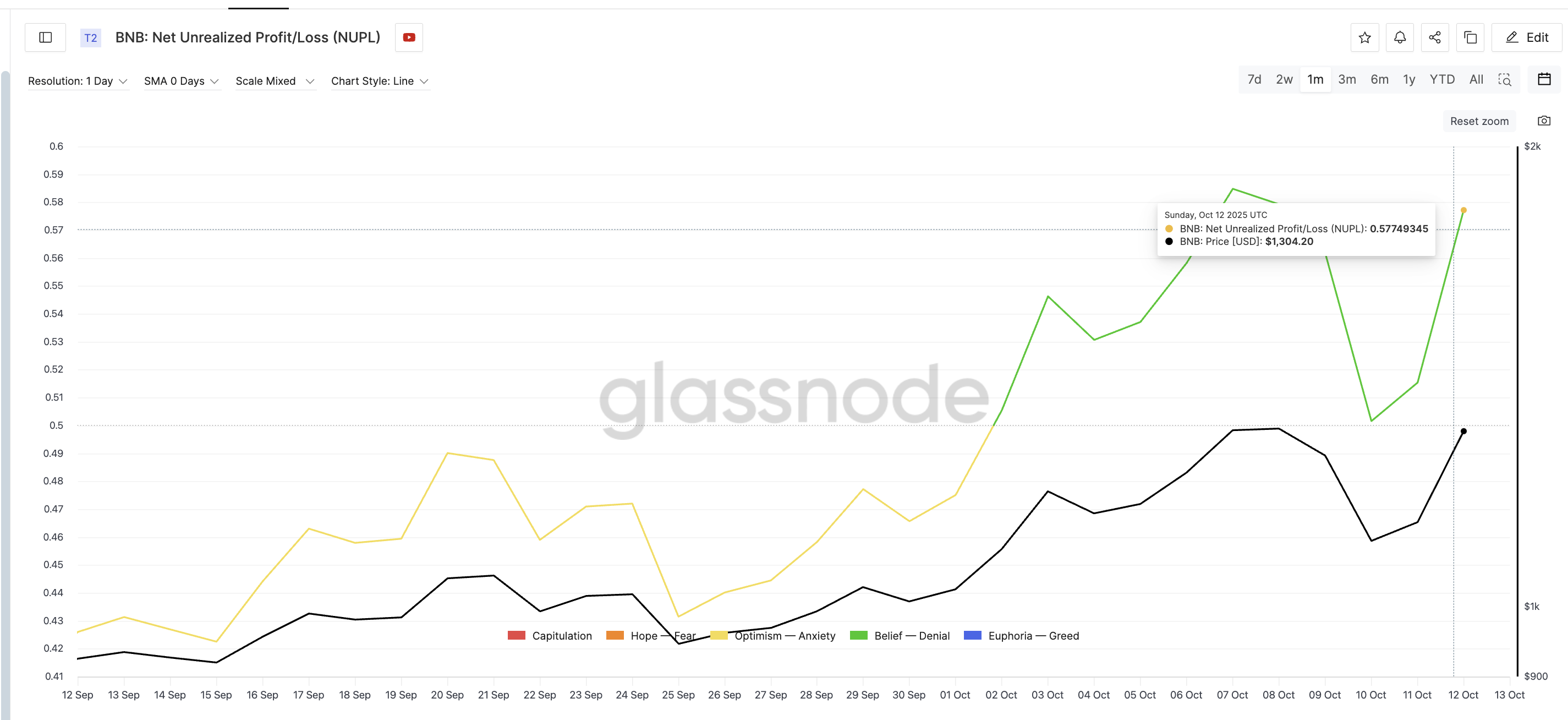

The primary warning signal comes from the Web Unrealized Revenue/Loss (NUPL) metric, which measures how a lot revenue or loss holders at the moment have on paper.

BNB’s NUPL has climbed to 0.57, an analogous degree final reached on October 7, proper earlier than the BNB worth corrected 15%, falling from round $1,300 to $1,100.

The same peak on October 3 noticed a smaller 3% pullback when merchants briefly offered to safe earnings.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

Sponsored

This recurring sample exhibits that when NUPL reaches native highs, traders are inclined to take earnings, cooling the market earlier than it resumes upward. With the indicator now at a contemporary native peak, an analogous short-term part might observe.

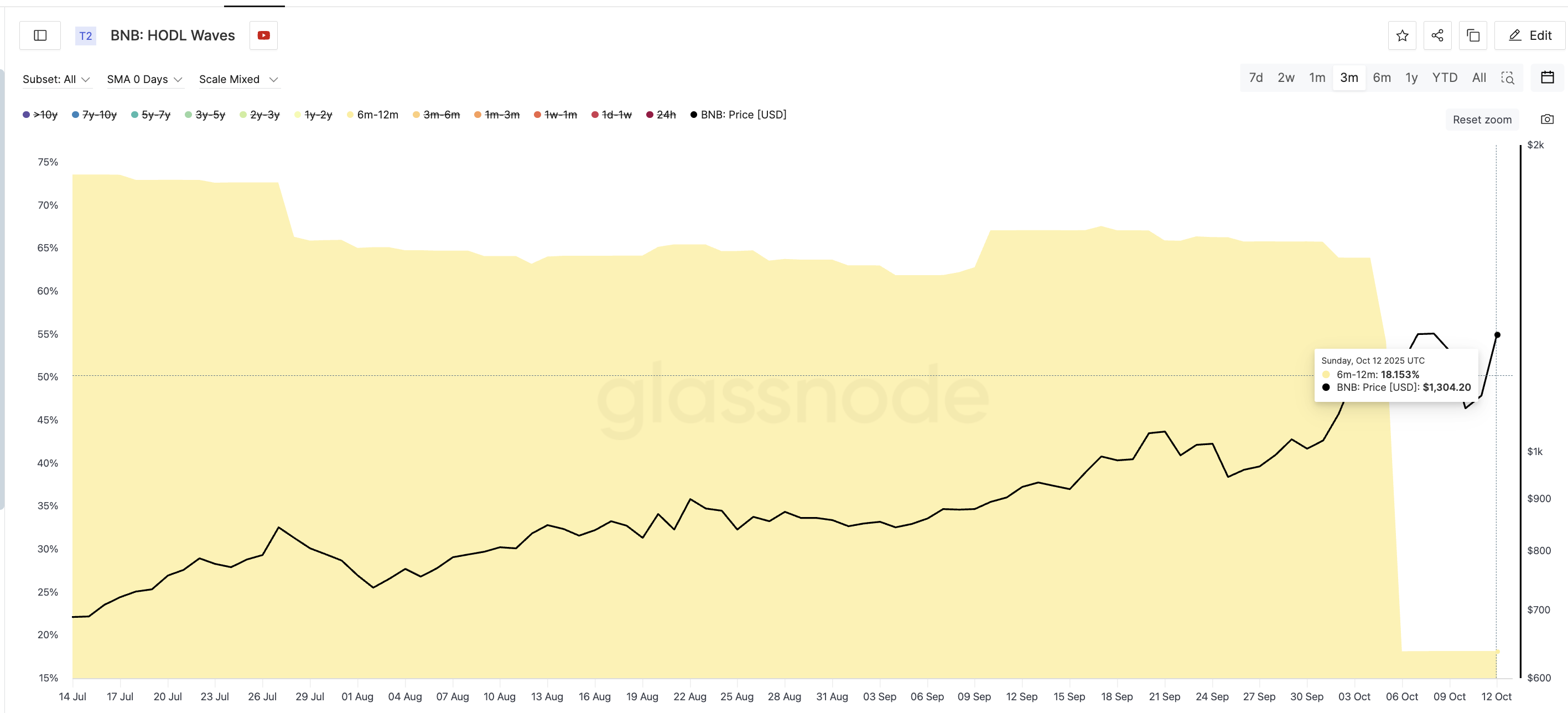

Apparently, that habits already appears to be displaying up within the six- to twelve-month holding group. This group is tracked by means of a metric known as HODL Waves, which exhibits how a lot of a coin’s provide is held for various lengths of time.

The six-to-twelve-month cohort, one in all BNB’s largest holder segments, has lowered its share sharply from 63.89% of provide on October 4 to only 18.15% now.

This group usually represents traders who add conviction to rallies after the early rebound part. Their current discount, mixed with profit-taking at NUPL highs, means that the correction could already be underway, or at the least that enthusiasm is cooling earlier than these mid-to-long-term gamers rejoin.

Sponsored

If the NUPL peak eases and this key cohort begins including once more, that would set off BNB’s subsequent sturdy, sustained rally.

BNB Worth Breaks Out, However Momentum Might Be Fading

From a technical perspective, BNB simply pulled off an vital transfer. The coin broke above the higher trendline of a rising wedge, invalidating a bearish setup that shaped through the crash. This breakout exhibits sturdy shopping for intent and flips short-term sentiment bullish.

BNB now trades round $1,340, testing the 0.382 Fibonacci extension degree at $1,382 — measured from the earlier swing between $930 (low) and $1,350 (excessive) with a retracement to $1,220.

Sponsored

A 12-hour shut above $1,380 would affirm power and open the trail towards $1,430 and $1,480, invalidating the BNB worth dip outlook.

Nonetheless, there’s a creating bearish divergence within the Relative Power Index (RSI), a momentum indicator that measures how sturdy or weak worth strikes are. Between October 10 and 12, BNB’s worth made a better excessive, however RSI made a decrease excessive (classical bearish divergence), displaying that purchasing power is fading at the same time as the worth climbs.

This divergence is a standard technical signal {that a} short-term worth dip might observe, particularly after a pointy rally. This technical signal aligns with the opposite alerts from the on-chain information: profit-taking at NUPL highs and mid-term holders stepping again.

If a pullback occurs, the primary help zone sits close to $1,320, adopted by $1,220. A deeper correction under $1,220 might ship the BNB worth towards $1,140.