The Oct. 10–11 sell-off that erased an estimated ~$19–20 billion throughout crypto inside 24 hours has ignited a fierce autopsy over whether or not market construction—or malice—turned a macro shock into cascading liquidations.

Crypto Crash Not Random?

On X, Uphold’s head of analysis Dr. Martin Hiesboeck alleged the crash “is suspected to be a focused assault that exploited a flaw in Binance’s Unified Account margin system,” arguing that collateral posted in property similar to USDe, wBETH and BnSOL “had liquidation costs based mostly on Binance’s personal unstable spot market, not dependable exterior knowledge,” which allowed a cascade as soon as these devices depegged on Binance order books. He added that the episode “was timed to use a window between Binance’s announcement of a repair and its implementation,” calling it “Luna 2.”

The crypto market crash on October 11 is suspected to be a focused assault that exploited a flaw in Binance’s Unified Account margin system.

The difficulty stemmed from utilizing property like USDE, wBETH, and BnSOL as collateral, whose liquidation costs have been based mostly on Binance’s personal…

— Dr Martin Hiesboeck (@MHiesboeck) October 12, 2025

Binance has publicly acknowledged extraordinary worth dislocations in precisely these devices throughout the crash window and has dedicated to compensating affected customers. In a sequence of notices revealed Oct. 12–13 (UTC), the change mentioned that “all Futures, Margin, and Mortgage customers who held USDE, BNSOL, and WBETH as collateral and have been impacted by the depeg between 2025-10-10 21:36 and 22:16 (UTC) might be compensated, along with any liquidation charges incurred,” with the payout “calculated because the distinction between the market worth at 2025-10-11 00:00 (UTC) and their respective liquidation worth.” Binance additionally outlined “threat management enhancements” after the incident.

Associated Studying

The depegs have been violent on Binance’s books: USDe printed as little as roughly $0.65, whereas wrapped staking tokens wBETH and BNSOL additionally plunged, briefly gutting the collateral worth in Unified Accounts and triggering pressured unwinds. Third-party market protection and change neighborhood posts documented these prints and the fast knock-on to margin balances throughout the 21:36–22:16 UTC window.

Hiesboeck later framed the chain of occasions as leverage assembly brittle collateral mechanics quite than pure worth discovery. In a follow-up explainer, he wrote: “The Set off: It began with exterior shock. A political put up (Trump’s new tariff risk) hit the US inventory market, and that worry spilled immediately into crypto… The Amplifier: …too many individuals utilizing huge leverage… Domino Impact: …panic promoting hit associated property that have been imagined to be secure (like USDe and wBETH), inflicting them to ‘depeg’… The Lesson (and Binance’s Position): Analysts say the true challenge was not an assault, however unhealthy design… [the] system dumped [collateral] instantly at any worth.” He added that “Binance is now making ready an enormous compensation plan.”

Associated Studying

Macro shock is, the truth is, a reputable first domino. The Oct. 10–11 liquidation wave was triggered by new tariff threats from the US President Donald Trump in opposition to China, which sparked cross-asset risk-off and an aggressive deleveraging throughout crypto perps. Friday’s crash was the “largest ever” liquidation occasion with roughly $20 billion in liquidations in a single day, with greater than $1.2 billion of dealer capital erased on Hyperliquid alone.

The place the talk turns technical is on the “exploit” declare. One camp factors to a design hole in how Binance’s Unified Account handled sure collateral: quite than anchoring to sturdy exterior pricing, liquidation thresholds referenced inside spot pairs that grew to become skinny and disorderly exactly after they have been most system-critical. That design, critics argue, created a reflexive loop wherein depegging collateral pressured liquidations that offered extra of the identical collateral again into the identical unstable books.

Binance, for its half, has mentioned it would modify pricing logic for wrapped property and has begun compensating customers who have been liquidated or suffered verified losses throughout the specified window. Ethena’s workforce, whose artificial greenback USDe was on the middle of the transfer, contends the issue was localized to Binance’s pricing/oracle path quite than a basic break in USDe’s mechanism.

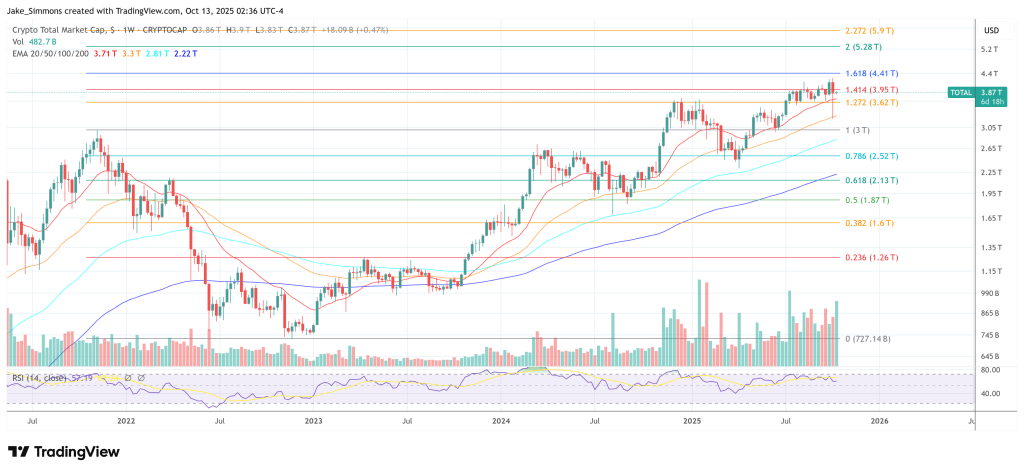

At press time, the entire crypto market cap recovered to $3.87 trillion.

Featured picture created with DALL.E, chart from TradingView.com