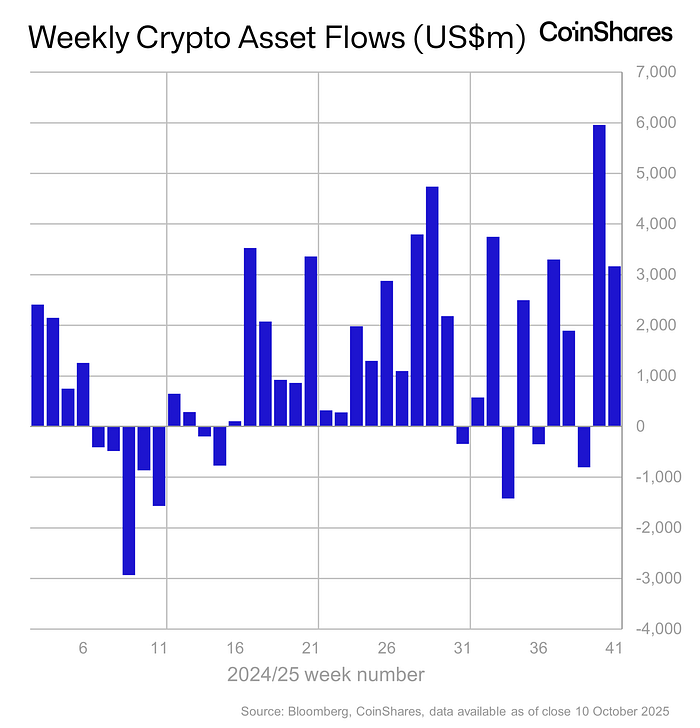

Digital asset funding merchandise attracted $3.17 billion in new capital final week, regardless of sharp market corrections linked to US–China tariff tensions.

Yr-to-date fund inflows have soared to a file $48.7 billion, already surpassing final yr’s whole—demonstrating digital belongings’ enduring enchantment with buyers.

Sponsored

Sponsored

Crypto Fund Inflows Shatter Information Regardless of Unstable Situations

Final week, digital asset funding merchandise took in $3.17 billion in web inflows, defying market corrections brought on by renewed tariff tensions between the US and China. With year-to-date inflows at $48.7 billion in 2025, digital asset funds have already exceeded 2024’s file.

Buying and selling volumes surged, and ETP volumes reached $53 billion for the week, greater than twice the 2025 common. Friday set a brand new each day file with $15.3 billion in traded belongings, based mostly on the newest CoinShares weekly report.

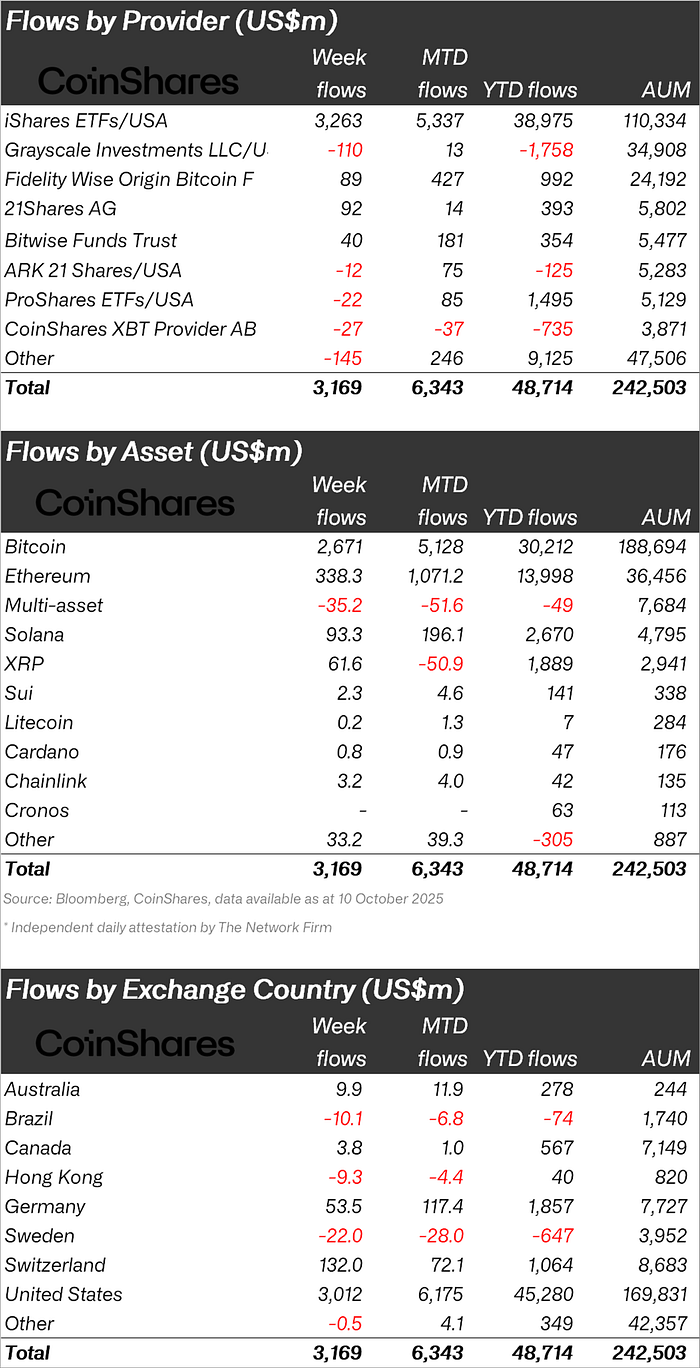

Though digital asset funds noticed file web inflows, mixture belongings beneath administration dropped 7% week-over-week to $242 billion.

Friday’s session marked the best correction quantity ever at $10.4 billion, with web inflows that day holding optimistic however comparatively muted at $0.39 million.

Sponsored

Sponsored

Bitcoin Leads Crypto Inflows as Altcoin Patterns Shift

Bitcoin stays the principle allocation for digital asset buyers, taking in $2.67 billion final week and bringing its 2025 whole to $30.2 billion. But, this trails the $41.7 billion it collected in 2024, hinting at altering investor preferences.

“We now have simply seen international digital asset fund flows surpass final yr’s whole inflows with US$48.67bn year-to-date. Inflows into altcoins appear to be confined to SOL and XRP at current,” wrote James Butterfill, head of analysis at CoinShares.

Ethereum introduced in $338 million in weekly inflows however skilled $172 million in outflows on Friday throughout turbulent buying and selling, highlighting its vulnerability to sentiment shifts.

Hypothesis about ETF approvals for main altcoins impacted funding focus. Solana acquired $93.3 million in inflows, whereas XRP adopted with $61.6 million. Nonetheless, each noticed a slowdown regardless of ongoing ETF curiosity.

Buying and selling surges and strategic fund allocations replicate rising institutional adoption amid ongoing regulatory adjustments.

A current survey by Ernst & Younger exhibits that 59% of institutional buyers plan to allocate over 5% of their portfolios to crypto by yr’s finish. As well as, the US authorities has up to date its regulatory framework, analyzing systemic dangers, investor protections, and authorized classifications in a White Home report issued beneath Government Order 14178.

These shifts spotlight how digital belongings are coming into mainstream finance regardless of ongoing volatility. The newest information suggests alternative and danger coexist for each institutional and complex retail buyers because the sector continues to develop.