Bitcoin and cryptocurrencies have turn into synonymous with excessive volatility. Whereas buyers have grown accustomed to this, final week’s value motion was completely different. As a result of the ‘Trump commerce’ has returned.

In only a few days, Bitcoin’s value swung by over $20,000 between its peak and its trough. A sequence of macroeconomic points drove the wild journey, and Bitcoin seems to be going through one other tumultuous week forward.

Sponsored

From a New Excessive to a Sudden Crash

Final week started on a excessive notice for Bitcoin, as its value surged previous $126,000 on Monday to set a brand new all-time excessive. A number of elements drove the rally.

The worth of US danger belongings, which have not too long ago proven a excessive correlation with Bitcoin, has been on a gentle uptrend. The market was additionally buoyed by Sanae Takaichi’s election as the brand new chief of Japan’s ruling occasion on October 4.

She is the political inheritor to Shinzo Abe, the architect of “Abenomics.” The market expects her to pursue a financial easing coverage regardless of Japan’s excessive inflation.

After hitting its peak, Bitcoin went by a pure correction, consolidating across the $122,000 stage for many of the week. Nevertheless, the market bumped into hassle round 4:00 PM UTC on Friday, when President Donald Trump all of a sudden posted on social media about China’s restrictions on uncommon earth exports, calling the transfer “a really hostile act.”

The Return of the ‘Trump Commerce’

He introduced that he was undecided if he would meet with President Xi Jinping on the APEC summit in two weeks and threatened to impose vital further tariffs on China. The sudden put up despatched the chance asset market reeling. Bitcoin’s value instantly plunged to $118,000, and US inventory indices just like the Nasdaq, S&P 500, and Dow Jones all dropped by about 2%.

Sponsored

However the actual bombshell dropped after the US inventory market closed. Trump made one other put up on social media. In it, he introduced a brand new 100% tariff on all Chinese language items and threatened to impose export controls on all key software program beginning November 1.

The crypto market, the one functioning asset market on the time, absorbed the total impression. Bitcoin’s value briefly dropped to the $102,000 stage on some exchanges. On the similar time, most altcoins fell greater than 30%, with some dropping over 50%.

Was the Crash Only a ‘Liquidation Cascade’?

The crypto market’s temper was subdued after the sharp decline. Whereas a brand new 100% tariff on China is a transparent unfavourable, was it unhealthy sufficient to trigger a $20,000 drop in Bitcoin? Trade consultants imagine not.

They attribute the sudden and profound drop to the liquidation cascade of futures positions on perpetual decentralized exchanges (DEXs). A domino impact worn out the huge variety of leveraged lengthy positions that had constructed up in the course of the rally, resulting in a pointy sell-off. In keeping with person testimonials, the stop-loss triggers did not work on some exchanges.

Sponsored

An estimated $19.21 billion was liquidated in 24 hours. Whereas most have been lengthy positions ($16.74 billion), $2.47 billion briefly positions was additionally worn out. That is 12 instances the earlier file of $1.6 billion from the FTX crash as a every day liquidation.

The liquidation vaporized an enormous quantity of investor capital. Nevertheless, there’s a optimistic aspect to this within the brief time period. The open curiosity in crypto derivatives has been utterly reset, which had been a major supply of stress in the marketplace. If a brand new optimistic macro sign emerges—corresponding to Trump reversing his 100% tariff risk—a value rally is now attainable.

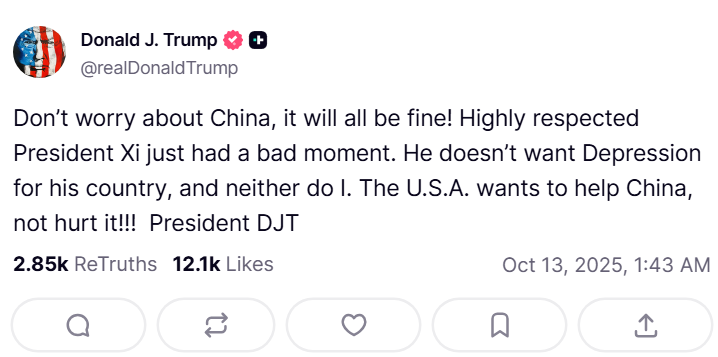

The optimistic information got here surprisingly shortly over the weekend. China didn’t retaliate with tariffs of its personal. Vice President JD Vance talked about the potential of a dialogue with China in a media interview. On Sunday morning, Trump posted on social media, “Don’t fear about China, it’s going to all be positive!” Following the put up, Bitcoin’s value shortly rebounded to the $114,000 stage.

With a single phrase from Trump, asset costs can plummet, and with one other, they will get better. This second introduced again recollections of the Trump commerce we skilled 5 months in the past.

Sponsored

A Tense Week Forward

Will the US-China tariff struggle return to its earlier state, or was this simply the primary skirmish? It’s not possible to know. What is obvious is that this situation will possible introduce extra volatility into danger asset costs this week. The Trump commerce is simply getting began.

This week, October 13 is Columbus Day within the US. Whereas main inventory markets just like the NYSE and Nasdaq will function as ordinary, the bond market might be closed for the vacation.

No main information releases are scheduled this week, however Fed Chair Jerome Powell is about to provide a public speech on Wednesday. With the federal government shutdown and the renewed risk of a tariff struggle, many market members anticipate a fee lower.

Any slight trace from Powell relating to the longer term route of financial coverage might create vital market volatility. Right here’s hoping buyers have a worthwhile week.