The liquidation of Ethereum includes a large market reset by means of the leverage flush of the asset. The buys are aggressive and the curiosity purge is open, indicating a attainable monster rebirth.

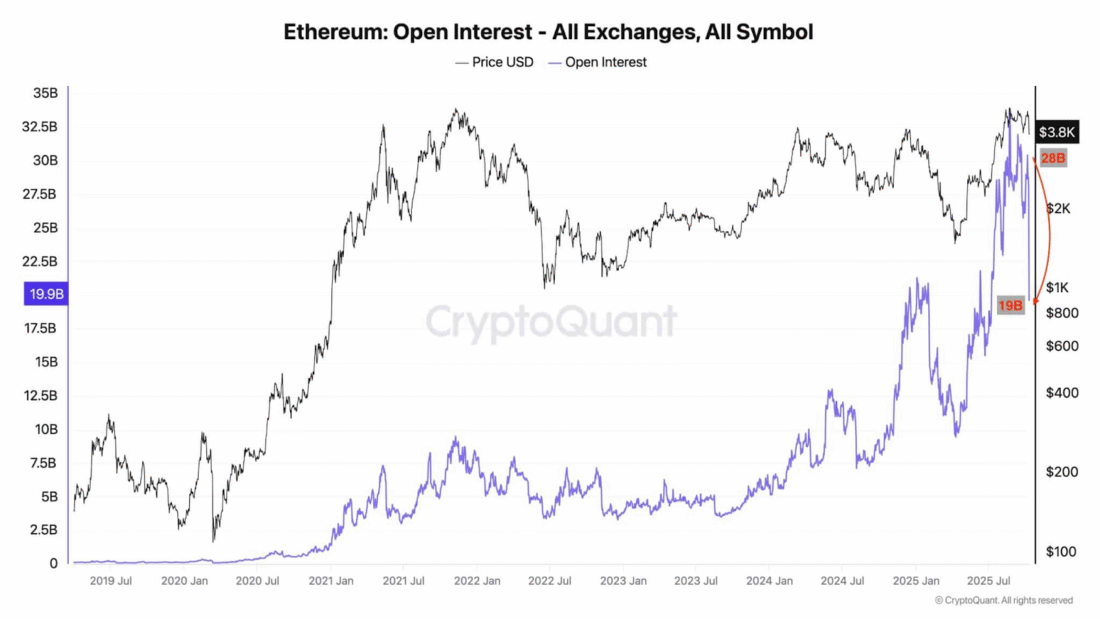

Ethereum has lately skilled the largest purge in open curiosity in its historical past, dropping greater than $28 billion to $19 billion in simply 24 hours.

Supply: CryptoQuant

This deleveraging plan of clearing off the surplus leverage at the next charge than regular re-established the market atmosphere. In information, when Ethereum sells off greater than Bitcoin does, it normally bounces again higher.

Ethereum dropped 18 p.c and Bitcoin dropped 7 p.c between mid-September. Two weeks after that, ETH rose 14 p.c, in comparison with 10 p.c in Bitcoin.

Such a pattern is immediately related to the fluctuations within the derivatives market, the place Ethereum has a bigger leverage, which ends up in extra intense actions.

Aggressive Whale Accumulation Cuts By way of Market Worry

BitMine (BMNR), which is a significant whale, was the largest purchaser on this timeframe, buying greater than 128,000 ETH value roughly 480 million on the newest dip.

Their imply value base is about $3,730, which justifies purchases of a shopping for alternative through the shakeout.

The conviction of BMNR serves as an indicator, pushing towards worry and uncertainty (FUD) and stimulating the worry of lacking out (FOMO).

This exercise within the whale is an indicator of the attainable level of inflection the place buyers can anticipate a pattern reversal.

Ethereum answered with an intraday enhance of two.27 p.c, and regained floor and made a larger present towards Bitcoin.

The $10B Open Curiosity Purge: A Wholesome Market Shakeout

Report open curiosity wipeout. On October 10, the derivatives market of Ethereum wiped round 10 billion {dollars} in positions in at some point, a significantly uncommon deleverage occasion.

That is seen as a long-overdue reset by analysts, and this has opened the best way to sensible cash coming in at discounted ranges.

Geopolitical tensions had been additionally current on the time of the purge, contributing to the volatility of leveraged positions on Ethereum and different giant cryptocurrencies.

Despite the purge, the market took the shock, and Ethereum was resilient once more, offering a chance for a robust restoration.

Ethereum’s Leverage Dynamics Make It Vulnerable to Volatility

The very excessive leverage futures market will increase the results of worth actions in Ethereum. Fluctuations in open curiosity turn into the direct causes of worth volatility and have a tendency to result in extra extreme drawdowns and rallies.

This places Ethereum in a particular place of fast rebounds following large flushes. The ETH/BTC ratio is seen to enhance all through the day, a superb indication that Ethereum can beat Bitcoin in a future restoration.

The derivatives rollover and whale shopping for would offer a lift in demand and worth motion within the quick time period.