In short

- Bitcoin bounces again to $115K, however the technical image suggests merchants lack conviction.

- Ethereum reveals the weakest pattern energy among the many three majors, regardless of reclaiming $4,200.

- Solana faces conflicting indicators with bearish short-term momentum combating bullish long-term construction.

The crypto market simply lived via one other violent reminder that leverage is a double-edged sword. On Friday, October 10, President Donald Trump unleashed a message on Fact Social promising to impose 100% tariffs on all Chinese language merchandise beginning November 1, triggering a worldwide chain response that noticed Bitcoin plunge from above $125,000 to briefly under $102,000, and Ethereum drop to under $3,800.

The carnage was historic: 1.6 million merchants liquidated and $19 billion evaporated in what grew to become the biggest single-day wipeout in historical past, with losses worse than the FTX collapse in 2022 and the COVID market crash earlier than it—mixed, and by a number of multiples.

Earlier than the crash, the markets had been bullish, with merchants largely betting on new all-time highs throughout crypto, in line with Myriad—a prediction market developed by Decrypt’s father or mother firm Dastan. However no person anticipated Trump to nuke their baggage—not less than no person besides one “fortunate” dealer who shorted the market simply earlier than the tariff announcement and pocketed tens of millions from the crash.

However here is the factor about crypto crashes: They have an inclination to reset the taking part in discipline. Now, because the mud settles and costs get better, merchants are asking the apparent query: Was this the flush the market wanted earlier than heading greater, or the start of one thing worse?

Bitcoin worth: Pattern confirmed, however barely

Merchants on Myriad at the moment anticipate Bitcoin to proceed its rebound, putting odds at above 90% that BTC stays above the $112K mark by tomorrow. Myriad customers additionally anticipate BTC to sooner hit $120K once more earlier than crashing right down to $100K, with the road at the moment set at 74% for a continued push upward.

Bitcoin at the moment trades at $115,089, having recovered from the flash crash lows after bouncing close to the 200-EMA—the typical worth of Bitcoin during the last 200 days. However do not let the worth bounce idiot you—the technical image reveals a market that is recovered however not satisfied.

Essentially the most telling indicator is the Common Directional Index, or ADX, sitting at 25.76. The ADX measures pattern energy on a scale from 0 to 100, the place readings above 25 verify a pattern is in place. Bitcoin simply crossed this threshold, which technically indicators pattern institution. Consider it like a automobile that is lastly shifted into gear after idling—we’re shifting, however we’re not precisely racing but. For merchants, this studying suggests we have exited the uneven, directionless waters, however the pattern is not sturdy sufficient to encourage confidence in aggressive positioning.

The Relative Energy Index, or RSI, for Bitcoin is at 46.48, which provides one other layer of warning. RSI measures momentum, with readings above 70 indicating overbought situations (time to doubtlessly promote) and under 30 signaling oversold (time to doubtlessly purchase). At 46.48, Bitcoin sits in impartial territory with a slight bearish tilt—not precisely the studying bulls need to see after such a dramatic selloff. This implies the bounce lacks the aggressive shopping for that usually marks main bottoms, a lot that it wasn’t sufficient to take costs up over the 50-day EMA reference.

The excellent news? Bitcoin’s 50-day exponential shifting common stays above the 200-day EMA, a configuration that usually signifies bullish long-term construction. EMAs give merchants a way of worth helps and resistances over the quick, medium, and long run.

When short-term averages keep above long-term ones, it suggests sustained shopping for strain over time. The Squeeze Momentum indicator exhibiting “off” standing with a Lengthy sign provides to the bullish case, indicating the latest consolidation section has been launched with upward bias.

With such an absence of momentum, costs may very well be bouncing exhausting between $110K and $125K till one thing triggers a motion in both course.

Key Ranges:

- Instant help: $110,000 (psychological degree)

- Sturdy help: $107,000 (flash crash low, should maintain)

- Instant resistance: $118,000 (pre-crash consolidation)

- Sturdy resistance: $125,000 (all-time excessive zone)

Ethereum worth: Weakest pattern amongst majors

As for Ethereum, Myriad merchants are likewise bullish on a sustained rebound: The market is at the moment pricing in 94% odds that ETH stays above $3,800 by Tuesday.

And you would perceive why: Ethereum’s restoration to $4,156 seems to be spectacular on the floor. However the technical knowledge inform a extra cautious story.

The ADX at simply 21.57 reveals the weakest pattern energy among the many three crypto majors: Bitcoin, Ethereum, and Solana. ETH’s ADX is under the essential 25 threshold that confirms directional motion and has lastly deleted any sturdy momentum registered by its spectacular bullrun. This studying tells merchants the market lacks conviction, suggesting ETH is drifting quite than decisively shifting in both course.

The RSI at 46.75 mirrors Bitcoin’s neutral-to-bearish studying, indicating neither patrons nor sellers have taken management post-crash.

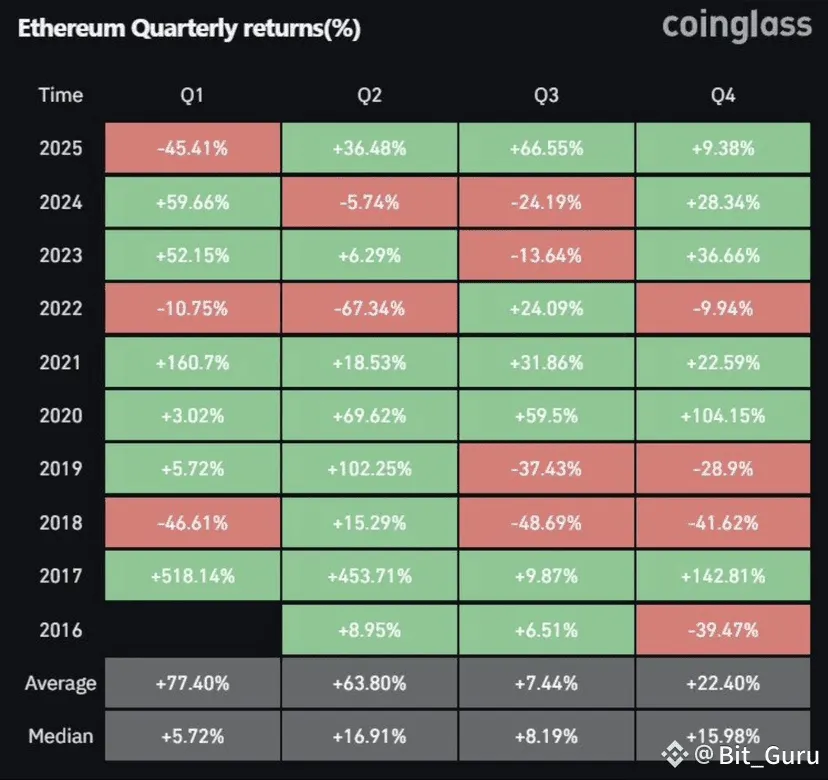

Historic fourth-quarter knowledge helps potential upside with Ethereum posting sturdy beneficial properties in previous years: +104% in This autumn 2020, +142% in This autumn 2017, and averaging practically +22.4% in This autumn, however the present technical setup suggests endurance could also be required earlier than that seasonal energy kicks in.

Like Bitcoin, ETH maintains its golden cross with the 50-day EMA above the 200-day EMA, preserving the longer-term bullish construction. The Squeeze Momentum indicator firing “off” with a Lengthy sign suggests the consolidation section is ending with an upward bias—however with such weak ADX readings, any transfer greater could lack follow-through.

Key Ranges:

- Instant help: $3,950 (latest bounce degree)

- Sturdy help: $3,500 (close to flash crash low)

- Instant resistance: $4,250 (technical confluence)

- Sturdy resistance: $4,800 (psychological goal)

Solana worth: Buying and selling gradual

Myriad merchants are equally bullish on Solana’s short-term worth prospects, putting odds at 88% that SOL continues to commerce above $185. Customers on Myriad, although, aren’t as satisfied on the long run prospects, putting odds at simply 44% that SOL hits a brand new all-time excessive above $294 earlier than the top of the 12 months. These odds are up from 33% on Friday, following the market crash.

Solana presents probably the most complicated technical image, at the moment buying and selling at $197.22, with conflicting indicators throughout completely different timeframes creating a very difficult setup for merchants.

The ADX at 22.82 sits under the 25 pattern affirmation degree, indicating weak directional motion much like Ethereum. So principally, SOL is caught in a transitional section the place neither bulls nor bears have established clear management.

The RSI at 43.48 leans bearish, sitting under the impartial 50 degree and suggesting promoting strain barely outweighs shopping for curiosity. For context, RSI readings between 40-50 usually happen throughout corrective phases inside uptrends—not fairly oversold sufficient to set off aggressive shopping for, however weak sufficient to concern holders.

The bulls are additionally making an attempt to place costs above the 50-day EMA, however issues should not trying too optimistic. The hole between the short- and long-term averages is reducing, the bounce was weaker than the dip, and the coin is more likely to register a decrease excessive earlier than a serious bullish tick.

Analysts observe SOL sits simply 0.22 inside the Bollinger Bands, indicating excessive oversold situations that traditionally precede sturdy bounces. Nevertheless, with conflicting momentum indicators, merchants ought to anticipate uneven worth motion because the market works via this indecision.

Key Ranges:

- Instant help: $180 (psychological degree)

- Sturdy help: $160 (should maintain for bulls)

- Instant resistance: $220 (preliminary goal zone above the EMA50)

- Sturdy resistance: $240 (stronger resistance)

BTC, ETH and SOL: Warning warranted regardless of restoration

Whereas all three cryptocurrencies have bounced from their crash lows, the technical indicators universally counsel this restoration lacks conviction. Bitcoin reveals the strongest setup with ADX confirming pattern institution, however barely. Ethereum and Solana each show weak pattern readings that usually precede uneven, range-bound buying and selling quite than sustained directional strikes.

The conflicting indicators—bullish long-term EMAs versus weak momentum readings—counsel the market is digesting the huge liquidation occasion quite than confidently shifting ahead. Merchants would interpret this as wholesome market conduct after such dramatic deleveraging, however it additionally means merchants ought to anticipate continued volatility within the close to time period.

A number of altcoins crashed between 20% to 40% because the market recoiled, and the information suggests bulls could should be affected person because the restoration might take time quite than following a swift V-shaped sample. With pattern energy readings this weak throughout the board, the prudent strategy is to attend for clearer indicators earlier than making aggressive directional bets.

Disclaimer

The views and opinions expressed by the creator are for informational functions solely and don’t represent monetary, funding, or different recommendation.

Each day Debrief E-newsletter

Begin day by day with the highest information tales proper now, plus authentic options, a podcast, movies and extra.