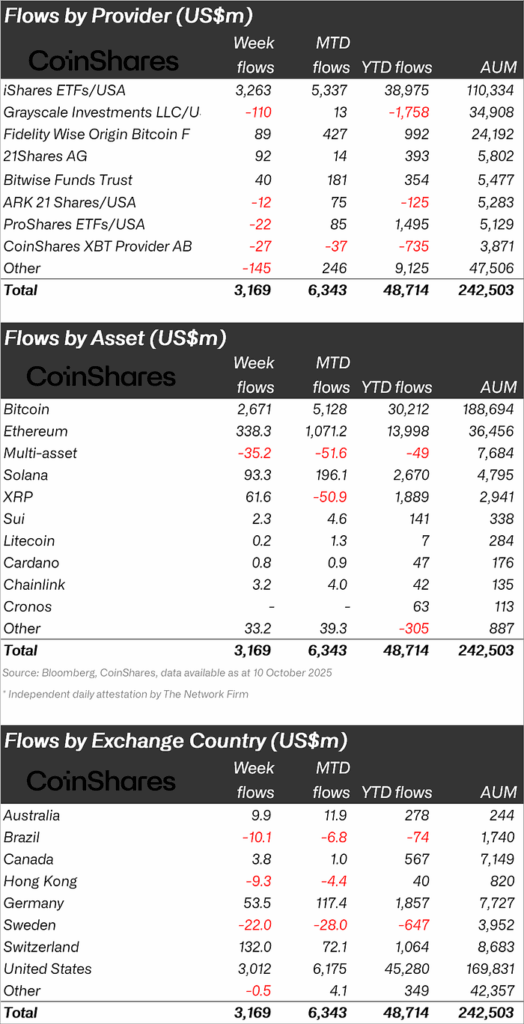

Regardless of a turbulent week within the markets, buyers poured $3.17 billion into digital asset funds, displaying sturdy confidence in cryptocurrencies whilst US-China tariff tensions rattled costs.

Up to now in 2025, these funds have attracted almost $49 billion, already topping final 12 months’s complete, which indicators sustained curiosity in digital belongings.

Buying and selling exercise additionally noticed a exceptional enhance, with weekly volumes for exchange-traded merchandise greater than doubling the yearly common and Friday alone breaking data at $15.3 billion. But, the whole worth of belongings managed by these funds fell barely to $242 billion, reflecting the broader market corrections.

Bitcoin remained the first focus, drawing $2.67 billion final week and sustaining its lead in investor allocations, although its year-to-date inflows path final 12 months’s file.

Ethereum skilled combined actions, with strong weekly inflows offset by heavy outflows throughout risky classes. Amongst altcoins, Solana and XRP stood out for attracting new capital, albeit at a slower tempo than earlier than.

The surge in institutional involvement continues, with surveys displaying {many professional} buyers aiming to dedicate a portion of their portfolios to crypto by year-end. In the meantime, evolving US laws, geared toward enhancing oversight and investor protections, level to rising mainstream acceptance. General, the info displays a market the place alternative and warning coexist as digital belongings acquire a firmer foothold in finance.