- XRP crashed 70% in minutes earlier than rebounding, sparking insider hypothesis.

- Establishments like Reliance World are including XRP to company treasuries.

- Ripple expands globally, securing a UAE license and rolling out RLUSD in Africa.

XRP’s had fairly the yr — the token’s up greater than 347% since January, now buying and selling round $2.41. However yesterday wasn’t clean crusing. Out of nowhere, a pointy sell-off hit the market, sending shockwaves throughout the crypto area and leaving merchants scrambling to determine what simply occurred.

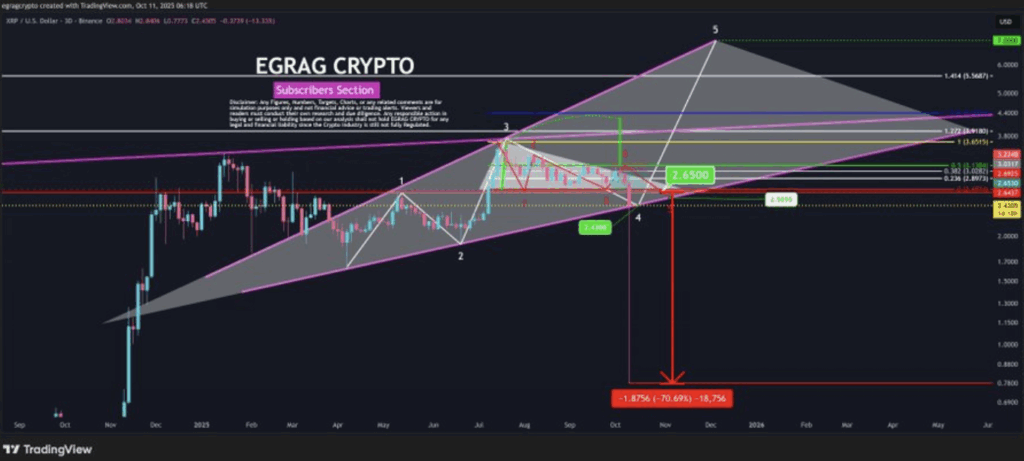

The drop was brutal. Inside eight minutes, XRP plunged practically 70%, crashing from $2.65 to simply $0.78 earlier than bouncing again. Bitcoin and Ethereum additionally dipped, although nowhere close to as severely — falling about 13% and 15%, respectively. For a lot of XRP holders, it felt much less like a correction and extra like somebody had pulled the rug.

Market analyst Egrag Crypto instructed the crash was doubtless engineered to wipe out overleveraged lengthy positions. The timing didn’t assist both — giant quick positions had been reportedly opened simply hours earlier than the transfer, which raised eyebrows about potential insider exercise.

Nonetheless, even after the carnage, XRP didn’t fully unravel. The token’s managed to carry key help ranges, displaying a shocking degree of energy given the panic. And as mud settles, the narrative is shifting again to fundamentals — XRP’s rising function in institutional finance and international cost techniques.

Establishments Quietly Again XRP as a Treasury Asset

What’s fueling optimism is the growing variety of large firms adopting XRP for extra than simply buying and selling. Reliance World, a Nasdaq-listed agency, not too long ago added XRP to its digital treasury, treating it like a reserve asset relatively than a speculative guess. That’s an enormous step towards legitimizing XRP as an actual steadiness sheet part, not only a “crypto token.”

Equally, VivoPower launched a brand new initiative known as XRPFi, mixing company finance with blockchain-based yield methods powered by the XRP Ledger (XRPL). It’s a small however telling signal that conventional corporations are beginning to faucet XRP for effectivity and yield — not hype.

Ripple’s personal strikes have been equally aggressive. The corporate’s $1.25 billion acquisition of Hidden Street, a primary brokerage platform, indicators a transparent push deeper into institutional infrastructure. With that deal, Ripple can convey its post-trade techniques immediately onto XRPL, successfully positioning XRP as a monetary spine for cross-border clearing and settlements.

Ripple Expands Its World Community and Challenges SWIFT

Ripple’s ambitions aren’t stopping at brokerage. The agency’s international cost community is increasing quick, and the RLUSD stablecoin rollout is the newest instance. Lately launched in Africa, RLUSD is being built-in with Chipper Money, VALR, and Yellow Card to energy blockchain-based remittances and enterprise settlements.

Within the UAE, Ripple has made even larger strides — incomes a regulatory license from the Dubai Monetary Companies Authority (DFSA). This makes it one of many few blockchain cost suppliers allowed to function inside the DIFC, one of many world’s most revered monetary hubs. Ripple additionally locked in partnerships with Zand Financial institution and Mamo, additional strengthening its Center East foothold.

All these developments level in a single course: Ripple is positioning XRP on the heart of next-generation funds — quicker, cheaper, and way more built-in with real-world finance. Whereas short-term volatility retains merchants nervous, the long-term image seems more and more clear.

The Larger Image

XRP may’ve simply weathered certainly one of its wildest buying and selling days ever, however the token’s nonetheless standing sturdy. The crash flushed out weak arms and overextended merchants, whereas the basics — institutional development, international growth, and actual utility — stay intact.

If something, this chaos may’ve been a reset earlier than the subsequent wave. As a result of whereas the charts inform one story, the cash — and the partnerships — are quietly telling one other.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.