Solmate Infrastructure (Nasdaq: SLMT) disclosed in a press launch issued earlier in the present day that it had bought $50 million of SOL immediately from the Solana Basis at a 15% low cost to market.

The corporate mentioned the tokens can be used to energy bare-metal validators in Abu Dhabi, UAE as a part of the Basis’s “Solana By Design” program, and that the Basis negotiated the precise to appoint as much as two administrators to Solmate’s board. Solmate described the timing as a purchase order “at market lows” throughout a serious liquidation and framed the transfer as aligning its treasury with its infrastructure build-out.

The press launch additionally famous that ARK Make investments held roughly 11.5% of Solmate, as of Sept. 30, 2025, citing a Schedule 13G submitting.

Solmate mentioned ARK beforehand purchased 6.5 million shares in an oversubscribed PIPE and disclosed subsequent purchases totaling about 780,000 shares, which the corporate characterised as continued conviction in its technique.

Solmate is the rebranded, Solana-focused successor to Nasdaq-listed Brera Holdings, which is shifting from a multi-club soccer technique to a digital asset treasury and infrastructure enterprise centered on Solana.

Chief Government Marco Santori mentioned the agency “purchased the dip” and referred to as Solmate “model new Solana infrastructure” for the UAE. He argued digital asset treasuries are “capital accumulation machines” and mentioned the UAE is the “Capital of capital,” positioning Abu Dhabi as a base for validator efficiency.

Solmate mentioned it would companion with RockawayX on staking infrastructure and plans to face up bare-metal validators in Abu Dhabi, with extra initiatives to observe.

CoinDesk Analysis’s tedhnical evaluation

The evaluation window runs from Oct. 13, 2025, 11:00 UTC to Oct. 14, 2025, 10:00 UTC. Beneath are the highlights:

- In keeping with CoinDesk Analysis’s technical evaluation information mannequin, over that span, SOL traded between $191.42 and $209.45, roughly a 9% swing.

- Worth superior from about $192.79 and sliced by the $200.62 and $205.64 areas on heavier-than-usual buying and selling, then momentum light after 00:00 UTC on Oct. 14, with a slide from roughly $206.34 into the $193–$194 space the place patrons reappeared.

- Within the last hour, 09:41–10:40 UTC on Oct. 14, SOL bounced from $196.20 however couldn’t maintain the transfer, dipping to $191.46 at 10:35 UTC earlier than settling round $192.43 by 10:40 UTC.

- Taken collectively, the tape exhibits help forming close to $193–$194 with a deeper cushion round $191, and provide displaying up close to $205–$206 and once more nearer to $209–$211.

- Holding above the mid-$190s retains the door open for a retest of $200 after which $205–$206; shedding $193 would put $191 again in play.

Newest 24-hour chart learn (all UTC)

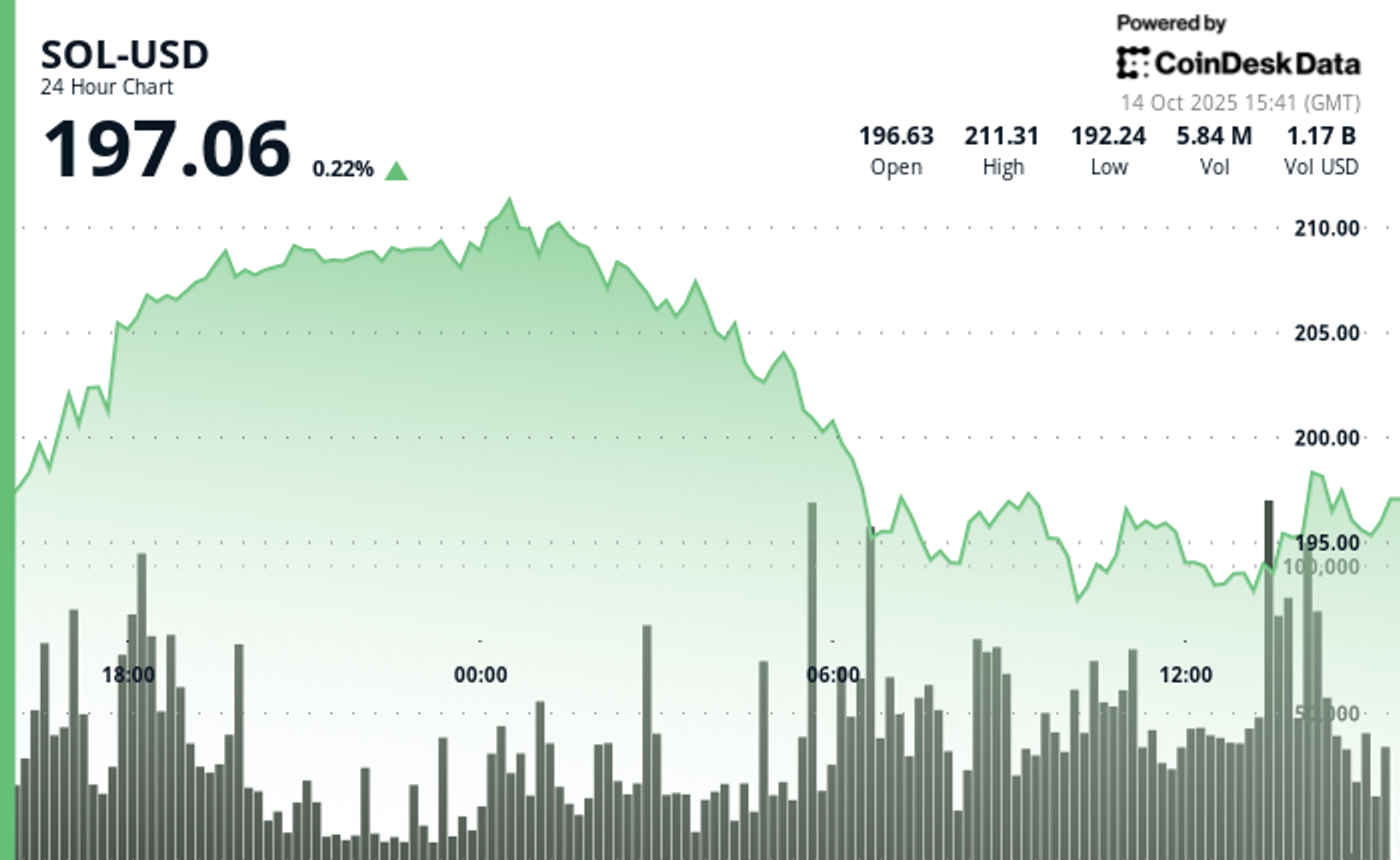

As of Oct. 14, 2025, 15:31 UTC, SOL was $197.06, up 0.22% over 24 hours.

Immediately’s session printed a excessive at $211.31 and a low at $192.24. The early rejection close to $211.00 was adopted by a drift decrease and stabilization round $196–$198.

In sensible phrases, $195.00 is the near-term pivot for patrons; holding above that degree leaves room to probe $200.00 and, if reclaimed on UTC closes, $205.00–$206.00 the place sellers had been energetic within the analysis window.

A decisive push by $206.00 on UTC closes would put $209.00–$211.00 again in view. On the draw back, a break beneath $195.00 would doubtless invite a verify of $193.00–$194.00; if that space offers means, the late-window cushion round $191.00 turns into the following reference.

Disclaimer: Components of this text had been generated with the help from AI instruments and reviewed by our editorial crew to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.