Be a part of Our Telegram channel to remain updated on breaking information protection

BlackRock CEO Larry Fink says Bitcoin might function a portfolio diversifier for traders who’re comfy taking over some danger.

“For these trying to diversify this isn’t a foul asset,” he stated about BTC throughout a latest interview with 60 Minutes. Nonetheless, he stated, “however I don’t consider that it ought to be a big part of your portfolio.”

There Is Now A Position For Bitcoin And Crypto, Says BlackRock’s CEO

Fink’s newest remarks are a pivot from his earlier criticism of Bitcoin. The BlackRock CEO acknowledged that he has not all the time been a fan of Bitcoin and the broader crypto market.

“I did say Bitcoin, as a result of we had been speaking about Bitcoin then, was the area of cash launderers and thieves,” he stated.

“However you recognize, the markets train you, you must all the time relook at your assumptions,” he added.

Now, Fink believes “there’s a position for crypto in the identical approach there’s a position for gold,” and added that digital belongings provide traders an “various.”

US Greenback Might Lose Reserve Forex Standing To Bitcoin

Earlier this 12 months in his 2025 Chairman’s letter, Fink warned that the greenback might lose its standing because the world’s reserve foreign money if the US nationwide debt continues to spiral.

“The US has benefited from the greenback serving because the world’s reserve foreign money for many years. However that’s not assured to final ceaselessly,” he wrote.

He then famous that “the nationwide debt has grown at thrice the tempo of GDP since Occasions Sq.’s debt clock began ticking in 1989.”

“If the US doesn’t get its debt underneath management, if deficits hold ballooning, America dangers shedding that place to digital belongings like Bitcoin,” he subsequently warned.

At first of the 12 months, Fink additionally predicted that Bitcoin might doubtlessly attain as excessive as $700K amid the continuing fears of foreign money debasement and world financial instability. This was after he had a gathering with a sovereign wealth fund who sought recommendation on whether or not to allocate 2% or 5% of its funding portfolio to BTC.

IBIT Continues Inflows Streak As Different Spot Bitcoin ETFs Document Withdraws

BlackRock’s US spot Bitcoin ETF (IBIT), which was launched final 12 months, has led the spot BTC ETF market in inflows for the reason that merchandise’ inception.

Knowledge from Farside Traders reveals that IBIT has seen $65.260 billion in cumulative inflows because it entered the market.

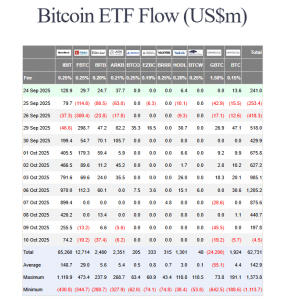

US spot BTC ETF flows (Supply: Farside Traders)

The fund can be on a multi-day inflows streak. After recording $74.2 million inflows on Oct. 10, IBIT prolonged its constructive flows streak to 9 days. This newest day of internet inflows was, nonetheless, not sufficient to cowl the outflows seen by the opposite funds on the day. As such, the US spot Bitcoin ETFs introduced an finish to their collective inflows streak with $4.5 million internet outflows.

Over the previous week, IBIT additionally bought greater than $2.6 billion value of Bitcoin.

That introduced the funds’ whole belongings underneath administration (AUM) to inside attain of $100 billion, in accordance with an X put up by Bloomberg ETF analyst Eric Balchunas. Nonetheless, the latest market pullback negatively impacted the product’s whole AUM.

Inches away.. $IBIT bought to $99.5b final week earlier than pullback. It might style the additional digit. It’s nonetheless inevitable milestone imo however wild simply how shut it bought. Two steps ahead, one step again in impact. pic.twitter.com/ByQKurFK3z

— Eric Balchunas (@EricBalchunas) October 11, 2025

“It’s nonetheless inevitable milestone imo however wild simply how shut it bought,” Balchunas wrote. Regardless of the pullback, IBIT was nonetheless in a position to go VIG, which the Bloomberg analyst stated is “an etf legend” to grow to be the Nineteenth-largest ETF in total AUM.

IBIT’s Share Value Retraces, However Nonetheless Exhibits “Utopia-Esque” Returns

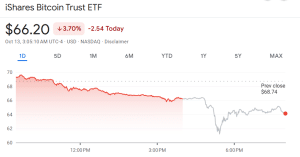

Regardless of the continued dominance, IBIT’s share worth did endure a greater than 3% pullback because the broader crypto market suffered $20 billion liquidations final week. Knowledge from Google Finance reveals that the latest correction in IBIT’s share worth has pushed its weekly efficiency to over 6% within the pink over the previous seven days.

IBIT share worth (Supply: Google Finance)

Even with the latest drop, IBIT’s shares are up greater than 76% over the previous 12 months.

In an Oct. 11 X put up, Balchunas criticised traders for “whining” over IBIT’s latest efficiency, and stated that the fund nonetheless reveals “utopia-esque returns.”

“Every day worth charts are the media’s finest buddy however an investor’s worst enemy,” he wrote, earlier than telling traders to “zoom out” on the chart to see the larger image.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection